Form Bc 1040 Py - Schedule 3 - Battle Creek City Income Tax

ADVERTISEMENT

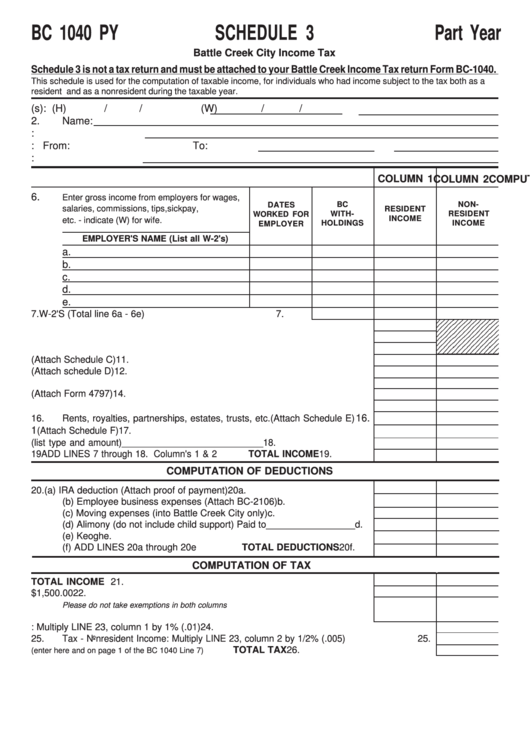

BC 1040 PY

SCHEDULE 3

Part Year

Battle Creek City Income Tax

Schedule 3 is not a tax return and must be attached to your Battle Creek Income Tax return Form BC-1040.

This schedule is used for the computation of taxable income, for individuals who had income subject to the tax both as a

resident and as a nonresident during the taxable year.

1.

Social Security Number(s): (H)

/

/

(W)

/

/

2.

Name:

3.

Address and City:

4.

Battle Creek resident time period: From:

To:

5.

Previous Adress:

COMPUTATION OF TAXABLE INCOME

COLUMN 1 COLUMN 2

6.

Enter gross income from employers for wages,

BC

NON-

DATES

salaries, commissions, tips,sickpay,

RESIDENT

WITH-

RESIDENT

WORKED FOR

INCOME

etc. - indicate (W) for wife.

HOLDINGS

INCOME

EMPLOYER

EMPLOYER'S NAME (List all W-2's)

a.

b.

c.

d.

e.

7.

W-2'S (Total line 6a - 6e)

7.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

8.

Taxable Interest Income

8.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

9.

Dividend Income

9.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

10.

Alimony received from_____________________________________ 10.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5

11.

Business income or loss (Attach Schedule C)

11.

12.

Capital gain or loss (Attach schedule D)

12.

13.

Capital gain distributions not reported on Line 12

13.

14.

Other gains or losses (Attach Form 4797)

14.

15.

Total IRA distributions

15.

16.

16.

Rents, royalties, partnerships, estates, trusts, etc.(Attach Schedule E)

1

7.

Farm income or losses (Attach Schedule F)

17.

18.

Other income (list type and amount)____________________________18.

19

ADD LINES 7 through 18. Column's 1 & 2

TOTAL INCOME 19.

COMPUTATION OF DEDUCTIONS

20.

(a) IRA deduction (Attach proof of payment)

20a.

(b) Employee business expenses (Attach BC-2106)

b.

(c) Moving expenses (into Battle Creek City only)

c.

(d) Alimony (do not include child support) Paid to_________________ d.

(e) Keogh

e.

(f) ADD LINES 20a through 20e

TOTAL DEDUCTIONS

20f.

COMPUTATION OF TAX

21.

LINE 19 minus LINE 20f

TOTAL INCOME 21.

22.

Exemptions - subtract for exemption______________x $1,500.00

22.

Please do not take exemptions in both columns

23.

Taxable Income - LINE 21 minus LINE 22

23.

24.

Tax- Resident Income: Multiply LINE 23, column 1 by 1% (.01)

24.

25.

Tax - Nonresident Income: Multiply LINE 23, column 2 by 1/2% (.005)

25.

26.

ADD LINES 24 and 25

TOTAL TAX26.

(enter here and on page 1 of the BC 1040 Line 7)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1