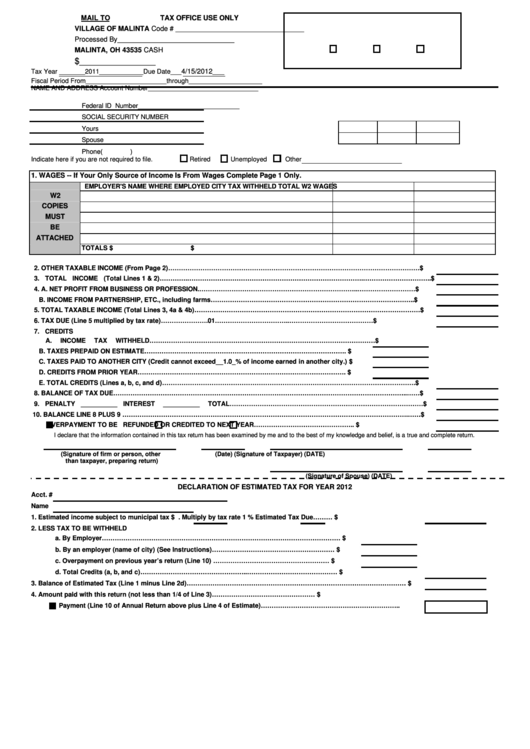

Declaration Of Estimated Tax For Year 2012 - Village Of Malinta

ADVERTISEMENT

MAIL TO

TAX OFFICE USE ONLY

VILLAGE OF MALINTA

Code # _________________________________

P.O. BOX 69

Processed By______________________________

MALINTA, OH 43535

CASH

M.O.

CHECK

$________________

4/15/2012___

Tax Year _______2011____________ Due Date___

Fiscal Period From______________________through____________________

NAME AND ADDRESS

Account Number______________________________

Federal ID Number____________________________

SOCIAL SECURITY NUMBER

Yours

Spouse

Phone (

)

Indicate here if you are not required to file.

Retired

Unemployed

Other

1. WAGES -- If Your Only Source of Income Is From Wages Complete Page 1 Only.

EMPLOYER'S NAME

WHERE EMPLOYED

CITY TAX WITHHELD

TOTAL W2 WAGES

W2

COPIES

MUST

BE

ATTACHED

TOTALS

$

$

2. OTHER TAXABLE INCOME (From Page 2)……………………………………………………………………………………………………… $

3. TOTAL INCOME (Total Lines 1 & 2)………….……………………………………………………………………….………………………….. $

4. A. NET PROFIT FROM BUSINESS OR PROFESSION.………………………………………………………………..……………………… $

B. INCOME FROM PARTNERSHIP, ETC., including farms………………………………………………………………………………….. $

5. TOTAL TAXABLE INCOME (Total Lines 3, 4a & 4b)…………………………………………………………………………………………… $

6. TAX DUE (Line 5 multiplied by tax rate)………………… .01 ………… …………………..………………………………….................... $

7. CREDITS

A. INCOME TAX WITHHELD……………………………………………………………………………………………

$

B. TAXES PREPAID ON ESTIMATE………………………………………………………………………………….

$

C. TAXES PAID TO ANOTHER CITY (Credit cannot exceed__1.0_% of income earned in another city.)

$

D. CREDITS FROM PRIOR YEAR…………………………………………………………………………………….

$

E. TOTAL CREDITS (Lines a, b, c, and d)………………………………………………………………………………………………………. $

8. BALANCE OF TAX DUE………………………………………………………………………………………………………………………..…… $

9. PENALTY

__________

INTEREST

__________

TOTAL……………………………………………………………………………… $

10. BALANCE LINE 8 PLUS 9 …………………………………………………………………………………………………………………….…… $

OVERPAYMENT TO BE

REFUNDED OR

CREDITED TO NEXT YEAR……………………………………….. $

I declare that the information contained in this tax return has been examined by me and to the best of my knowledge and belief, is a true and complete return.

(Signature of firm or person, other

(Date)

(Signature of Taxpayer)

(DATE)

than taxpayer, preparing return)

(Signature of Spouse)

(DATE)

DECLARATION OF ESTIMATED TAX FOR YEAR 2012

Acct. #

Name

1. Estimated income subject to municipal tax

$

. Multiply by tax rate

1

% Estimated Tax Due………

$

2. LESS TAX TO BE WITHHELD

a. By Employer…………………………………………………………………………………………………

$

b. By an employer (name of city) (See Instructions)…………………………………………………

$

c. Overpayment on previous year’s return (Line 10) ………………………………………………

$

d. Total Credits (a, b, and c)…………………………………………..……………………………………

$

3. Balance of Estimated Tax (Line 1 minus Line 2d)…………………………………………………………………………………………

$

4. Amount paid with this return (not less than 1/4 of Line 3)…………………………………………

$

Payment (Line 10 of Annual Return above plus Line 4 of Estimate)………………………………………………………..

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2