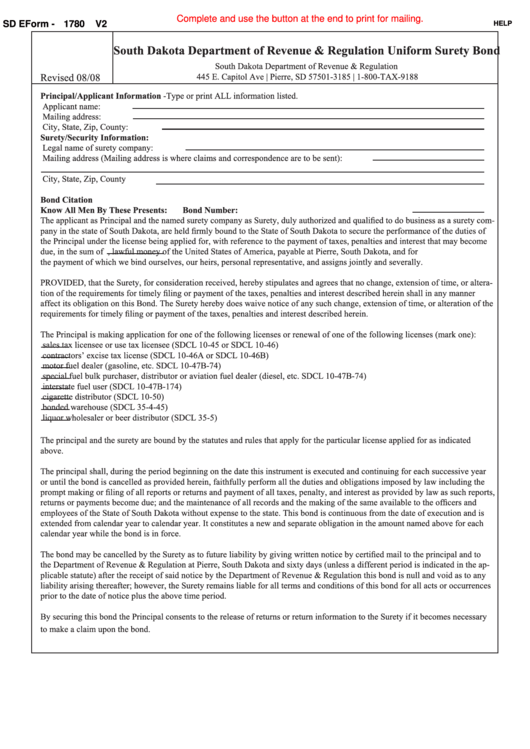

Complete and use the button at the end to print for mailing.

SD EForm - 1780

V2

HELP

South Dakota Department of Revenue & Regulation Uniform Surety Bond

South Dakota Department of Revenue & Regulation

Revised 08/08

445 E. Capitol Ave | Pierre, SD 57501-3185 | 1-800-TAX-9188

Principal/Applicant Information -Type or print ALL information listed.

Applicant name:

Mailing address:

City, State, Zip, County:

Surety/Security Information:

Legal name of surety company:

Mailing address (Mailing address is where claims and correspondence are to be sent):

City, State, Zip, County

Bond Citation

Know All Men By These Presents:

Bond Number:

The applicant as Principal and the named surety company as Surety, duly authorized and qualified to do business as a surety com-

pany in the state of South Dakota, are held firmly bound to the State of South Dakota to secure the performance of the duties of

the Principal under the license being applied for, with reference to the payment of taxes, penalties and interest that may become

due, in the sum of

, lawful money of the United States of America, payable at Pierre, South Dakota, and for

the payment of which we bind ourselves, our heirs, personal representative, and assigns jointly and severally.

PROVIDED, that the Surety, for consideration received, hereby stipulates and agrees that no change, extension of time, or altera-

tion of the requirements for timely filing or payment of the taxes, penalties and interest described herein shall in any manner

affect its obligation on this Bond. The Surety hereby does waive notice of any such change, extension of time, or alteration of the

requirements for timely filing or payment of the taxes, penalties and interest described herein.

The Principal is making application for one of the following licenses or renewal of one of the following licenses (mark one):

sales tax licensee or use tax licensee (SDCL 10-45 or SDCL 10-46)

contractors’ excise tax license (SDCL 10-46A or SDCL 10-46B)

motor fuel dealer (gasoline, etc. SDCL 10-47B-74)

special fuel bulk purchaser, distributor or aviation fuel dealer (diesel, etc. SDCL 10-47B-74)

interstate fuel user (SDCL 10-47B-174)

cigarette distributor (SDCL 10-50)

bonded warehouse (SDCL 35-4-45)

liquor wholesaler or beer distributor (SDCL 35-5)

The principal and the surety are bound by the statutes and rules that apply for the particular license applied for as indicated

above.

The principal shall, during the period beginning on the date this instrument is executed and continuing for each successive year

or until the bond is cancelled as provided herein, faithfully perform all the duties and obligations imposed by law including the

prompt making or filing of all reports or returns and payment of all taxes, penalty, and interest as provided by law as such reports,

returns or payments become due; and the maintenance of all records and the making of the same available to the officers and

employees of the State of South Dakota without expense to the state. This bond is continuous from the date of execution and is

extended from calendar year to calendar year. It constitutes a new and separate obligation in the amount named above for each

calendar year while the bond is in force.

The bond may be cancelled by the Surety as to future liability by giving written notice by certified mail to the principal and to

the Department of Revenue & Regulation at Pierre, South Dakota and sixty days (unless a different period is indicated in the ap-

plicable statute) after the receipt of said notice by the Department of Revenue & Regulation this bond is null and void as to any

liability arising thereafter; however, the Surety remains liable for all terms and conditions of this bond for all acts or occurrences

prior to the date of notice plus the above time period.

By securing this bond the Principal consents to the release of returns or return information to the Surety if it becomes necessary

to make a claim upon the bond.

1

1 2

2 3

3 4

4