Form 51a131 - Sales And Use Tax - Monthly Aviation Fuel Dealer Supplementary Schedule

ADVERTISEMENT

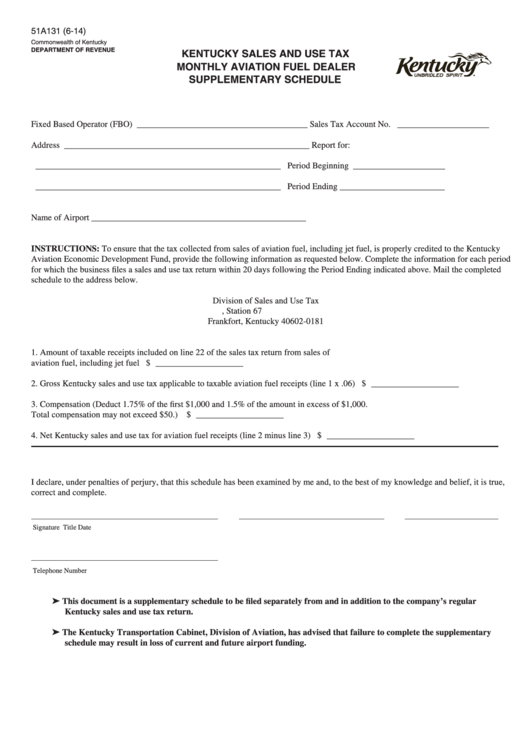

51A131 (6-14)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

KENTUCKY SALES AND USE TAX

MONTHLY AVIATION FUEL DEALER

SUPPLEMENTARY SCHEDULE

Fixed Based Operator (FBO) _______________________________________

Sales Tax Account No. _____________________

Address ________________________________________________________

Report for:

________________________________________________________

Period Beginning _____________________

________________________________________________________

Period Ending ________________________

Name of Airport _________________________________________________

INSTRUCTIONS: To ensure that the tax collected from sales of aviation fuel, including jet fuel, is properly credited to the Kentucky

Aviation Economic Development Fund, provide the following information as requested below. Complete the information for each period

for which the business files a sales and use tax return within 20 days following the Period Ending indicated above. Mail the completed

schedule to the address below.

Division of Sales and Use Tax

P.O. Box 181, Station 67

Frankfort, Kentucky 40602-0181

1. Amount of taxable receipts included on line 22 of the sales tax return from sales of

aviation fuel, including jet fuel ................................................................................................................. $ ____________________

2. Gross Kentucky sales and use tax applicable to taxable aviation fuel receipts (line 1 x .06) ................... $ ____________________

3. Compensation (Deduct 1.75% of the first $1,000 and 1.5% of the amount in excess of $1,000.

Total compensation may not exceed $50.) ............................................................................................... $ ____________________

4. Net Kentucky sales and use tax for aviation fuel receipts (line 2 minus line 3) ....................................... $ ____________________

I declare, under penalties of perjury, that this schedule has been examined by me and, to the best of my knowledge and belief, it is true,

correct and complete.

Signature

Title

Date

Telephone Number

➤ This document is a supplementary schedule to be filed separately from and in addition to the company’s regular

Kentucky sales and use tax return.

➤ The Kentucky Transportation Cabinet, Division of Aviation, has advised that failure to complete the supplementary

schedule may result in loss of current and future airport funding.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1