Reset Form

Print Form

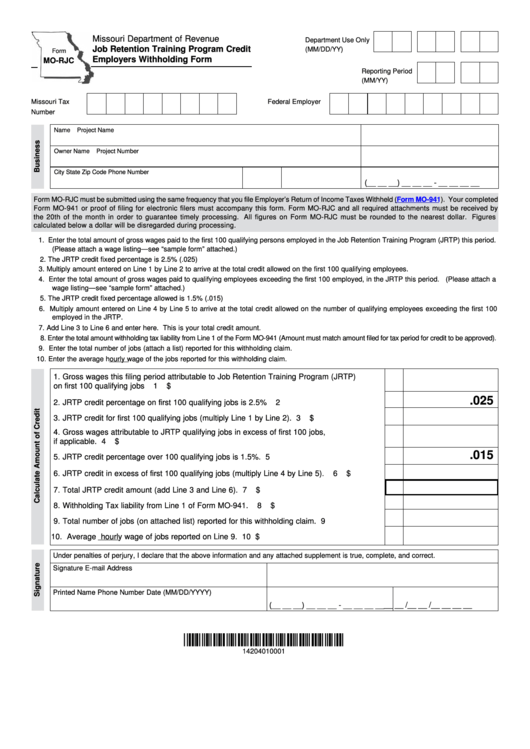

Missouri Department of Revenue

Department Use Only

Job Retention Training Program Credit

(MM/DD/YY)

Form

Employers Withholding Form

MO-RJC

Reporting Period

(MM/YY)

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Name

Project Name

Owner Name

Project Number

City

State

Zip Code

Phone Number

(__ __ __) __ __ __ - __ __ __ __

Form MO-RJC must be submitted using the same frequency that you file Employer’s Return of Income Taxes Withheld

(Form

MO-941). Your completed

Form MO-941 or proof of filing for electronic filers must accompany this form. Form MO-RJC and all required attachments must be received by

the 20th of the month in order to guarantee timely processing. All figures on Form MO-RJC must be rounded to the nearest dollar. Figures

calculated below a dollar will be disregarded during processing.

1. Enter the total amount of gross wages paid to the first 100 qualifying persons employed in the Job Retention Training Program (JRTP) this period.

(Please attach a wage listing—see “sample form” attached.)

2. The JRTP credit fixed percentage is 2.5% (.025)

3. Multiply amount entered on Line 1 by Line 2 to arrive at the total credit allowed on the first 100 qualifying employees.

4. Enter the total amount of gross wages paid to qualifying employees exceeding the first 100 employed, in the JRTP this period. (Please attach a

wage listing—see “sample form” attached.)

5. The JRTP credit fixed percentage allowed is 1.5% (.015)

6. Multiply amount entered on Line 4 by Line 5 to arrive at the total credit allowed on the number of qualifying employees exceeding the first 100

employed in the JRTP.

7. Add Line 3 to Line 6 and enter here. This is your total credit amount.

8. Enter the total amount withholding tax liability from Line 1 of the Form MO-941 (Amount must match amount filed for tax period for credit to be approved).

9. Enter the total number of jobs (attach a list) reported for this withholding claim.

10. Enter the average hourly wage of the jobs reported for this withholding claim.

1. Gross wages this filing period attributable to Job Retention Training Program (JRTP)

on first 100 qualifying jobs .......................................................................................................

1

$

.025

2. JRTP credit percentage on first 100 qualifying jobs is 2.5% ...................................................

2

3. JRTP credit for first 100 qualifying jobs (multiply Line 1 by Line 2). ......................................

3

$

4. Gross wages attributable to JRTP qualifying jobs in excess of first 100 jobs,

if applicable. ............................................................................................................................

4

$

.015

5. JRTP credit percentage over 100 qualifying jobs is 1.5%. .....................................................

5

6. JRTP credit in excess of first 100 qualifying jobs (multiply Line 4 by Line 5)..........................

6

$

7. Total JRTP credit amount (add Line 3 and Line 6). ................................................................

7

$

8. Withholding Tax liability from Line 1 of Form MO-941.............................................................

8

$

9. Total number of jobs (on attached list) reported for this withholding claim. ...........................

9

10. Average hourly wage of jobs reported on Line 9. ................................................................... 10

$

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Signature

E-mail Address

Printed Name

Phone Number

Date (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

(__ __ __) __ __ __ - __ __ __ __

*14204010001*

14204010001

1

1 2

2