Instructions For 500 Uet - Underpayment Of Estimated Tax By Individuals/fiduciary

ADVERTISEMENT

Instructions for 500 UET Underpayment of

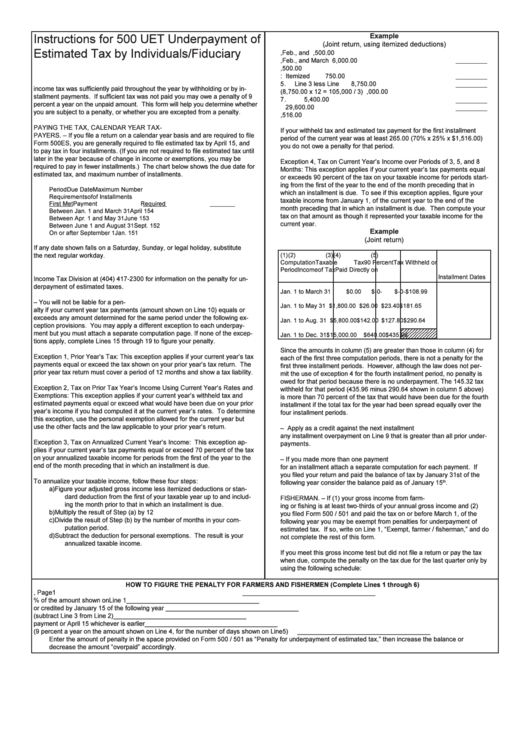

Example

(Joint return, using itemized deductions)

Estimated Tax by Individuals/Fiduciary

1.

Wages received during Jan., Feb., and March ...........

3,500.00

2.

Self-employment income during Jan., Feb., and March

6,000.00

3.

Adjusted gross income ...............................................

9,500.00

4.

Less: Itemized Deductions ......... ...............................

750.00

A.

Individual or fiduciary taxpayers may use this form to determine whether

5.

Line 3 less Line 4..........................................................

8,750.00

income tax was sufficiently paid throughout the year by withholding or by in-

6.

Annualized income (8,750.00 x 12 = 105,000 / 3) ......

35,000.00

stallment payments. If sufficient tax was not paid you may owe a penalty of 9

7.

Exemption.....................................................................

5,400.00

percent a year on the unpaid amount. This form will help you determine whether

8.

Annualized taxable income .........................................

29,600.00

you are subject to a penalty, or whether you are excepted from a penalty.

9.

Total Income Tax ........................................................

1,516.00

B.

FILING AN ESTIMATE AND PAYING THE TAX, CALENDAR YEAR TAX-

If your withheld tax and estimated tax payment for the first installment

PAYERS. – If you file a return on a calendar year basis and are required to file

period of the current year was at least 265.00 (70% x 25% x $1,516.00)

Form 500ES, you are generally required to file estimated tax by April 15, and

you do not owe a penalty for that period.

to pay tax in four installments. (If you are not required to file estimated tax until

later in the year because of change in income or exemptions, you may be

Exception 4, Tax on Current Year’s Income over Periods of 3, 5, and 8

required to pay in fewer installments.) The chart below shows the due date for

Months: This exception applies if your current year’s tax payments equal

estimated tax, and maximum number of installments.

or exceeds 90 percent of the tax on your taxable income for periods start-

ing from the first of the year to the end of the month preceding that in

Period

Due Date

Maximum Number

which an installment is due. To see if this exception applies, figure your

Requirements

of

of Installments

taxable income from January 1, of the current year to the end of the

First Met

Payment

Required

month preceding that in which an installment is due. Then compute your

Between Jan. 1 and March 31

April 15

4

tax on that amount as though it represented your taxable income for the

Between Apr. 1 and May 31

June 15

3

current year.

Between June 1 and August 31

Sept. 15

2

Example

On or after September 1

Jan. 15

1

(Joint return)

If any date shown falls on a Saturday, Sunday, or legal holiday, substitute

the next regular workday.

(1)

(2)

(3)

(4)

(5)

Computation

Taxable

Tax

90 Percent

Tax Withheld or

Period

Income

of Tax

Paid Directly on

C.

FISCAL YEAR TAXPAYERS. - Fiscal year taxpayers should contact the

Installment Dates

Income Tax Division at (404) 417-2300 for information on the penalty for un-

derpayment of estimated taxes.

