Form L-1 - City Income Tax Return For Individuals - 2011

ADVERTISEMENT

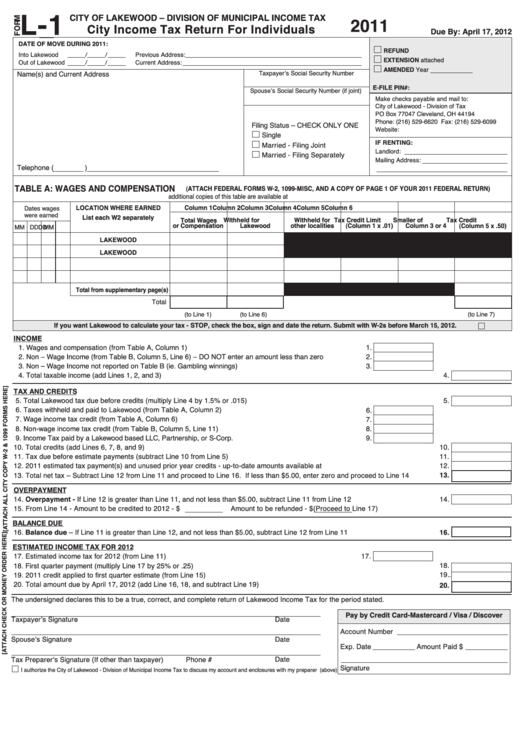

L-1

CITY OF LAKEWOOD – DIVISION OF MUNICIPAL INCOME TAX

2011

City Income Tax Return For Individuals

Due By: April 17, 2012

DATE OF MOVE DURING 2011:

REFUND

Into Lakewood

/

/

Previous Address:

EXTENSION attached

Out of Lakewood

/

/

Current Address:

AMENDED Year

Name(s) and Current Address

Taxpayer’s Social Security Number

E-FILE PIN#:

Spouse’s Social Security Number (if joint)

Make checks payable and mail to:

City of Lakewood - Division of Tax

PO Box 77047 Cleveland, OH 44194

Phone: (216) 529-6620 Fax: (216) 529-6099

Filing Status – CHECK ONLY ONE

Website:

Single

IF RENTING:

Married - Filing Joint

Landlord:

Married - Filing Separately

Mailing Address:

Telephone (

)

TABLE A: WAGES AND COMPENSATION

(ATTACH FEDERAL FORMS W-2, 1099-MISC, AND A COPY OF PAGE 1 OF YOUR 2011 FEDERAL RETURN)

additional copies of this table are available at

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

LOCATION WHERE EARNED

Dates wages

were earned

List each W2 separately

Total Wages

Withheld for

Withheld for

Tax Credit Limit

Smaller of

Tax Credit

or Compensation

Lakewood

other localities

(Column 1 x .01)

Column 3 or 4

(Column 5 x .50)

MM DD

MM

DD

LAKEWOOD

LAKEWOOD

Total from supplementary page(s)

Total

(to Line 1)

(to Line 6)

(to Line 7)

If you want Lakewood to calculate your tax - STOP, check the box, sign and date the return. Submit with W-2s before March 15, 2012.

INCOME

1. Wages and compensation (from Table A, Column 1)

1.

2. Non – Wage Income (from Table B, Column 5, Line 6) – DO NOT enter an amount less than zero

2.

3.

3. Non – Wage Income not reported on Table B (ie. Gambling winnings)

4. Total taxable income (add Lines 1, 2, and 3)

4.

TAX AND CREDITS

5. Total Lakewood tax due before credits (multiply Line 4 by 1.5% or .015)

5.

6. Taxes withheld and paid to Lakewood (from Table A, Column 2)

6.

7. Wage income tax credit (from Table A, Column 6)

7.

8. Non-wage income tax credit (from Table B, Column 5, Line 11)

8.

9. Income Tax paid by a Lakewood based LLC, Partnership, or S-Corp.

9.

10. Total credits (add Lines 6, 7, 8, and 9)

10.

11.

Tax due before estimate payments (subtract Line 10 from Line 5)

11.

12. 2011 estimated tax payment(s) and unused prior year credits - up-to-date amounts available at

12.

13.

13. Total net tax – Subtract Line 12 from Line 11 and proceed to Line 16. If less than $5.00, enter zero and proceed to Line 14

OVERPAYMENT

14. Overpayment - If Line 12 is greater than Line 11, and not less than $5.00, subtract Line 11 from Line 12

14.

Amount to be refunded - $

(Proceed to Line 17)

15. From Line 14 - Amount to be credited to 2012 - $

BALANCE DUE

16. Balance due – If Line 11 is greater than Line 12, and not less than $5.00, subtract Line 12 from Line 11

16.

ESTIMATED INCOME TAX FOR 2012

17. Estimated income tax for 2012 (from Line 11)

17.

18.

18. First quarter payment (multiply Line 17 by 25% or .25)

19..

19. 2011 credit applied to first quarter estimate (from Line 15)

20. Total amount due by April 17, 2012 (add Line 16, 18, and subtract Line 19)

20.

The undersigned declares this to be a true, correct, and complete return of Lakewood Income Tax for the period stated.

Pay by Credit Card-Mastercard / Visa / Discover

Taxpayer’s Signature

Date

Account Number

Spouse’s Signature

Date

Exp. Date

Amount Paid $

Tax Preparer’s Signature (If other than taxpayer)

Phone #

Date

Signature

I authorize the City of Lakewood - Division of Municipal Income Tax to discuss my account and enclosures with my preparer (above)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2