Instructions For Form 8939 - Allocation Of Increase In Basis For Property Acquired From A Decedent - 2010 Page 9

ADVERTISEMENT

EPS Filename: 55218y02

Size Width= 44.0 picas, Depth= Page

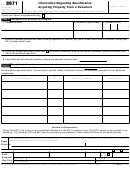

ATTACHMENT TO RACHEL'S SCHEDULE A:

Description: Real Property located at 1234 South Avenue, City, State.

Date Decedent Acquired Property:

12/10/2007

Adjusted basis at decedent's death:

$425,000

FMV at decedent's death:

$967,000

General Basis Increase allocated by executor:

$542,000

Spousal Property Basis Increase allocated by executor:

$0

Section 7520 Rate for October 2010:

2.0%

Life Tenant's (Larry) Age:

48

Life Estate Factor (from Table S of §20.2031-7(d)):

0.54955

Computation of Actuarial Interest

Adjusted Basis:

$425,000 X 0.54955 =

$233,559

FMV:

$967,000 X 0.54955 =

$531,415

General Basis Increase:

$542,000 X 0.54955 =

$297,856

Spousal Property Basis Increase:

$0 X 0.54955 =

$0

RACHEL'S SCHEDULE A: Line 4

(a)

(b)

(c)

(d)

(e)*

(f)

Description

Date decedent

Adjusted basis

FMV at death

Allocation of basis increase

Amount of gain

that would be

of property

acquired

at death

Item

ordinary income

property

(i)

(ii)

No.

General basis

Spousal property

basis increase

increase

1

Remainder interest in real property located at 1234 South Avenue,

12/10/2007

$233,559

$531,415

$297,856

$0

$0

City, State

Line 4—Property Acquired

permitted under sections 469, 1016, or

having been owned by the decedent at

2654.

the time of death to the extent provided in

From the Decedent With

rule 2 or rule 3 under Jointly held

Adjusted Basis Less Than FMV

Column (a). Description of the

property, earlier, attach a statement and

property. For each item of property

List each item of property (other than

show how the extent of the decedent’s

acquired from the decedent, accurately

cash) acquired from the decedent by the

ownership is figured.

describe the property received by the

person listed on line 2a the basis of which

person listed on line 2a. Use the

Column (b). Date decedent acquired

at the time of death is less than its FMV at

guidelines discussed under the

the property. For each item of property,

the date of death.

instructions to line 3, column (a), earlier.

enter the date the decedent acquired the

Number each item of property in the

property. If the actual date of acquisition

If the property is property in which the

left-hand column. Four categories of

is not known, and cannot be determined

surviving spouse acquires a qualified

property can be reported here.

after reasonable inquiry, enter the

terminable interest, include a description

approximate date of acquisition and write

1. Property that receives an allocation

of the spouse’s interest in the property

“approximate” after the date.

of both General Basis Increase in column

and include the designation “QTIP” in the

(e)(i) and also Spousal Property Basis

description of the property.

Column (c). Adjusted basis at death.

Increase in column (e)(ii).

For each item of property, enter the

If the property is any of the kinds of

2. Property that receives only an

adjusted basis of the property as of the

property listed under Property Not Eligible

allocation of Spousal Property Basis

date of the decedent’s death. See

for Increase to Basis earlier, include

Increase in column (e)(ii).

Decedent’s Adjusted Basis, earlier, for

sufficient information to identify the kind of

3. Property that receives only an

more details.

ineligible property and the designation

allocation of General Basis Increase in

“Ineligible Property” in the description of

Column (d). FMV at death. For each

column (e)(i).

the property. Attach a statement that lists

item of property, enter the FMV of the

4. Property that receives no allocation

the item number from Schedule A, Line 4

property as of the date of the decedent’s

of increase to basis.

and an explanation as to why the property

death. See Fair Market Value (FMV),

is ineligible for a basis increase.

earlier, for more information.

Do not include in column (e)(i) or (e)(ii)

of line 4 any adjustments to basis other

If the item of property acquired from

Column (e)(i). Basis Increase allocated

than adjustments to basis under section

the decedent is treated as not having

to property. List the amount of General

1022(b) or (c). For example, do not

been owned by the decedent at the time

Basis Increase (as defined in Rev. Proc.

include in column (e)(i) or (e)(ii) any

of death, so state. If the item of property

2011-41, section 4.02(2)) allocated to the

adjustments to basis required or

acquired from the decedent is treated as

property described in column (a).

-8-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11