RESET

PRINT

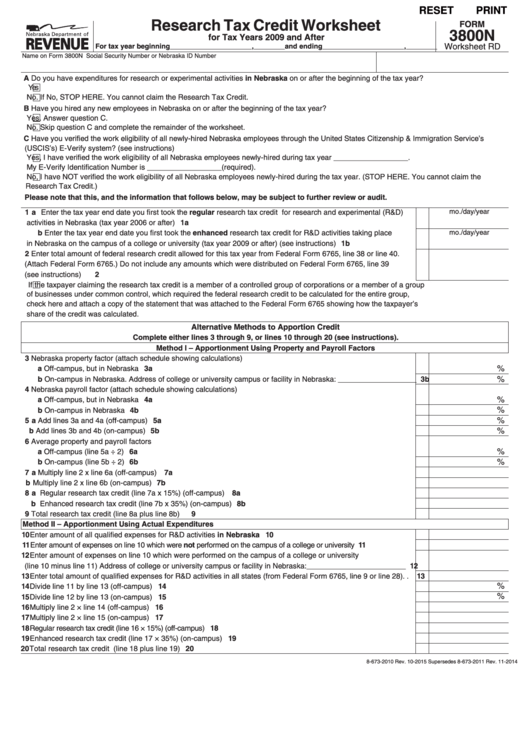

Research Tax Credit Worksheet

FORM

3800N

for Tax Years 2009 and After

Worksheet RD

For tax year beginning_____________________,________and ending_____________________,________

Name on Form 3800N

Social Security Number or Nebraska ID Number

A Do you have expenditures for research or experimental activities in Nebraska on or after the beginning of the tax year?

Yes

No . If No, STOP HERE . You cannot claim the Research Tax Credit .

B Have you hired any new employees in Nebraska on or after the beginning of the tax year?

Yes . Answer question C .

No . Skip question C and complete the remainder of the worksheet .

C Have you verified the work eligibility of all newly-hired Nebraska employees through the United States Citizenship & Immigration Service’s

(USCIS’s) E-Verify system? (see instructions)

Yes, I have verified the work eligibility of all Nebraska employees newly-hired during tax year __________________ .

My E-Verify Identification Number is __________________(required) .

No, I have NOT verified the work eligibility of all Nebraska employees newly-hired during the tax year . (STOP HERE . You cannot claim the

Research Tax Credit .)

Please note that this, and the information that follows below, may be subject to further review or audit.

1 a Enter the tax year end date you first took the regular research tax credit for research and experimental (R&D)

mo ./day/year

activities in Nebraska (tax year 2006 or after) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

b Enter the tax year end date you first took the enhanced research tax credit for R&D activities taking place

mo ./day/year

in Nebraska on the campus of a college or university (tax year 2009 or after) (see instructions) . . . . . . . . . . . . . . . 1b

2 Enter total amount of federal research credit allowed for this tax year from Federal Form 6765, line 38 or line 40 .

(Attach Federal Form 6765 .) Do not include any amounts which were distributed on Federal Form 6765, line 39

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

If the taxpayer claiming the research tax credit is a member of a controlled group of corporations or a member of a group

of businesses under common control, which required the federal research credit to be calculated for the entire group,

check here and attach a copy of the statement that was attached to the Federal Form 6765 showing how the taxpayer’s

share of the credit was calculated .

Alternative Methods to Apportion Credit

Complete either lines 3 through 9, or lines 10 through 20 (see instructions).

Method I – Apportionment Using Property and Payroll Factors

3 Nebraska property factor (attach schedule showing calculations)

%

a Off-campus, but in Nebraska . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a

%

b On-campus in Nebraska . Address of college or university campus or facility in Nebraska: ___________________ 3b

4 Nebraska payroll factor (attach schedule showing calculations)

%

a Off-campus, but in Nebraska . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a

%

b On-campus in Nebraska . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b

%

5 a Add lines 3a and 4a (off-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5a

%

b Add lines 3b and 4b (on-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

6 Average property and payroll factors

%

a Off-campus (line 5a ÷ 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a

%

b On-campus (line 5b ÷ 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

7 a Multiply line 2 x line 6a (off-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7a

b Multiply line 2 x line 6b (on-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

8 a Regular research tax credit (line 7a x 15%) (off-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8a

b Enhanced research tax credit (line 7b x 35%) (on-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8b

9 Total research tax credit (line 8a plus line 8b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Method II – Apportionment Using Actual Expenditures

10 Enter amount of all qualified expenses for R&D activities in Nebraska . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Enter amount of expenses on line 10 which were not performed on the campus of a college or university . . . . . . . . . . . . . 11

12 Enter amount of expenses on line 10 which were performed on the campus of a college or university

(line 10 minus line 11) Address of college or university campus or facility in Nebraska:________________________ 12

13 Enter total amount of qualified expenses for R&D activities in all states (from Federal Form 6765, line 9 or line 28) . . 13

%

14 Divide line 11 by line 13 (off-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

%

15 Divide line 12 by line 13 (on-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Multiply line 2 × line 14 (off-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Multiply line 2 × line 15 (on-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Regular research tax credit (line 16 × 15%) (off-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Enhanced research tax credit (line 17 × 35%) (on-campus) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Total research tax credit (line 18 plus line 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

8-673-2010 Rev . 10-2015 Supersedes 8-673-2011 Rev . 11-2014

1

1 2

2