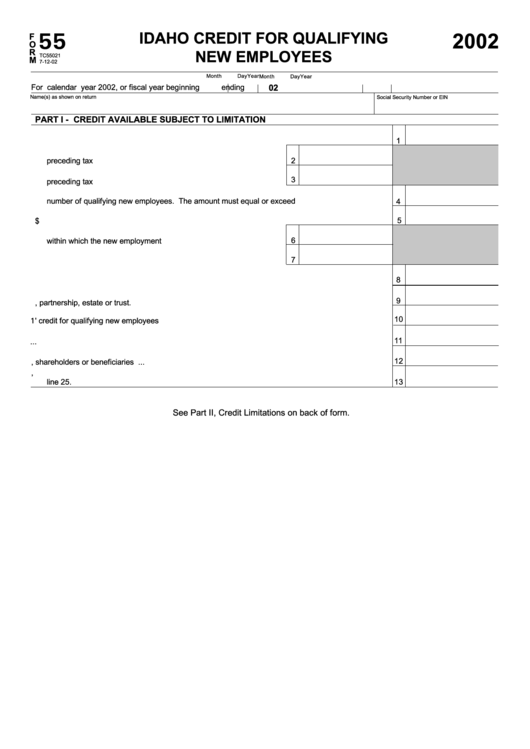

Form 55 Tc55011 - Idaho Credit For Qualifying New Employees - 2002

ADVERTISEMENT

55

IDAHO CREDIT FOR QUALIFYING

F

2002

O

R

NEW EMPLOYEES

TC55021

M

7-12-02

Month

Day

Year

Month

Day

Year

For calendar year 2002, or fiscal year beginning

02

ending

Name(s) as shown on return

Social Security Number or EIN

PART I - CREDIT AVAILABLE SUBJECT TO LIMITATION

1. The average number of qualifying employees during the tax year .........................................................

1

2. The average number of qualifying employees during the three

preceding tax years .............................................................................

2

3. The average number of qualifying employees during the

3

preceding tax year ...............................................................................

4. Subtract the greater of line 2 or 3 from line 1 and enter the difference. This is the

number of qualifying new employees. The amount must equal or exceed one. ....................................

4

5

5. Multiply the number on line 4 by $500. .................................................................................................

6. Enter the net income of the revenue-producing enterprise

6

within which the new employment occurred. ........................................

7

7. Multiply the number on line 6 by .0325. ...............................................

8

8. Enter the smaller of line 5 or line 7. .......................................................................................................

9

9. Enter the pass-through share of credit from an S corporation, partnership, estate or trust. ...................

10. Carryover from prior years' credit for qualifying new employees ............................................................

10

11

11. Credit available prior to distributions. Add lines 8 through 10. ..............................................................

12

12. Credit distributed to partners, shareholders or beneficiaries ..................................................................

13. Total credit available subject to limitation. Subtract line 12 from line 11. Carry to Part II,

line 25.

13

See Part II, Credit Limitations on back of form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2