Instructions For Form S-1065 - Income Tax 2001 Partnership Return - City Of Saginaw

ADVERTISEMENT

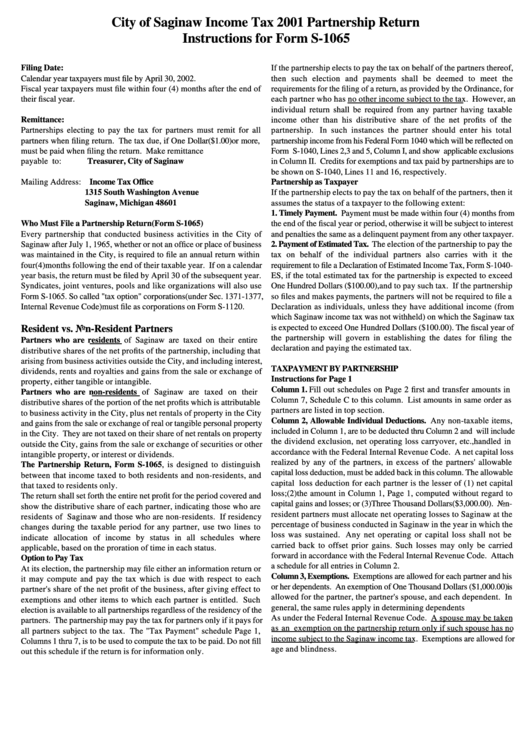

City of Saginaw Income Tax 2001 Partnership Return

Instructions for Form S-1065

Filing Date:

If the partnership elects to pay the tax on behalf of the partners thereof,

Calendar year taxpayers must file by April 30, 2002.

then such election and payments shall be deemed to meet the

Fiscal year taxpayers must file within four (4) months after the end of

requirements for the filing of a return, as provided by the Ordinance, for

their fiscal year.

each partner who has no other income subject to the tax. However, an

individual return shall be required from any partner having taxable

Remittance:

income other than his distributive share of the net profits of the

Partnerships electing to pay the tax for partners must remit for all

partnership. In such instances the partner should enter his total

partners when filing return. The tax due, if One Dollar($1.00)or more,

partnership income from his Federal Form 1040 which will be reflected on

must be paid when filing the return. Make remittance

Form S-1040, Lines 2,3 and 5, Column I, and show applicable exclusions

payable to:

Treasurer, City of Saginaw

in Column II. Credits for exemptions and tax paid by partnerships are to

be shown on S-1040, Lines 11 and 16, respectively.

Mailing Address: Income Tax Office

Partnership as Taxpayer

1315 South Washington Avenue

If the partnership elects to pay the tax on behalf of the partners, then it

Saginaw, Michigan 48601

assumes the status of a taxpayer to the following extent:

1. Timely Payment. Payment must be made within four (4) months from

Who Must File a Partnership Return(Form S-1065)

the end of the fiscal year or period, otherwise it will be subject to interest

Every partnership that conducted business activities in the City of

and penalties the same as a delinquent payment from any other taxpayer.

Saginaw after July 1, 1965, whether or not an office or place of business

2. Payment of Estimated Tax. The election of the partnership to pay the

was maintained in the City, is required to file an annual return within

tax on behalf of the individual partners also carries with it the

four(4)months following the end of their taxable year. If on a calendar

requirement to file a Declaration of Estimated Income Tax, Form S-1040-

year basis, the return must be filed by April 30 of the subsequent year.

ES, if the total estimated tax for the partnership is expected to exceed

Syndicates, joint ventures, pools and like organizations will also use

One Hundred Dollars ($100.00),and to pay such tax. If the partnership

Form S-1065. So called "tax option" corporations(under Sec. 1371-1377,

so files and makes payments, the partners will not be required to file a

Internal Revenue Code)must file as corporations on Form S-1120.

Declaration as individuals, unless they have additional income (from

which Saginaw income tax was not withheld) on which the Saginaw tax

is expected to exceed One Hundred Dollars ($100.00). The fiscal year of

Resident vs. Non-Resident Partners

the partnership will govern in establishing the dates for filing the

Partners who are residents of Saginaw are taxed on their entire

declaration and paying the estimated tax.

distributive shares of the net profits of the partnership, including that

arising from business activities outside the City, and including interest,

TAX PAYMENT BY PARTNERSHIP

dividends, rents and royalties and gains from the sale or exchange of

Instructions for Page 1

property, either tangible or intangible.

Column 1. Fill out schedules on Page 2 first and transfer amounts in

Partners who are non-residents of Saginaw are taxed on their

Column 7, Schedule C to this column. List amounts in same order as

distributive shares of the portion of the net profits which is attributable

partners are listed in top section.

to business activity in the City, plus net rentals of property in the City

Column 2, Allowable Individual Deductions. Any non-taxable items,

and gains from the sale or exchange of real or tangible personal property

included in Column 1, are to be deducted thru Column 2 and will include

in the City. They are not taxed on their share of net rentals on property

the dividend exclusion, net operating loss carryover, etc.,handled in

outside the City, gains from the sale or exchange of securities or other

accordance with the Federal Internal Revenue Code. A net capital loss

intangible property, or interest or dividends.

realized by any of the partners, in excess of the partners' allowable

The Partnership Return, Form S-1065, is designed to distinguish

capital loss deduction, must be added back in this column. The allowable

between that income taxed to both residents and non-residents, and

capital loss deduction for each partner is the lesser of (1) net capital

that taxed to residents only.

loss;(2)the amount in Column 1, Page 1, computed without regard to

The return shall set forth the entire net profit for the period covered and

capital gains and losses; or (3)Three Thousand Dollars($3,000.00). Non-

show the distributive share of each partner, indicating those who are

resident partners must allocate net operating losses to Saginaw at the

residents of Saginaw and those who are non-residents. If residency

percentage of business conducted in Saginaw in the year in which the

changes during the taxable period for any partner, use two lines to

loss was sustained. Any net operating or capital loss shall not be

indicate allocation of income by status in all schedules where

carried back to offset prior gains. Such losses may only be carried

applicable, based on the proration of time in each status.

forward in accordance with the Federal Internal Revenue Code. Attach

Option to Pay Tax

a schedule for all entries in Column 2.

At its election, the partnership may file either an information return or

Column 3, Exemptions. Exemptions are allowed for each partner and his

it may compute and pay the tax which is due with respect to each

or her dependents. An exemption of One Thousand Dollars ($1,000.00)is

partner's share of the net profit of the business, after giving effect to

allowed for the partner, the partner's spouse, and each dependent. In

exemptions and other items to which each partner is entitled. Such

general, the same rules apply in determining dependents

election is available to all partnerships regardless of the residency of the

As under the Federal Internal Revenue Code. A spouse may be taken

partners. The partnership may pay the tax for partners only if it pays for

as an exemption on the partnership return only if such spouse has no

all partners subject to the tax. The "Tax Payment" schedule Page 1,

income subject to the Saginaw income tax. Exemptions are allowed for

Columns 1 thru 7, is to be used to compute the tax to be paid. Do not fill

age and blindness.

out this schedule if the return is for information only.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3