Jobs And Investment Tax Credit Worksheet - 2003

ADVERTISEMENT

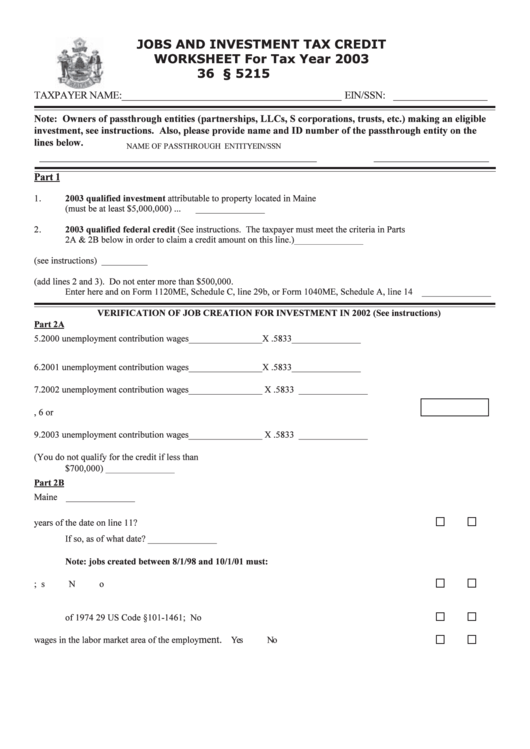

JOBS AND INVESTMENT TAX CREDIT

WORKSHEET For Tax Year 2003

36 M.R.S.A. § 5215

TAXPAYER NAME: __________________________________________ EIN/SSN: __________________

Note: Owners of passthrough entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Also, please provide name and ID number of the passthrough entity on the

lines below.

NAME OF PASSTHROUGH ENTITY

EIN/SSN

_____________________________________________________

______________________

Part 1

1.

2003 qualified investment attributable to property located in Maine

(must be at least $5,000,000) .....................................................................................................

_______________

2.

2003 qualified federal credit (See instructions. The taxpayer must meet the criteria in Parts

2A & 2B below in order to claim a credit amount on this line.) ................................................

_______________

3.

Carryover from prior years (see instructions) ...........................................................................

_______________

4.

Total available credit (add lines 2 and 3). Do not enter more than $500,000.

Enter here and on Form 1120ME, Schedule C, line 29b, or Form 1040ME, Schedule A, line 14 _______________

VERIFICATION OF JOB CREATION FOR INVESTMENT IN 2002 (See instructions)

Part 2A

5.

2000 unemployment contribution wages ________________ X .5833 ...................................

_______________

6.

2001 unemployment contribution wages ________________ X .5833 ...................................

_______________

7.

2002 unemployment contribution wages ________________ X .5833 ..................................

_______________

8.

Enter greatest of line 5, 6 or 7 ...................................................................................................

9.

2003 unemployment contribution wages ________________ X .5833 ..................................

_______________

10.

New jobs credit base. Subtract line 8 from line 9 (You do not qualify for the credit if less than

$700,000) ...................................................................................................................................

_______________

Part 2B

11.

Date qualified investment placed in service in Maine ...............................................................

_______________

12.

Were there at least 100 new jobs created within 2 years of the date on line 11? .......................

Yes

No

If so, as of what date? ...............................................................................................................

_______________

Note: jobs created between 8/1/98 and 10/1/01 must:

a.

have group health insurance coverage; ......................................................................................

Yes

No

b.

be covered by a retirement program subject to the Employee Retirement Income Security Act

of 1974 29 US Code §101-1461; ...............................................................................................

Yes

No

ment.

c.

be paid higher than the average per capita wages in the labor market area of the employ

Yes

No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1