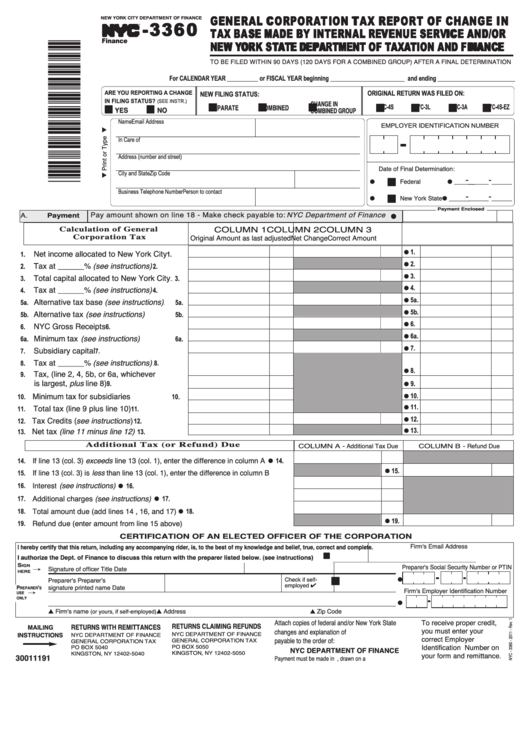

Form Nyc-3360 - General Corporation Tax Report Of Change In Tax Base Made By Internal Revenue Service And/or New York State Department Of Taxation And Finance

ADVERTISEMENT

G G E E N N E E R R A A L L C C O O R R P P O O R R A A T T I I O O N N T T A A X X R R E E P P O O R R T T O O F F C C H H A A N N G G E E I I N N

- - 3 3 3 3 6 6 0 0

NEW YORK CITY DEPARTMENT OF FINANCE

T T A A X X B B A A S S E E M M A A D D E E B B Y Y I I N N T T E E R R N N A A L L R R E E V V E E N N U U E E S S E E R R V V I I C C E E A A N N D D / / O O R R

TM

N N E E W W Y Y O O R R K K S S T T A A T T E E D D E E P P A A R R T T M M E E N N T T O O F F T T A A X X A A T T I I O O N N A A N N D D F F I I N N A A N N C C E E

Finance

TO BE FILED WITHIN 90 DAYS (120 DAYS FOR A COMBINED GROUP) AFTER A FINAL DETERMINATION

For CALENDAR YEAR __________ or FISCAL YEAR beginning ________________________ and ending _________________________

ORIGINAL RETURN WAS FILED ON:

ARE YOU REPORTING A CHANGE

NEW FILING STATUS:

CHANGE IN

IN FILING STATUS?

I I

SEPARATE

I I

COMBINED

I I

I I

I I

I I

I I

(SEE INSTR.)

I I

YES

I I

NO

COMBINED GROUP

NYC-4S

NYC-3L

NYC-3A

NYC-4S-EZ

Name

Email Address

EMPLOYER IDENTIFICATION NUMBER

In Care of

Address (number and street)

Date of Final Determination:

City and State

Zip Code

G ______ - ______ - ______

I I

Federal

G

Business Telephone Number

Person to contact

New York State G ______ - ______ - ______

I I

G

Payment Enclosed

Pay amount shown on line 18 - Make check payable to: NYC Department of Finance G

Payment

A.

Calculation of General

COLUMN 1

COLUMN 2

COLUMN 3

Corporation Tax

Original Amount as last adjusted

Net Change

Correct Amount

Net income allocated to New York City

1.

1.

1.

G

.....

Tax at ______% (see instructions)

2.

2.

2.

G

.................

Total capital allocated to New York City

3.

3.

3.

G

..

Tax at ______% (see instructions)

4.

4.

4.

G

.................

Alternative tax base (see instructions)

5a.

5a.

5a.

G

.......

Alternative tax (see instructions)

5b.

5b.

5b.

G

.......................

NYC Gross Receipts

6.

6.

6.

G

.......................................................

Minimum tax (see instructions)

6a.

6a.

6a.

G

...........................

Subsidiary capital

7.

7.

7.

G

................................................................

Tax at ______% (see instructions)

8.

8.

.................

Tax, (line 2, 4, 5b, or 6a, whichever

8.

G

9.

is largest, plus line 8)

9.

9.

......................................................

G

Minimum tax for subsidiaries

10.

10.

10.

G

........................................

Total tax (line 9 plus line 10)

11.

11.

11.

G

..................................

Tax Credits ( see instructions )

12.

12.

12.

G

..............................

Net tax (line 11 minus line 12)

13.

13.

13.

G

...........................

Additional Tax (or Refund) Due

COLUMN A - Additional Tax Due

COLUMN B - Refund Due

If line 13 (col. 3) exceeds line 13 (col. 1), enter the difference in column A

14.

14.

....

G

If line 13 (col. 3) is less than line 13 (col. 1), enter the difference in column B

15.

15.

G

Interest (see instructions)

16.

16.

...................................................................................................................................

G

Additional charges (see instructions)

17.

17.

.....................................................................................................

G

Total amount due (add lines 14 , 16, and 17)

18.

18.

...............................................................................

G

Refund due (enter amount from line 15 above)

19.

19.

G

...............................................................................

CERTIFICATION OF AN ELECTED OFFICER OF THE CORPORATION

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

Firm's Email Address

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .................YES

I I

__________________________________________

S

Preparer's Social Security Number or PTIN

Signature of officer

Title

Date

IGN

¡

HERE

I I

Check if self-

Preparer's

Preparerʼs

G

employed

signature

printed name

Date

P

'

Firm's Employer Identification Number

REPARER

S

¡

USE

ONLY

G

L Firm's name

L Address

L Zip Code

(or yours, if self-employed)

Attach copies of federal and/or New York State

To receive proper credit,

RETURNS CLAIMING REFUNDS

RETURNS WITH REMITTANCES

MAILING

you must enter your

changes and explanation of items. Make remittance

INSTRUCTIONS

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

correct Employer

payable to the order of:

GENERAL CORPORATION TAX

GENERAL CORPORATION TAX

Identification Number on

NYC DEPARTMENT OF FINANCE

PO BOX 5050

PO BOX 5040

30011191

your form and remittance.

KINGSTON, NY 12402-5050

KINGSTON, NY 12402-5040

Payment must be made in U.S.dollars, drawn on a U.S. bank.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1