Jan. 1 to March 31

$0.00

$-0-

$-0-

$108.99

D.

EXCEPTIONS FROM THE PENALTY. – You will not be liable for a pen-

Jan. 1 to May 31

$1,800.00

$26.00 $23.40

$181.65

alty if your current year tax payments (amount shown on Line 10) equals or

exceeds any amount determined for the same period under the following ex-

Jan. 1 to Aug. 31

$5,800.00

$142.00 $127.80

$290.64

ception provisions. You may apply a different exception to each underpay-

1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4

ment but you must attach a separate computation page. If none of the excep-

Jan. 1 to Dec. 31

$15,000.00

$640.00

1 2 3 4 5 6 7 8 9 0 1 2 3 4

$435.96

1 2 3 4 5 6 7 8 9 0 1 2 3 4

tions apply, complete Lines 15 through 19 to figure your penalty.

Since the amounts in column (5) are greater than those in column (4) for

Exception 1, Prior Year’s Tax: This exception applies if your current year’s tax

each of the first three computation periods, there is not a penalty for the

payments equal or exceed the tax shown on your prior year’s tax return. The

first three installment periods. However, although the law does not per-

prior year tax return must cover a period of 12 months and show a tax liability.

mit the use of exception 4 for the fourth installment period, no penalty is

owed for that period because there is no underpayment. The 145.32 tax

Exception 2, Tax on Prior Tax Year’s Income Using Current Year’s Rates and

withheld for that period (435.96 minus 290.64 shown in column 5 above)

Exemptions: This exception applies if your current year’s withheld tax and

is more than 70 percent of the tax that would have been due for the fourth

estimated payments equal or exceed what would have been due on your prior

installment if the total tax for the year had been spread equally over the

year’s income if you had computed it at the current year’s rates. To determine

four installment periods.

this exception, use the personal exemption allowed for the current year but

use the other facts and the law applicable to your prior year’s return.

E.

OVERPAYMENT. – Apply as a credit against the next installment

any installment overpayment on Line 9 that is greater than all prior under-

Exception 3, Tax on Annualized Current Year’s Income: This exception ap-

payments.

plies if your current year’s tax payments equal or exceed 70 percent of the tax

on your annualized taxable income for periods from the first of the year to the

F.

INSTALLMENT PAYMENTS. – If you made more than one payment

end of the month preceding that in which an installment is due.

for an installment attach a separate computation for each payment. If

you filed your return and paid the balance of tax by January 31st of the

To annualize your taxable income, follow these four steps:

following year consider the balance paid as of January 15

.

th

a)

Figure your adjusted gross income less itemized deductions or stan-

dard deduction from the first of your taxable year up to and includ-

G.

FARMERS AND FISHERMAN. – If (1) your gross income from farm-

ing the month prior to that in which an installment is due.

ing or fishing is at least two-thirds of your annual gross income and (2)

b)

Multiply the result of Step (a) by 12

you filed Form 500 / 501 and paid the tax on or before March 1, of the

c)

Divide the result of Step (b) by the number of months in your com-

following year you may be exempt from penalties for underpayment of

putation period.

estimated tax. If so, write on Line 1, “Exempt, farmer / fisherman,” and do

d)

Subtract the deduction for personal exemptions. The result is your

not complete the rest of this form.

annualized taxable income.

If you meet this gross income test but did not file a return or pay the tax

when due, compute the penalty on the tax due for the last quarter only by

using the following schedule:

HOW TO FIGURE THE PENALTY FOR FARMERS AND FISHERMEN (Complete Lines 1 through 6)

1.

Enter amount listed on Line 3, Page 1

_____________________________________

2.

Enter 66 2/3% of the amount shown on Line 1

_____________________________________

3.

Amount withheld during current year and amounts paid or credited by January 15 of the following year _____________________________________

4.

Underpayment of Estimated Tax (subtract Line 3 from Line 2)

_____________________________________

5.

Number of days from January 15 to date of payment or April 15 whichever is earlier

_____________________________________

6.

Penalty (9 percent a year on the amount shown on Line 4, for the number of days shown on Line 5)

_____________________________________

Enter the amount of penalty in the space provided on Form 500 / 501 as “Penalty for underpayment of estimated tax,” then increase the balance or

decrease the amount “overpaid” accordingly.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1