Form Rpd-41308 - Fuel Retailer Report

ADVERTISEMENT

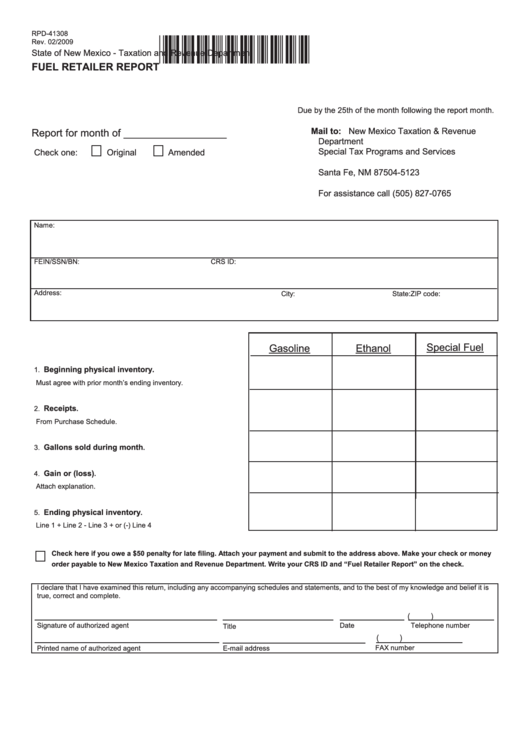

RPD-41308

Rev. 02/2009

*96570100*

State of New Mexico - Taxation and Revenue Department

FUEL RETAILER REPORT

Due by the 25th of the month following the report month.

Mail to: New Mexico Taxation & Revenue

Report for month of __________________

Department

Special Tax Programs and Services

Check one:

Original

Amended

P.O. Box 25123

Santa Fe, NM 87504-5123

For assistance call (505) 827-0765

Name:

FEIN/SSN/BN:

CRS ID:

Address:

City:

State:

ZIP code:

Special Fuel

Gasoline

Ethanol

Beginning physical inventory.

1.

........................................ 1.

Must agree with prior month’s ending inventory.

Receipts

2.

. ................................................................................ 2.

From Purchase Schedule.

Gallons sold during month

3.

. ............................................. 3.

Gain or (loss)

4.

. ..................................................................... 4.

Attach explanation.

Ending physical inventory

5.

. .............................................. 5.

Line 1 + Line 2 - Line 3 + or (-) Line 4

Check here if you owe a $50 penalty for late filing. Attach your payment and submit to the address above. Make your check or money

order payable to New Mexico Taxation and Revenue Department. Write your CRS ID and “Fuel Retailer Report” on the check.

I declare that I have examined this return, including any accompanying schedules and statements, and to the best of my knowledge and belief it is

true, correct and complete.

(

)

Signature of authorized agent

Date

Telephone number

Title

(

)

FAX number

Printed name of authorized agent

E-mail address

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1