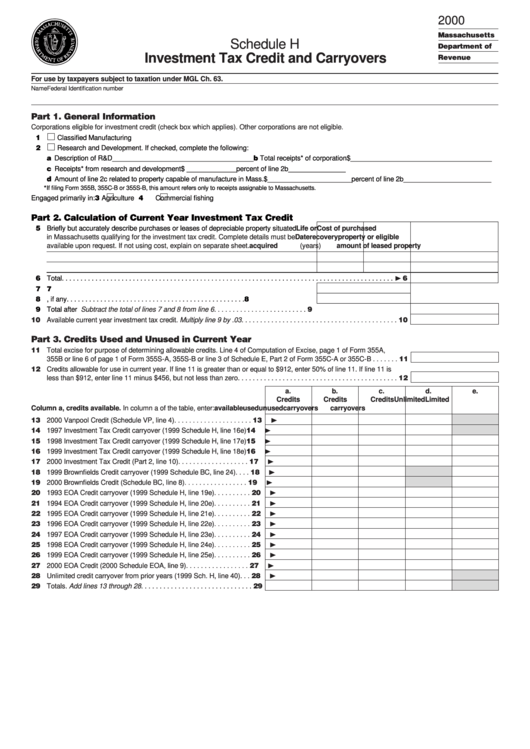

Schedule H - Investment Tax Credit And Carryovers - State Of Massachusetts 2000

ADVERTISEMENT

2000

Massachusetts

Schedule H

Department of

Investment Tax Credit and Carryovers

Revenue

For use by taxpayers subject to taxation under MGL Ch. 63.

Name

Federal Identification number

Part 1. General Information

Corporations eligible for investment credit (check box which applies). Other corporations are not eligible.

11

Classified Manufacturing

12

Research and Development. If checked, complete the following:

a Description of R&D_____________________________________

b Total receipts* of corporation $_____________________________________

c Receipts* from research and development $ _____________ percent of line 2b _______________

d Amount of line 2c related to property capable of manufacture in Mass. $______________________ percent of line 2b _______________________

*

If filing Form 355B, 355C-B or 355S-B, this amount refers only to receipts assignable to Massachusetts.

Engaged primarily in: 3

Agriculture 4

Commercial fishing

Part 2. Calculation of Current Year Investment Tax Credit

15 Briefly but accurately describe purchases or leases of depreciable property situated

Life or

Cost of purchased

in Massachusetts qualifying for the investment tax credit. Complete details must be

Date

recovery

property or eligible

available upon request. If not using cost, explain on separate sheet.

acquired

(years)

amount of leased property

❿ 6

16 Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 U.S. investment credit taken . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 U.S. basis reduction, if any . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Total after U.S. basis reduction and credit.

Subtract the total of lines 7 and 8 from line 6 . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Available current year investment tax credit. Multiply line 9 by .03. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Part 3. Credits Used and Unused in Current Year

11 Total excise for purpose of determining allowable credits. Line 4 of Computation of Excise, page 1 of Form 355A,

355B or line 6 of page 1 of Form 355S-A, 355S-B or line 3 of Schedule E, Part 2 of Form 355C-A or 355C-B . . . . . . . 11

12 Credits allowable for use in current year. If line 11 is greater than or equal to $912, enter 50% of line 11. If line 11 is

less than $912, enter line 11 minus $456, but not less than zero . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

a.

b.

c.

d.

e.

Credits

Credits

Credits

Unlimited

Limited

Column a, credits available. In column a of the table, enter:

available

used

unused

carryovers

carryovers

❿

13 2000 Vanpool Credit (Schedule VP, line 4). . . . . . . . . . . . . . . . . . . . . 13

❿

14 1997 Investment Tax Credit carryover (1999 Schedule H, line 16e) 14

❿

15 1998 Investment Tax Credit carryover (1999 Schedule H, line 17e) 15

❿

16 1999 Investment Tax Credit carryover (1999 Schedule H, line 18e) 16

❿

17 2000 Investment Tax Credit (Part 2, line 10) . . . . . . . . . . . . . . . . . . . 17

❿

18 1999 Brownfields Credit carryover (1999 Schedule BC, line 24) . . . . 18

❿

19 2000 Brownfields Credit (Schedule BC, line 8) . . . . . . . . . . . . . . . . . 19

❿

20 1993 EOA Credit carryover (1999 Schedule H, line 19e). . . . . . . . . . 20

❿

21 1994 EOA Credit carryover (1999 Schedule H, line 20e). . . . . . . . . . 21

❿

22 1995 EOA Credit carryover (1999 Schedule H, line 21e). . . . . . . . . . 22

❿

23 1996 EOA Credit carryover (1999 Schedule H, line 22e). . . . . . . . . . 23

❿

24 1997 EOA Credit carryover (1999 Schedule H, line 23e). . . . . . . . . . 24

❿

25 1998 EOA Credit carryover (1999 Schedule H, line 24e). . . . . . . . . . 25

❿

26 1999 EOA Credit carryover (1999 Schedule H, line 25e). . . . . . . . . . 26

❿

27 2000 EOA Credit (2000 Schedule EOA, line 9) . . . . . . . . . . . . . . . . . 27

❿

28 Unlimited credit carryover from prior years (1999 Sch. H, line 40). . . 28

29 Totals. Add lines 13 through 28. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2