Ui Form 1 - Application For An Unemployment Insurance Tax Account Number

ADVERTISEMENT

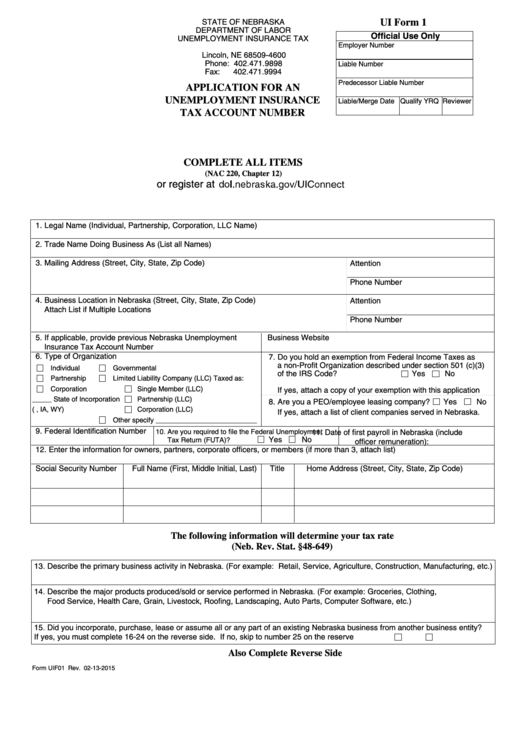

UI Form 1

STATE OF NEBRASKA

DEPARTMENT OF LABOR

Official Use Only

UNEMPLOYMENT INSURANCE TAX

Employer Number

P.O. Box 94600

Lincoln, NE 68509-4600

Phone: 402.471.9898

Liable Number

Fax:

402.471.9994

Predecessor Liable Number

APPLICATION FOR AN

UNEMPLOYMENT INSURANCE

Liable/Merge Date Qualify YRQ Reviewer

TAX ACCOUNT NUMBER

COMPLETE ALL ITEMS

(NAC 220, Chapter 12)

or register at

1. Legal Name (Individual, Partnership, Corporation, LLC Name)

2. Trade Name Doing Business As (List all Names)

3. Mailing Address (Street, City, State, Zip Code)

Attention

Phone Number

4. Business Location in Nebraska (Street, City, State, Zip Code)

Attention

Attach List if Multiple Locations

Phone Number

5. If applicable, provide previous Nebraska Unemployment

Business Website

Insurance Tax Account Number

6. Type of Organization

7. Do you hold an exemption from Federal Income Taxes as

a non-Profit Organization described under section 501 (c)(3)

Individual

Governmental

of the IRS Code?

Yes

No

Partnership

Limited Liability Company (LLC) Taxed as:

Corporation

Single Member (LLC)

If yes, attach a copy of your exemption with this application

_____ State of Incorporation

Partnership (LLC)

8. Are you a PEO/employee leasing company?

Yes

No

(i.e. NE, IA, WY)

Corporation (LLC)

If yes, attach a list of client companies served in Nebraska.

Other specify __________________________

9. Federal Identification Number

10. Are you required to file the Federal Unemployment

11. Date of first payroll in Nebraska (include

Yes

No

Tax Return (FUTA)?

officer remuneration):

12. Enter the information for owners, partners, corporate officers, or members (if more than 3, attach list)

Social Security Number

Full Name (First, Middle Initial, Last)

Title

Home Address (Street, City, State, Zip Code)

The following information will determine your tax rate

(Neb. Rev. Stat. §48-649)

13. Describe the primary business activity in Nebraska. (For example: Retail, Service, Agriculture, Construction, Manufacturing, etc.)

14. Describe the major products produced/sold or service performed in Nebraska. (For example: Groceries, Clothing,

Food Service, Health Care, Grain, Livestock, Roofing, Landscaping, Auto Parts, Computer Software, etc.)

15. Did you incorporate, purchase, lease or assume all or any part of an existing Nebraska business from another business entity?

If yes, you must complete 16-24 on the reverse side. If no, skip to number 25 on the reserve side.

Yes

No

Also Complete Reverse Side

Form UIF01 Rev. 02-13-2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2