Instructions For Ftb 3520 - Power Of Attorney Declaration - 2015

ADVERTISEMENT

Instructions for FTB 3520 – Power of Attorney Declaration

General Information

A. Purpose

Use FTB 3520, Power of Attorney Declaration, to grant authority, or to

What’s New - Online POA Submission

receive confidential tax information or to represent you before us.

Our enhanced MyFTB provides access to more tax information, online

This form can also authorize an individual to receive information from

services, and new ways to communicate with the Franchise Tax Board

our nontax programs, such as Court-Ordered Debt Collections and

(FTB). Beginning 2016, taxpayers and representatives should submit

Vehicle Registration Collections (Part 7 – Nontax Issues).

POA declarations online through the enhanced MyFTB, unless you meet

B. General Privileges

one of the following exceptions for paper submissions:

• Located in a declared disaster area

Unless you specify additional privileges in Part 5 – Additional Privileges,

• Documented physical/mental impairment

your representative is authorized as attorney-in-fact to:

• Non-professional representative (for example, relative, friend, etc.)

• Talk to FTB agents about your account.

• First-time filer for the State of California

• Receive and inspect your confidential tax information.

• Do not have a PTIN, EFIN, California CPA or CTEC number

• Represent you in FTB matters.

(for example, attorney)

• Waive the California statute of limitations (SOL).

• Estates and trusts

• Execute settlement and closing agreements.

• Active duty military member in combat zone

• Request information we receive from IRS.

• Other (for example, no computer, nontax debt, etc.)

Electronically submitted POA declarations will be processed faster than

C. Duration

those submitted on paper.

Generally, your Power of Attorney (POA) remains in effect until you

All taxpayers and representatives who want access to the enhanced

revoke it. Use the chart below to determine how long your POA remains

MyFTB must register. The following changes will become available to

in effect.

you and your representative through MyFTB:

Important: Submitting a new POA declaration revokes prior POA

Important Notes for POA Representatives Regarding MyFTB

declarations for overlapping tax periods unless you complete

Registration

Part 6 – Retention or Revocation of a Prior POA.

Beginning 2016, we will no longer mail paper copies of most notices

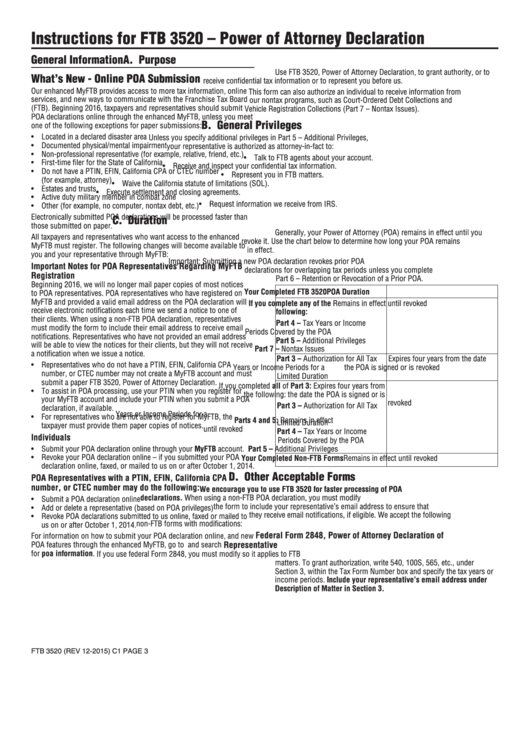

Your Completed FTB 3520

POA Duration

to POA representatives. POA representatives who have registered on

MyFTB and provided a valid email address on the POA declaration will

If you complete any of the

Remains in effect until revoked

receive electronic notifications each time we send a notice to one of

following:

their clients. When using a non-FTB POA declaration, representatives

Part 4 – Tax Years or Income

must modify the form to include their email address to receive email

Periods Covered by the POA

notifications. Representatives who have not provided an email address

Part 5 – Additional Privileges

will be able to view the notices for their clients, but they will not receive

Part 7 – Nontax Issues

a notification when we issue a notice.

Part 3 – Authorization for All Tax

Expires four years from the date

• Representatives who do not have a PTIN, EFIN, California CPA

Years or Income Periods for a

the POA is signed or is revoked

number, or CTEC number may not create a MyFTB account and must

Limited Duration

submit a paper FTB 3520, Power of Attorney Declaration.

If you completed all of

Part 3: Expires four years from

• To assist in POA processing, use your PTIN when you register for

the following:

the date the POA is signed or is

your MyFTB account and include your PTIN when you submit a POA

revoked

Part 3 – Authorization for All Tax

declaration, if available.

Years or Income Periods for a

• For representatives who are not able to register for MyFTB, the

Parts 4 and 5: Remains in effect

Limited Duration

taxpayer must provide them paper copies of notices.

until revoked

Part 4 – Tax Years or Income

Individuals

Periods Covered by the POA

• Submit your POA declaration online through your MyFTB account.

Part 5 – Additional Privileges

• Revoke your POA declaration online – if you submitted your POA

Your Completed Non-FTB Forms

Remains in effect until revoked

declaration online, faxed, or mailed to us on or after October 1, 2014.

D. Other Acceptable Forms

POA Representatives with a PTIN, EFIN, California CPA

number, or CTEC number may do the following:

We encourage you to use FTB 3520 for faster processing of POA

declarations. When using a non-FTB POA declaration, you must modify

• Submit a POA declaration online

the form to include your representative’s email address to ensure that

• Add or delete a representative (based on POA privileges)

they receive email notifications, if eligible. We accept the following

• Revoke POA declarations submitted to us online, faxed or mailed to

non-FTB forms with modifications:

us on or after October 1, 2014.

Federal Form 2848, Power of Attorney Declaration of

For information on how to submit your POA declaration online, and new

Representative

POA features through the enhanced MyFTB, go to ftb.ca.gov and search

for poa information.

If you use federal Form 2848, you must modify so it applies to FTB

matters. To grant authorization, write 540, 100S, 565, etc., under

Section 3, within the Tax Form Number box and specify the tax years or

income periods. Include your representative’s email address under

Description of Matter in Section 3.

FTB 3520 (REV 12-2015) C1 PAGE 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3