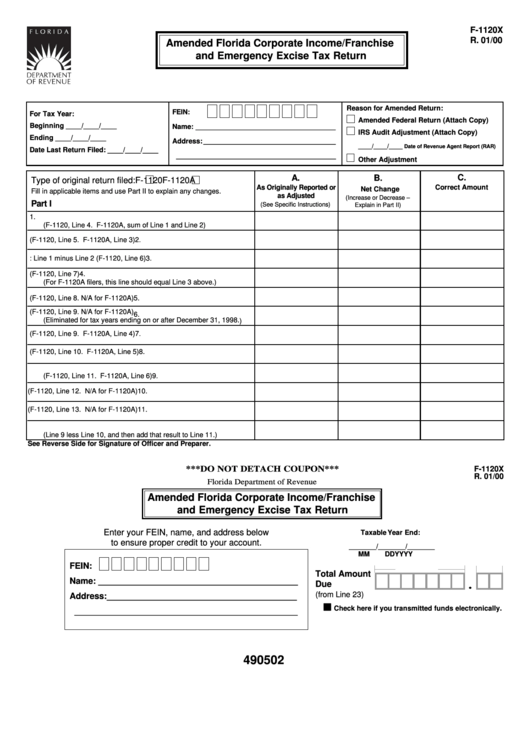

Form F-1120x - Amended Florida Corporate Income/franchise And Emergency Excise Tax Return

ADVERTISEMENT

F-1120X

R. 01/00

Amended Florida Corporate Income/Franchise

and Emergency Excise Tax Return

Reason for Amended Return:

FEIN:

For Tax Year:

Amended Federal Return (Attach Copy)

Beginning

____/____/____

Name: ____________________________________

IRS Audit Adjustment (Attach Copy)

Ending

____/____/____

Address: __________________________________

____/____/____

Date of Revenue Agent Report (RAR)

Date Last Return Filed: ____/____/____

_________________________________________

Other Adjustment

C.

A.

B.

Type of original return filed:

F-1120

F-1120A

Correct Amount

As Originally Reported or

Net Change

Fill in applicable items and use Part II to explain any changes.

as Adjusted

(Increase or Decrease –

Part I

(See Specific Instructions)

Explain in Part II)

1.

Total Income and Additions

1.

(F-1120, Line 4. F-1120A, sum of Line 1 and Line 2)

2.

Total Subtractions and Deductions (F-1120, Line 5. F-1120A, Line 3)

2.

3.

Adjusted Federal Income: Line 1 minus Line 2 (F-1120, Line 6)

3.

4.

Florida portion of Adjusted Federal Income (F-1120, Line 7)

4.

(For F-1120A filers, this line should equal Line 3 above.)

5.

Allocated Nonbusiness Income (F-1120, Line 8. N/A for F-1120A)

5.

6.

Child Care Facility Start-up Costs (F-1120, Line 9. N/A for F-1120A)

6.

(Eliminated for tax years ending on or after December 31, 1998. )

7.

Florida Exemption (F-1120, Line 9. F-1120A, Line 4)

7.

8.

Florida Net Income (F-1120, Line 10. F-1120A, Line 5)

8.

9.

Corporate Income/Franchise Tax Due

(F-1120, Line 11. F-1120A, Line 6)

9.

10. Credits Against the Tax (F-1120, Line 12. N/A for F-1120A)

10.

11. Emergency Excise Tax Due (F-1120, Line 13. N/A for F-1120A)

11.

12. Total Corporate Income/Franchise and Emergency Excise Tax Due

12.

(Line 9 less Line 10, and then add that result to Line 11.)

See Reverse Side for Signature of Officer and Preparer.

***DO NOT DETACH COUPON***

F-1120X

R. 01/00

Florida Department of Revenue

Amended Florida Corporate Income/Franchise

and Emergency Excise Tax Return

Enter your FEIN, name, and address below

Taxable Year End:

to ensure proper credit to your account.

_______/_______/_______

MM

DD

YYYY

FEIN:

U.S. DOLLARS

CENTS

Total Amount

Name: __________________________________________

Due

(from Line 23)

Address: ________________________________________

Check here if you transmitted funds electronically.

_______________________________________________

490502

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2