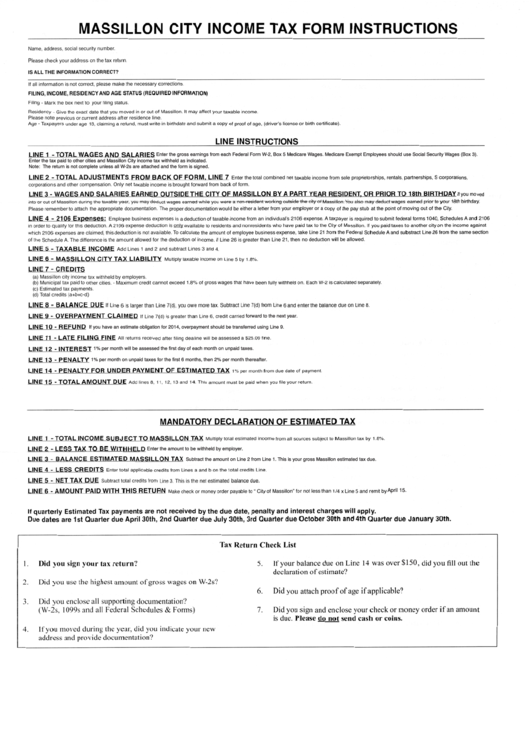

Massillon City Income Tax Form Instructions

ADVERTISEMENT

Enter the gross earnings from each Federal Form W-2, Box 5 Medicare Wages. Medicare Exempt Employees should use Social Security Wages (Box 3).

Enter the tax paid to other cities and Massillon City income tax withheld as indicated.

Note: The return is not complete unless all W-2s are attached and the form is signed.

forward to the next year.

If you have an estimate obligation for 2014, overpayment should be transferred using Line 9.

1% per month will be assessed the first day of each month on unpaid taxes.

1% per month on unpaid taxes for the first 6 months, then 2% per month thereafter.

Enter the amount to be withheld by employer.

Subtract the amount on Line 2 from Line 1. This is your gross Massillon estimated tax due.

April 15.

$150

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2