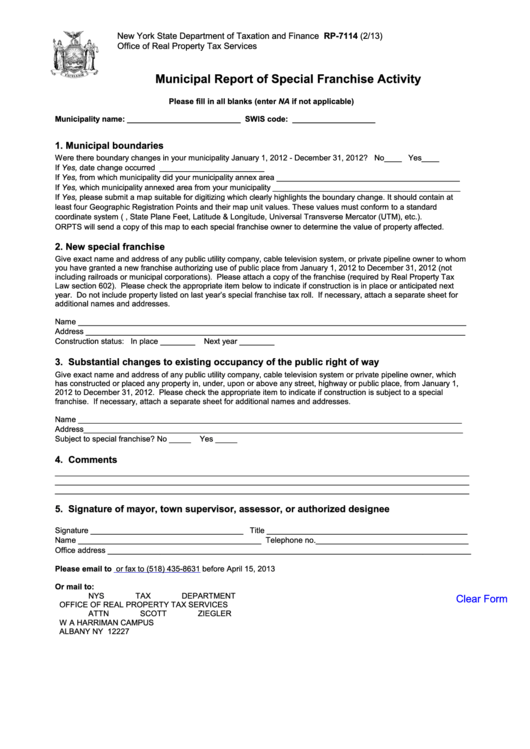

New York State Department of Taxation and Finance

RP-7114 (2/13)

Office of Real Property Tax Services

Municipal Report of Special Franchise Activity

Please fill in all blanks (enter NA if not applicable)

Municipality name: __________________________ SWIS code: ___________________

1. Municipal boundaries

Were there boundary changes in your municipality January 1, 2012 - December 31, 2012? No____ Yes____

If Yes, date change occurred ________________________

If Yes, from which municipality did your municipality annex area __________________________________________

If Yes, which municipality annexed area from your municipality ___________________________________________

If Yes, please submit a map suitable for digitizing which clearly highlights the boundary change. It should contain at

least four Geographic Registration Points and their map unit values. These values must conform to a standard

coordinate system (i.e., State Plane Feet, Latitude & Longitude, Universal Transverse Mercator (UTM), etc.).

ORPTS will send a copy of this map to each special franchise owner to determine the value of property affected.

2. New special franchise

Give exact name and address of any public utility company, cable television system, or private pipeline owner to whom

you have granted a new franchise authorizing use of public place from January 1, 2012 to December 31, 2012 (not

including railroads or municipal corporations). Please attach a copy of the franchise (required by Real Property Tax

Law section 602). Please check the appropriate item below to indicate if construction is in place or anticipated next

year. Do not include property listed on last year’s special franchise tax roll. If necessary, attach a separate sheet for

additional names and addresses.

Name _________________________________________________________________________________________

Address _______________________________________________________________________________________

Construction status:

In place ________

Next year ________

3. Substantial changes to existing occupancy of the public right of way

Give exact name and address of any public utility company, cable television system or private pipeline owner, which

has constructed or placed any property in, under, upon or above any street, highway or public place, from January 1,

2012 to December 31, 2012. Please check the appropriate item to indicate if construction is subject to a special

franchise. If necessary, attach a separate sheet for additional names and addresses.

Name ________________________________________________________________________________________

Address_______________________________________________________________________________________

Subject to special franchise?

No _____

Yes _____

4. Comments

_______________________________________________________________________________________________

_______________________________________________________________________________________________

_______________________________________________________________________________________________

5. Signature of mayor, town supervisor, assessor, or authorized designee

Signature ___________________________________ Title ______________________________________________

Name __________________________________________ Telephone no.___________________________________

Office address ___________________________________________________________________________________

Please email to

Scott.Ziegler@tax.ny.gov

or fax to (518) 435-8631 before April 15, 2013

Or mail to:

NYS TAX DEPARTMENT

Clear Form

OFFICE OF REAL PROPERTY TAX SERVICES

ATTN SCOTT ZIEGLER

W A HARRIMAN CAMPUS

ALBANY NY 12227

1

1