Form 2804 - 2000 Equalization Single-Year Study Sales Ratio Adjustments

ADVERTISEMENT

Michigan Department of Treaury - PTD

2804 (Rev. 6-00), Formerly L-4047

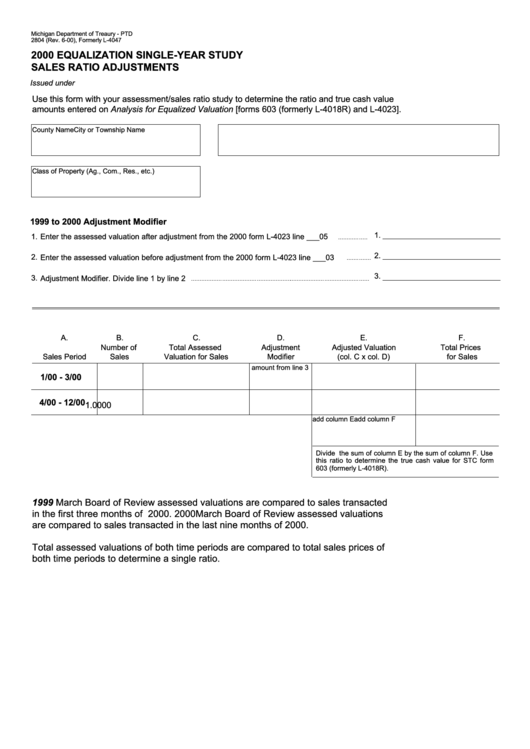

2000 EQUALIZATION SINGLE-YEAR STUDY

SALES RATIO ADJUSTMENTS

Issued under P.A. 206 of 1893. Filing is voluntary.

Use this form with your assessment/sales ratio study to determine the ratio and true cash value

amounts entered on Analysis for Equalized Valuation [forms 603 (formerly L-4018R) and L-4023].

County Name

City or Township Name

Class of Property (Ag., Com., Res., etc.)

1999 to 2000 Adjustment Modifier

1.

1.

Enter the assessed valuation after adjustment from the 2000 form L-4023 line ___05

2.

2.

Enter the assessed valuation before adjustment from the 2000 form L-4023 line ___03

3.

3.

Adjustment Modifier. Divide line 1 by line 2

A.

B.

C.

D.

E.

F.

Number of

Total Assessed

Adjustment

Adjusted Valuation

Total Prices

Sales Period

Sales

Valuation for Sales

Modifier

(col. C x col. D)

for Sales

amount from line 3

1/00 - 3/00

4/00 - 12/00

1.0000

add column E

add column F

Divide the sum of column E by the sum of column F. Use

this ratio to determine the true cash value for STC form

603 (formerly L-4018R).

1999 March Board of Review assessed valuations are compared to sales transacted

in the first three months of 2000. 2000 March Board of Review assessed valuations

are compared to sales transacted in the last nine months of 2000.

Total assessed valuations of both time periods are compared to total sales prices of

both time periods to determine a single ratio.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1