Real Estate Tax Relief For Elderly And/or Totally Disabled Persons Application - City Of Alexandria - 2005

ADVERTISEMENT

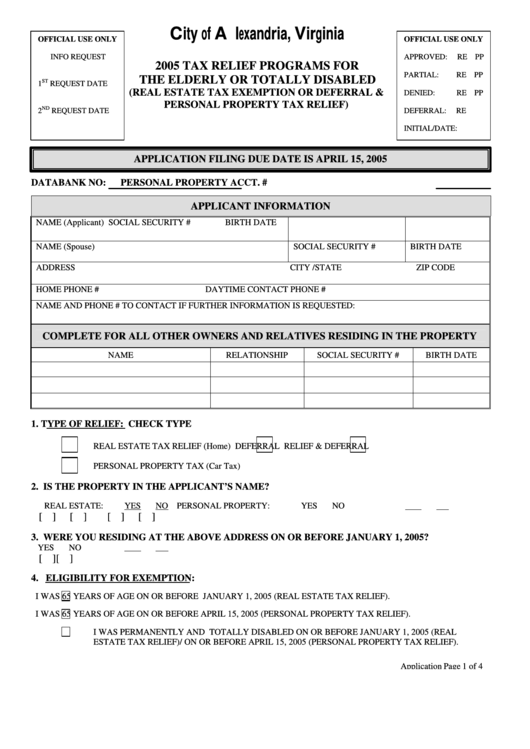

City of Alexandria, Virginia

OFFICIAL USE ONLY

OFFICIAL USE ONLY

INFO REQUEST

APPROVED:

RE PP

2005 TAX RELIEF PROGRAMS FOR

PARTIAL:

RE PP

THE ELDERLY OR TOTALLY DISABLED

ST

1

REQUEST DATE

(REAL ESTATE TAX EXEMPTION OR DEFERRAL &

DENIED:

RE PP

PERSONAL PROPERTY TAX RELIEF)

ND

2

REQUEST DATE

DEFERRAL:

RE

INITIAL/DATE:

APPLICATION FILING DUE DATE IS APRIL 15, 2005

DATABANK NO:

PERSONAL PROPERTY ACCT. #

APPLICANT INFORMATION

NAME (Applicant)

SOCIAL SECURITY #

BIRTH DATE

NAME (Spouse)

SOCIAL SECURITY #

BIRTH DATE

ADDRESS

CITY /STATE

ZIP CODE

HOME PHONE #

DAYTIME CONTACT PHONE #

NAME AND PHONE # TO CONTACT IF FURTHER INFORMATION IS REQUESTED:

COMPLETE FOR ALL OTHER OWNERS AND RELATIVES RESIDING IN THE PROPERTY

NAME

RELATIONSHIP

SOCIAL SECURITY #

BIRTH DATE

1. TYPE OF RELIEF: CHECK TYPE

REAL ESTATE TAX RELIEF (Home)

DEFERRAL

RELIEF & DEFERRAL

PERSONAL PROPERTY TAX (Car Tax)

2. IS THE PROPERTY IN THE APPLICANT’S NAME?

REAL ESTATE:

YES

NO

PERSONAL PROPERTY:

YES

NO

[ ]

[ ]

[ ]

[ ]

3. WERE YOU RESIDING AT THE ABOVE ADDRESS ON OR BEFORE JANUARY 1, 2005?

YES

NO

[ ]

[ ]

4. ELIGIBILITY FOR EXEMPTION:

I WAS 65 YEARS OF AGE ON OR BEFORE JANUARY 1, 2005 (REAL ESTATE TAX RELIEF).

I WAS 65 YEARS OF AGE ON OR BEFORE APRIL 15, 2005 (PERSONAL PROPERTY TAX RELIEF).

I WAS PERMANENTLY AND TOTALLY DISABLED ON OR BEFORE JANUARY 1, 2005 (REAL

ESTATE TAX RELIEF)/ ON OR BEFORE APRIL 15, 2005 (PERSONAL PROPERTY TAX RELIEF).

Application Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4