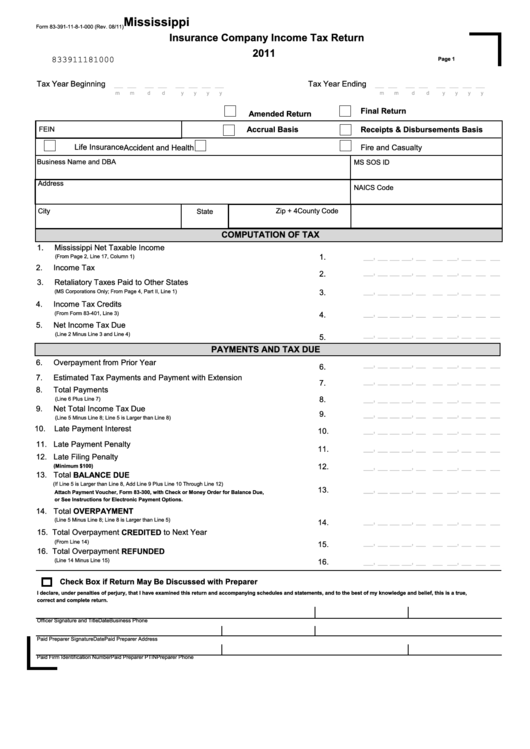

Form 83-391-11-8-1-000 - Mississippi Insurance Company Income Tax Return - 2011

ADVERTISEMENT

Mississippi

Form 83-391-11-8-1-000 (Rev. 08/11)

Insurance Company Income Tax Return

2011

833911181000

Page 1

Tax Year Ending

__ __

__ __

__ __ __ __

Tax Year Beginning

__ __

__ __

__ __ __ __

m

m

d

d

y

y

y

y

m

m

d

d

y

y

y

y

Final Return

Amended Return

Accrual Basis

FEIN

Receipts & Disbursements Basis

Life Insurance

Accident and Health

Fire and Casualty

Business Name and DBA

MS SOS ID

Address

NAICS Code

City

Zip + 4

County Code

State

COMPUTATION OF TAX

1.

Mississippi Net Taxable Income

__, __ __ __, __ __ __, __ __ __

1.

(From Page 2, Line 17, Column 1)

2.

Income Tax

__, __ __ __, __ __ __, __ __ __

2.

3.

Retaliatory Taxes Paid to Other States

__, __ __ __, __ __ __, __ __ __

3.

(MS Corporations Only; From Page 4, Part II, Line 1)

4.

Income Tax Credits

__, __ __ __, __ __ __, __ __ __

4.

(From Form 83-401, Line 3)

5.

Net Income Tax Due

__, __ __ __, __ __ __, __ __ __

(Line 2 Minus Line 3 and Line 4)

5.

PAYMENTS AND TAX DUE

6.

Overpayment from Prior Year

__, __ __ __, __ __ __, __ __ __

6.

7.

Estimated Tax Payments and Payment with Extension

__, __ __ __, __ __ __, __ __ __

7.

8.

Total Payments

__, __ __ __, __ __ __, __ __ __

8.

(Line 6 Plus Line 7)

9.

Net Total Income Tax Due

__, __ __ __, __ __ __, __ __ __

9.

(Line 5 Minus Line 8; Line 5 is Larger than Line 8)

10.

Late Payment Interest

__, __ __ __, __ __ __, __ __ __

10.

11. Late Payment Penalty

__, __ __ __, __ __ __, __ __ __

11.

12. Late Filing Penalty

__, __ __ __, __ __ __, __ __ __

12.

(Minimum $100)

13. Total BALANCE DUE

(If Line 5 is Larger than Line 8, Add Line 9 Plus Line 10 Through Line 12)

__, __ __ __, __ __ __, __ __ __

13.

Attach Payment Voucher, Form 83-300, with Check or Money Order for Balance Due,

or See Instructions for Electronic Payment Options.

14. Total OVERPAYMENT

__, __ __ __, __ __ __, __ __ __

(Line 5 Minus Line 8; Line 8 is Larger than Line 5)

14.

15. Total Overpayment CREDITED to Next Year

__, __ __ __, __ __ __, __ __ __

(From Line 14)

15.

16. Total Overpayment REFUNDED

__, __ __ __, __ __ __, __ __ __

(Line 14 Minus Line 15)

16.

Check Box if Return May Be Discussed with Preparer

I declare, under penalties of perjury, that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, this is a true,

correct and complete return.

Officer Signature and Title

Date

Business Phone

Paid Preparer Signature

Date

Paid Preparer Address

Paid Firm Identification Number

Paid Preparer PTIN

Preparer Phone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4