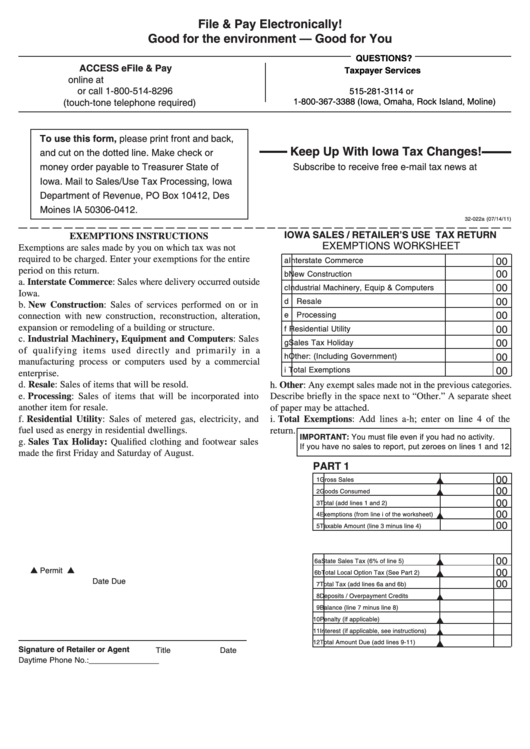

Form 32-022 - Iowa Sales/retailer'S Use Tax Return - 2012

ADVERTISEMENT

File & Pay Electronically!

Good for the environment — Good for You

QUESTIONS?

ACCESS eFile & Pay

Taxpayer Services

online at

idr@iowa.gov

or call 1-800-514-8296

515-281-3114 or

1-800-367-3388 (Iowa, Omaha, Rock Island, Moline)

(touch-tone telephone required)

To use this form, please print front and back,

Keep Up With Iowa Tax Changes!

and cut on the dotted line. Make check or

money order payable to Treasurer State of

Subscribe to receive free e-mail tax news at

Iowa. Mail to Sales/Use Tax Processing, Iowa

Department of Revenue, PO Box 10412, Des

Moines IA 50306-0412.

32-022a (07/14/11)

IOWA SALES / RETAILER’S USE TAX RETURN

EXEMPTIONS INSTRUCTIONS

EXEMPTIONS WORKSHEET

Exemptions are sales made by you on which tax was not

00

required to be charged. Enter your exemptions for the entire

a Interstate Commerce

period on this return.

00

b New Construction

a. Interstate Commerce: Sales where delivery occurred outside

00

c Industrial Machinery, Equip & Computers

Iowa.

00

d Resale

b. New Construction: Sales of services performed on or in

00

e Processing

connection with new construction, reconstruction, alteration,

00

expansion or remodeling of a building or structure.

f

Residential Utility

c. Industrial Machinery, Equipment and Computers: Sales

00

g Sales Tax Holiday

of qualifying items used directly and primarily in a

00

h Other: (Including Government)

manufacturing process or computers used by a commercial

00

i

Total Exemptions

enterprise.

d. Resale: Sales of items that will be resold.

h. Other: Any exempt sales made not in the previous categories.

e. Processing: Sales of items that will be incorporated into

Describe briefly in the space next to “Other.” A separate sheet

another item for resale.

of paper may be attached.

f. Residential Utility: Sales of metered gas, electricity, and

i. Total Exemptions: Add lines a-h; enter on line 4 of the

fuel used as energy in residential dwellings.

return.

IMPORTANT: You must file even if you had no activity.

g. Sales Tax Holiday: Qualified clothing and footwear sales

If you have no sales to report, put zeroes on lines 1 and 12.

made the first Friday and Saturday of August.

PART 1

00

1 Gross Sales

00

2 Goods Consumed

00

3 Total (add lines 1 and 2)

00

4 Exemptions (from line i of the worksheet)

00

5 Taxable Amount (line 3 minus line 4)

00

6a State Sales Tax (6% of line 5)

Permit No.

Period

00

6b Total Local Option Tax (See Part 2)

Date Due

00

7 Total Tax (add lines 6a and 6b)

8 Deposits / Overpayment Credits

9 Balance (line 7 minus line 8)

10 Penalty (if applicable)

11 Interest (if applicable, see instructions)

12 Total Amount Due (add lines 9-11)

Signature of Retailer or Agent

Title

Date

Daytime Phone No.: ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2