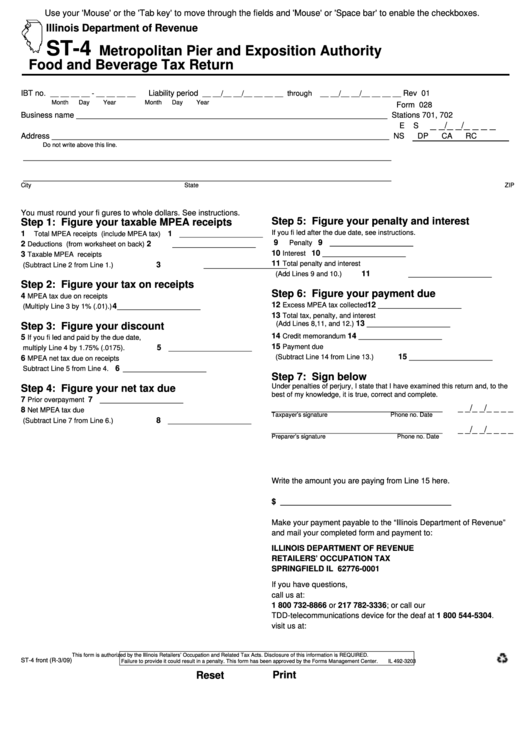

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-4

Metropolitan Pier and Exposition Authority

Food and Beverage Tax Return

IBT no.

__ __ __ __ - __ __ __ __

Liability period

__ __/__ __/__ __ __ __ through __ __/__ __/__ __ __ __

Rev 01

Month

Day

Year

Month

Day

Year

Form 028

Business name _______________________________________________________________________

Stations 701, 702

_ _

_ _

_ _ _ _

/

/

E

S

Address _____________________________________________________________________________

NS

DP

CA

RC

Do not write above this line.

____________________________________________________________________________________

____________________________________________________________________________________

City

State

ZIP

You must round your fi gures to whole dollars. See instructions.

Step 5: Figure your penalty and interest

Step 1: Figure your taxable MPEA receipts

If you fi led after the due date, see instructions.

1

1 ___________________

Total MPEA receipts (include MPEA tax)

9

9 ___________________

Penalty

2

2 ___________________

Deductions (from worksheet on back)

10

10 ___________________

Interest

3

Taxable MPEA receipts

11

Total penalty and interest

3 ___________________

(Subtract Line 2 from Line 1.)

11 ___________________

(Add Lines 9 and 10.)

Step 2: Figure your tax on receipts

Step 6: Figure your payment due

4

MPEA tax due on receipts

12

12 ___________________

Excess MPEA tax collected

4 ___________________

(Multiply Line 3 by 1% (.01).)

13

Total tax, penalty, and interest

Step 3: Figure your discount

13 ___________________

(Add Lines 8,11, and 12.)

14

14 ___________________

Credit memorandum

5

If you fi led and paid by the due date,

15

Payment due

5 ___________________

multiply Line 4 by 1.75% (.0175).

15 ___________________

(Subtract Line 14 from Line 13.)

6

MPEA net tax due on receipts

6 ___________________

Subtract Line 5 from Line 4.

Step 7: Sign below

Under penalties of perjury, I state that I have examined this return and, to the

Step 4: Figure your net tax due

best of my knowledge, it is true, correct and complete.

7

7 ___________________

Prior overpayment

_ _/_ _/_ _ _ _

_______________________________________

8

Net MPEA tax due

Taxpayer’s signature

Phone no.

Date

8 ___________________

(Subtract Line 7 from Line 6.)

_ _/_ _/_ _ _ _

_______________________________________

Preparer’s signature

Phone no.

Date

Write the amount you are paying from Line 15 here.

$ _______________________________________

Make your payment payable to the “Illinois Department of Revenue”

and mail your completed form and payment to:

ILLINOIS DEPARTMENT OF REVENUE

RETAILERS’ OCCUPATION TAX

SPRINGFIELD IL 62776-0001

If you have questions,

call us at:

1 800 732-8866 or 217 782-3336; or call our

TDD-telecommunications device for the deaf at 1 800 544-5304.

visit us at:

tax.illinois.gov

This form is authorized by the Illinois Retailers’ Occupation and Related Tax Acts. Disclosure of this information is REQUIRED.

ST-4 front (R-3/09)

Failure to provide it could result in a penalty. This form has been approved by the Forms Management Center.

IL 492-3203

Print

Reset

1

1