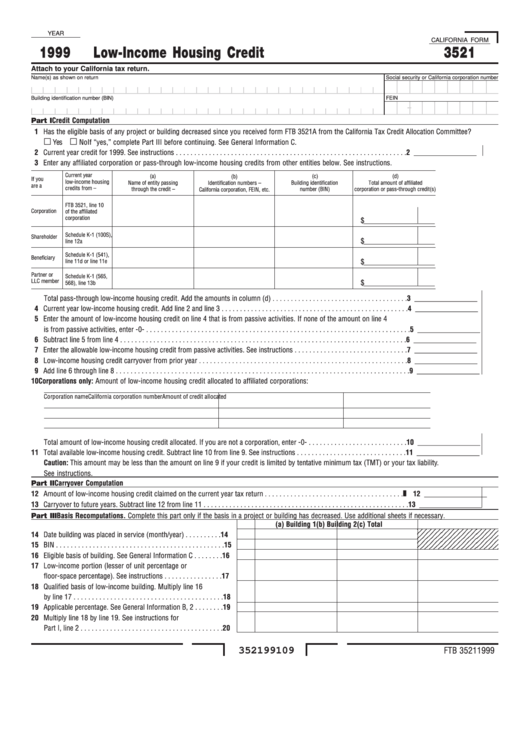

California Form 3521 - Low-Income Housing Credit - 1999

ADVERTISEMENT

YEAR

CALIFORNIA FORM

1999

Low-Income Housing Credit

3521

Attach to your California tax return.

Name(s) as shown on return

Social security or California corporation number

Building identification number (BIN)

FEIN

-

Credit Computation

Part I

1 Has the eligible basis of any project or building decreased since you received form FTB 3521A from the California Tax Credit Allocation Committee?

Yes

No If “yes,” complete Part III before continuing. See General Information C.

2 Current year credit for 1999. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 _________________

3 Enter any affiliated corporation or pass-through low-income housing credits from other entities below. See instructions.

Current year

(a)

(c)

(d)

(b)

If you

low-income housing

Name of entity passing

Building identification

Total amount of affiliated

Identification numbers –

are a

credits from –

through the credit –

number (BIN)

corporation or pass-through credit(s)

California corporation, FEIN, etc.

FTB 3521, line 10

Corporation

of the affiliated

corporation

$_________________________

Schedule K-1 (100S),

Shareholder

$_________________________

line 12a

Schedule K-1 (541),

Beneficiary

line 11d or line 11e

$_________________________

Partner or

Schedule K-1 (565,

LLC member

$_________________________

568), line 13b

Total pass-through low-income housing credit. Add the amounts in column (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 _________________

4 Current year low-income housing credit. Add line 2 and line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 _________________

5 Enter the amount of low-income housing credit on line 4 that is from passive activities. If none of the amount on line 4

is from passive activities, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 _________________

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6 _________________

7 Enter the allowable low-income housing credit from passive activities. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 _________________

8 Low-income housing credit carryover from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 _________________

9 Add line 6 through line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 _________________

10 Corporations only: Amount of low-income housing credit allocated to affiliated corporations:

Corporation name

California corporation number

Amount of credit allocated

Total amount of low-income housing credit allocated. If you are not a corporation, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 _________________

11 Total available low-income housing credit. Subtract line 10 from line 9. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 _________________

Caution: This amount may be less than the amount on line 9 if your credit is limited by tentative minimum tax (TMT) or your tax liability.

See instructions.

Part II Carryover Computation

12 Amount of low-income housing credit claimed on the current year tax return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 _________________

13 Carryover to future years. Subtract line 12 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 _________________

Part III Basis Recomputations. Complete this part only if the basis in a project or building has decreased. Use additional sheets if necessary.

(a) Building 1

(b) Building 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

(c) Total

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

14 Date building was placed in service (month/year) . . . . . . . . . .

14

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

15 BIN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

16 Eligible basis of building. See General Information C . . . . . . . .

16

17 Low-income portion (lesser of unit percentage or

floor-space percentage). See instructions . . . . . . . . . . . . . . . .

17

18 Qualified basis of low-income building. Multiply line 16

by line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19 Applicable percentage. See General Information B, 2 . . . . . . . .

19

20 Multiply line 18 by line 19. See instructions for

Part I, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

352199109

FTB 3521 1999

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1