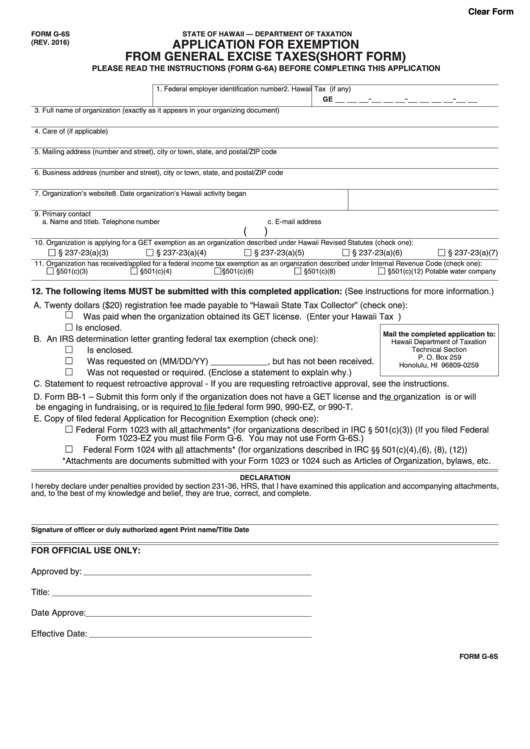

Clear Form

FORM G-6S

STATE OF HAWAII — DEPARTMENT OF TAXATION

APPLICATION FOR EXEMPTION

(REV. 2016)

FROM GENERAL EXCISE TAXES (SHORT FORM)

PLEASE READ THE INSTRUCTIONS (FORM G-6A) BEFORE COMPLETING THIS APPLICATION

1. Federal employer identification number

2. Hawaii Tax I.D. number (if any)

GE

__ __ __-__ __ __-__ __ __ __-__ __

3. Full name of organization (exactly as it appears in your organizing document)

4. Care of (if applicable)

5. Mailing address (number and street), city or town, state, and postal/ZIP code

6. Business address (number and street), city or town, state, and postal/ZIP code

7. Organization’s website

8. Date organization’s Hawaii activity began

9. Primary contact

a. Name and title

b. Telephone number

c. E-mail address

(

)

10. Organization is applying for a GET exemption as an organization described under Hawaii Revised Statutes (check one):

§ 237-23(a)(3)

§ 237-23(a)(4)

§ 237-23(a)(5)

§ 237-23(a)(6)

§ 237-23(a)(7)

11. Organization has received/applied for a federal income tax exemption as an organization described under Internal Revenue Code (check one):

§501(c)(3)

§501(c)(4)

§501(c)(6)

§501(c)(8)

§501(c)(12) Potable water company

12. The following items MUST be submitted with this completed application: (See instructions for more information.)

A.

Twenty dollars ($20) registration fee made payable to “Hawaii State Tax Collector” (check one):

Was paid when the organization obtained its GET license. (Enter your Hawaii Tax I.D. number on line 2.)

Is enclosed.

Mail the completed application to:

B.

An IRS determination letter granting federal tax exemption (check one):

Hawaii Department of Taxation

Is enclosed.

Technical Section

P. O. Box 259

Was requested on (MM/DD/YY) ____________, but has not been received.

Honolulu, HI 96809-0259

Was not requested or required. (Enclose a statement to explain why.)

C.

Statement to request retroactive approval - If you are requesting retroactive approval, see the instructions.

D.

Form BB-1 – Submit this form only if the organization does not have a GET license and the organization is or will

be engaging in fundraising, or is required to file federal form 990, 990-EZ, or 990-T.

E.

Copy of filed federal Application for Recognition Exemption (check one):

Federal Form 1023 with all attachments* (for organizations described in IRC

501(c)(3)) (If you filed Federal

§

Form 1023-EZ you must file Form G-6. You may not use Form G-6S.)

Federal Form 1024 with all attachments* (for organizations described in IRC

501(c)(4),(6), (8), (12))

§§

*Attachments are documents submitted with your Form 1023 or 1024 such as Articles of Organization, bylaws, etc.

DECLARATION

I hereby declare under penalties provided by section 231-36, HRS, that I have examined this application and accompanying attachments,

and, to the best of my knowledge and belief, they are true, correct, and complete.

Signature of officer or duly authorized agent

Print name/Title

Date

FOR OFFICIAL USE ONLY:

Approved by:

Title:

Date Approve:

Effective Date:

FORM G-6S

1

1 2

2