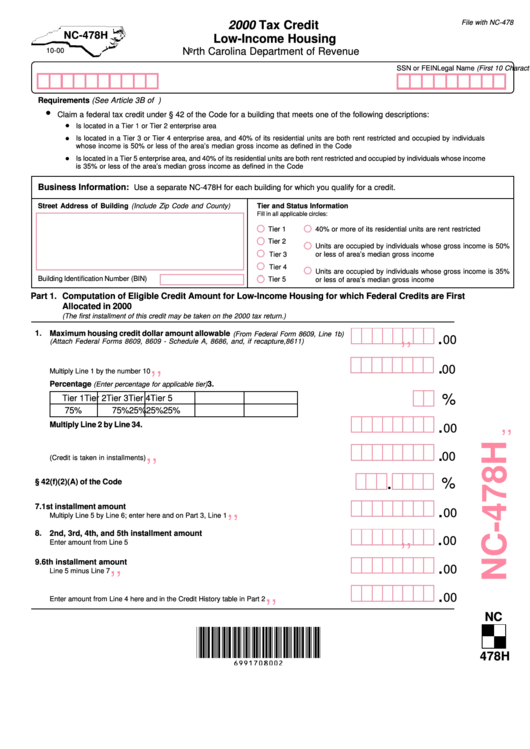

Form Nc-478h - 2000 Tax Credit Low-Income Housing

ADVERTISEMENT

File with NC-478

2000 Tax Credit

NC-478H

Low-Income Housing

North Carolina Department of Revenue

10-00

Legal Name (First 10 Characters)

SSN or FEIN

Requirements (See Article 3B of G.S. Chapter 105 for more information.)

Claim a federal tax credit under § 42 of the Code for a building that meets one of the following descriptions:

Is located in a Tier 1 or Tier 2 enterprise area

Is located in a Tier 3 or Tier 4 enterprise area, and 40% of its residential units are both rent restricted and occupied by individuals

whose income is 50% or less of the area’s median gross income as defined in the Code

Is located in a Tier 5 enterprise area, and 40% of its residential units are both rent restricted and occupied by individuals whose income

is 35% or less of the area’s median gross income as defined in the Code

Business Information:

Use a separate NC-478H for each building for which you qualify for a credit.

Street Address of Building (Include Zip Code and County)

Tier and Status Information

Fill in all applicable circles:

Tier 1

40% or more of its residential units are rent restricted

Tier 2

Units are occupied by individuals whose gross income is 50%

Tier 3

or less of area’s median gross income

Tier 4

Units are occupied by individuals whose gross income is 35%

Building Identification Number (BIN)

Tier 5

or less of area’s median gross income

Part 1.

Computation of Eligible Credit Amount for Low-Income Housing for which Federal Credits are First

Allocated in 2000

(The first installment of this credit may be taken on the 2000 tax return.)

,

,

.

1.

Maximum housing credit dollar amount allowable

(From Federal Form 8609, Line 1b)

00

(Attach Federal Forms 8609, 8609 - Schedule A, 8686, and, if recapture,8611)

2. Maximum federal credit

,

,

.

00

Multiply Line 1 by the number 10

3.

Percentage

(Enter percentage for applicable tier)

%

Tier 1

Tier 2

Tier 3

Tier 4

Tier 5

75%

75%

25%

25%

25%

,

,

.

4.

Multiply Line 2 by Line 3

00

5.

Divide Line 4 by the number 5

,

,

.

00

(Credit is taken in installments)

.

%

6.

First year modified percentage under § 42(f)(2)(A) of the Code

,

,

.

7.

1st installment amount

00

Multiply Line 5 by Line 6; enter here and on Part 3, Line 1

8.

2nd, 3rd, 4th, and 5th installment amount

,

,

.

00

Enter amount from Line 5

9.

6th installment amount

,

,

.

00

Line 5 minus Line 7

,

,

.

10.

Eligible credit amount

00

Enter amount from Line 4 here and in the Credit History table in Part 2

NC

478H

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2