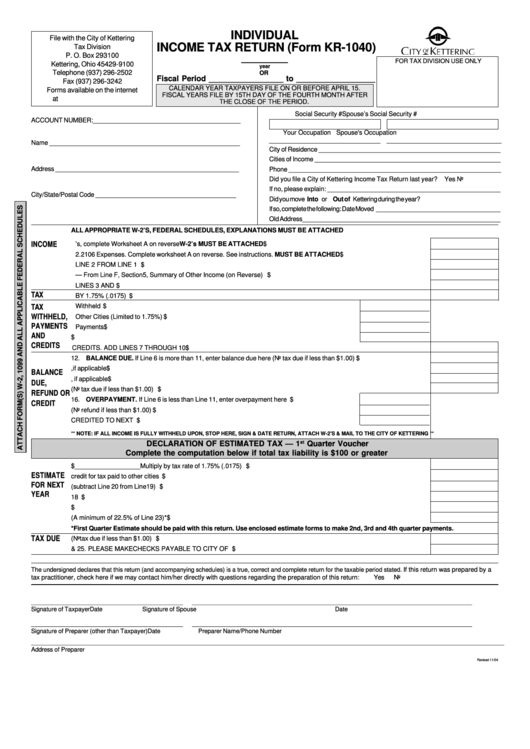

INDIVIDUAL

File with the City of Kettering

INCOME TAX RETURN (Form KR-1040)

Tax Division

P. O. Box 293100

________

FOR TAX DIVISION USE ONLY

Kettering, Ohio 45429-9100

year

Telephone (937) 296-2502

OR

Fiscal Period _________________ to __________________

Fax (937) 296-3242

CALENDAR YEAR TAXPAYERS FILE ON OR BEFORE APRIL 15.

Forms available on the internet

FISCAL YEARS FILE BY 15TH DAY OF THE FOURTH MONTH AFTER

at

THE CLOSE OF THE PERIOD.

Social Security #

Spouse’s Social Security #

ACCOUNT NUMBER:_________________________________________

Your Occupation

Spouse's Occupation

________________________________ _________________________________

Name _____________________________________________________

City of Residence ___________________________________________________

Cities of Income ____________________________________________________

Address ___________________________________________________

Phone ____________________________________________________________

Did you file a City of Kettering Income Tax Return last year?

Yes

No

If no, please explain: ________________________________________________

City/State/Postal Code _______________________________________

Did you move

Into or

Out of Kettering during the year?

If so, complete the following: Date Moved ____________________________________

Old Address_______________________________________________________

ALL APPROPRIATE W-2’S, FEDERAL SCHEDULES, EXPLANATIONS MUST BE ATTACHED

INCOME

1. Total W-2 wages. For multiple W-2’s, complete Worksheet A on reverse W-2’s MUST BE ATTACHED ........................... 1 $

2. 2106 Expenses. Complete worksheet A on reverse. See instructions. MUST BE ATTACHED .......................................... 2 $

3. TAXABLE WAGES. SUBTRACT LINE 2 FROM LINE 1 .................................................................................................. 3 $

4. Other income — From Line F, Section 5, Summary of Other Income (on Reverse) .......................................................... 4 $

5. KETTERING TAXABLE INCOME. ADD LINES 3 AND 4 ................................................................................................. 5 $

TAX

6. KETTERING INCOME TAX. MULTIPLY LINE 5 BY 1.75% (.0175) .................................................................................. 6 $

7. Kettering Tax Withheld ............................................................................................................... 7 $

TAX

WITHHELD,

8. Credit for Taxes Paid to Other Cities (Limited to 1.75%) ............................................................. 8 $

PAYMENTS

9. Estimated Payments/Extension Payments .................................................................................. 9 $

AND

10. Prior Year Credit ....................................................................................................................... 10 $

CREDITS

11. TOTAL PAYMENTS AND CREDITS. ADD LINES 7 THROUGH 10 ................................................................................ 11 $

12. BALANCE DUE. If Line 6 is more than 11, enter balance due here (No tax due if less than $1.00) ................................. 12 $

13. Penalty, if applicable ....................................................................................................................................................... 13 $

BALANCE

14. Interest, if applicable ...................................................................................................................................................... 14 $

DUE,

15. Total due. Carry to Line 25 below (No tax due if less than $1.00) .................................................................................... 15 $

REFUND OR

16. OVERPAYMENT. If Line 6 is less than Line 11, enter overpayment here ................................... 16 $

CREDIT

17. AMOUNT FROM LINE 16 TO BE REFUNDED (No refund if less than $1.00) .......................... 17 $

18. AMOUNT FROM LINE 16 TO BE CREDITED TO NEXT YEAR .............................................. 18 $

** NOTE: IF ALL INCOME IS FULLY WITHHELD UPON, STOP HERE, SIGN & DATE RETURN, ATTACH W-2’S & MAIL TO THE CITY OF KETTERING **

st

DECLARATION OF ESTIMATED TAX — 1

Quarter Voucher

Complete the computation below if total tax liability is $100 or greater

19. Total income subject to tax $__________________ Multiply by tax rate of 1.75% (.0175) .............................................. 19 $

ESTIMATE

20. Subtract Kettering income tax to be withheld or credit for tax paid to other cities ............................................................. 20 $

FOR NEXT

21. Estimated balance due (subtract Line 20 from Line 19) .................................................................................................. 21 $

YEAR

22. Credit from Line 18 above .............................................................................................................................................. 22 $

23. Balance of Estimated Tax Due ........................................................................................................................................ 23 $

24. Amount due with this return (A minimum of 22.5% of Line 23)* ...................................................................................... 24 $

*First Quarter Estimate should be paid with this return. Use enclosed estimate forms to make 2nd, 3rd and 4th quarter payments.

TAX DUE

25. Enter balance due from Line 15 above (No tax due if less than $1.00) ............................................................................ 25 $

26. TOTAL TAX DUE. ADD LINES 24 & 25. PLEASE MAKE CHECKS PAYABLE TO CITY OF KETTERING .................... 26 $

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated.

If this return was prepared by a

tax practitioner, check here if we may contact him/her directly with questions regarding the preparation of this return:

Yes

No

_____________________________________________

___________________

_____________________________________________

___________________

Signature of Taxpayer

Date

Signature of Spouse

Date

_____________________________________________

___________________

_____________________________________________

___________________

Signature of Preparer (other than Taxpayer)

Date

Preparer Name/Phone Number

_____________________________________________________________________________________________________________________________________________

Address of Preparer

Revised 11/04

1

1 2

2