Instructions For Long-Term Enterprise Zone Facilities Credit

ADVERTISEMENT

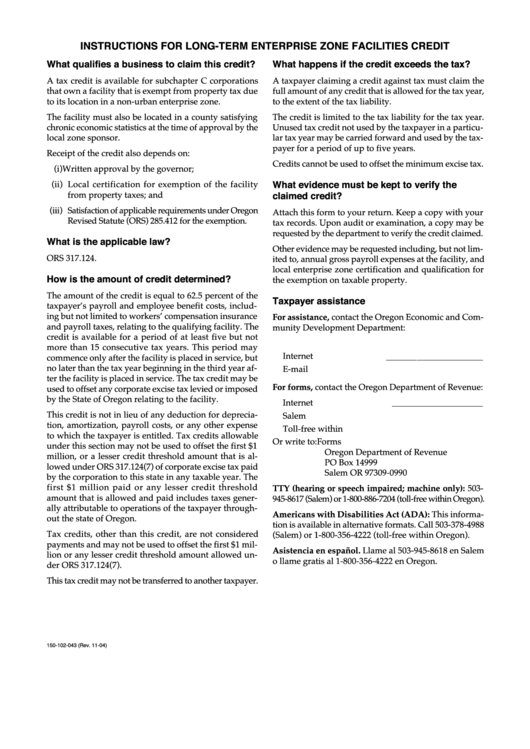

INSTRUCTIONS FOR LONG-TERM ENTERPRISE ZONE FACILITIES CREDIT

What qualifies a business to claim this credit?

What happens if the credit exceeds the tax?

A tax credit is available for subchapter C corporations

A taxpayer claiming a credit against tax must claim the

that own a facility that is exempt from property tax due

full amount of any credit that is allowed for the tax year,

to its location in a non-urban enterprise zone.

to the extent of the tax liability.

The facility must also be located in a county satisfying

The credit is limited to the tax liability for the tax year.

chronic economic statistics at the time of approval by the

Unused tax credit not used by the taxpayer in a particu-

local zone sponsor.

lar tax year may be carried forward and used by the tax-

payer for a period of up to five years.

Receipt of the credit also depends on:

Credits cannot be used to offset the minimum excise tax.

(i) Written approval by the governor;

What evidence must be kept to verify the

(ii) Local certification for exemption of the facility

from property taxes; and

claimed credit?

(iii) Satisfaction of applicable requirements under Oregon

Attach this form to your return. Keep a copy with your

Revised Statute (ORS) 285.412 for the exemption.

tax records. Upon audit or examination, a copy may be

requested by the department to verify the credit claimed.

What is the applicable law?

Other evidence may be requested including, but not lim-

ORS 317.124.

ited to, annual gross payroll expenses at the facility, and

local enterprise zone certification and qualification for

How is the amount of credit determined?

the exemption on taxable property.

The amount of the credit is equal to 62.5 percent of the

Taxpayer assistance

taxpayer’s payroll and employee benefit costs, includ-

ing but not limited to workers’ compensation insurance

For assistance, contact the Oregon Economic and Com-

and payroll taxes, relating to the qualifying facility. The

munity Development Department:

credit is available for a period of at least five but not

Telephone .................................................. 503-986-0123

more than 15 consecutive tax years. This period may

Internet ...............................

commence only after the facility is placed in service, but

no later than the tax year beginning in the third year af-

E-mail ............................................... bi.info@state.or.us

ter the facility is placed in service. The tax credit may be

For forms, contact the Oregon Department of Revenue:

used to offset any corporate excise tax levied or imposed

by the State of Oregon relating to the facility.

Internet ..................................

This credit is not in lieu of any deduction for deprecia-

Salem .......................................................... 503-378-4988

tion, amortization, payroll costs, or any other expense

Toll-free within Oregon ....................... 1-800-356-4222

to which the taxpayer is entitled. Tax credits allowable

Or write to: Forms

under this section may not be used to offset the first $1

Oregon Department of Revenue

million, or a lesser credit threshold amount that is al-

PO Box 14999

lowed under ORS 317.124(7) of corporate excise tax paid

Salem OR 97309-0990

by the corporation to this state in any taxable year. The

first $1 million paid or any lesser credit threshold

TTY (hearing or speech impaired; machine only): 503-

amount that is allowed and paid includes taxes gener-

945-8617 (Salem) or 1-800-886-7204 (toll-free within Oregon).

ally attributable to operations of the taxpayer through-

Americans with Disabilities Act (ADA): This informa-

out the state of Oregon.

tion is available in alternative formats. Call 503-378-4988

Tax credits, other than this credit, are not considered

(Salem) or 1-800-356-4222 (toll-free within Oregon).

payments and may not be used to offset the first $1 mil-

Asistencia en español. Llame al 503-945-8618 en Salem

lion or any lesser credit threshold amount allowed un-

o llame gratis al 1-800-356-4222 en Oregon.

der ORS 317.124(7).

This tax credit may not be transferred to another taxpayer.

150-102-043 (Rev. 11-04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1