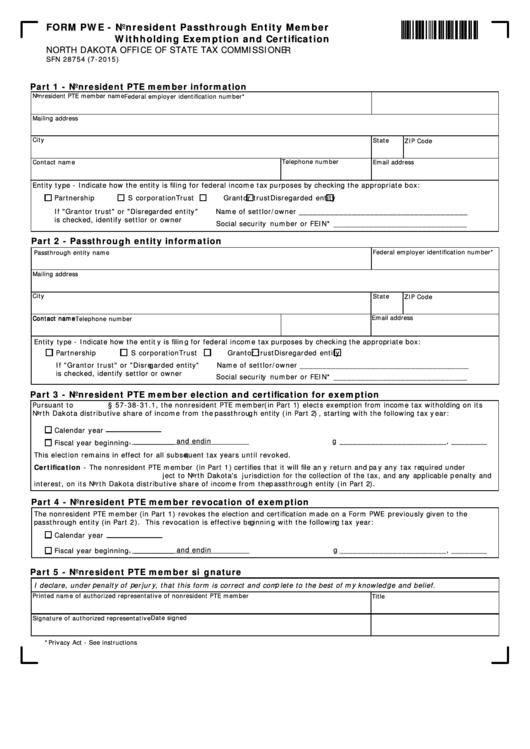

FORM PWE - Nonresident Passthrough Entity Member

Withholding Exemption and Certification

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER

SFN 28754 (7-2015)

Part 1 - Nonresident PTE member information

Nonresident PTE member name

Federal employer identification number*

Mailing address

City

State

ZIP Code

Telephone number

Contact name

Email address

Entity type - Indicate how the entity is filing for federal income tax purposes by checking the appropriate box:

Partnership

S corporation

Trust

Grantor trust

Disregarded entity

If "Grantor trust" or "Disregarded entity"

Name of settlor/owner ______________________________________

is checked, identify settlor or owner

Social security number or FEIN* ______________________________

Part 2 - Passthrough entity information

Federal employer identification number*

Passthrough entity name

Mailing address

City

State

ZIP Code

Email address

Contact name

Contact name

Telephone number

Entity type - Indicate how the entity is filing for federal income tax purposes by checking the appropriate box:

Partnership

S corporation

Trust

Grantor trust

Disregarded entity

If "Grantor trust" or "Disregarded entity"

Name of settlor/owner ______________________________________

is checked, identify settlor or owner

Social security number or FEIN* ______________________________

Part 3 - Nonresident PTE member election and certification for exemption

Pursuant to N.D.C.C. § 57-38-31.1, the nonresident PTE member (in Part 1) elects exemption from income tax witholding on its

North Dakota distributive share of income from the passthrough entity (in Part 2), starting with the following tax year:

Calendar year

, _________ and ending ________________________, ________

Fiscal year beginning

This election remains in effect for all subsequent tax years until revoked.

Certification - The nonresident PTE member (in Part 1) certifies that it will file any return and pay any tax required under

N.D.C.C. ch. 57-38 and that it is subject to North Dakota's jurisdiction for the collection of the tax, and any applicable penalty and

interest, on its North Dakota distributive share of income from the passthrough entity (in Part 2).

Part 4 - Nonresident PTE member revocation of exemption

The nonresident PTE member (in Part 1) revokes the election and certification made on a Form PWE previously given to the

passthrough entity (in Part 2). This revocation is effective beginning with the following tax year:

Calendar year

, _________ and ending ________________________, ________

Fiscal year beginning

Part 5 - Nonresident PTE member signature

I declare, under penalty of perjury, that this form is correct and complete to the best of my knowledge and belief.

Printed name of authorized representative of nonresident PTE member

Title

Date signed

Signature of authorized representative

*Privacy Act - See instructions

1

1