Instructions For Form 1040nr-Ez 2004

ADVERTISEMENT

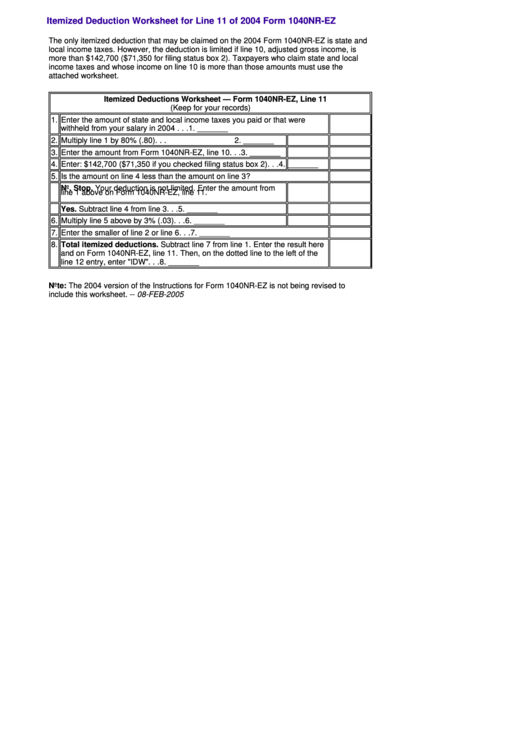

Itemized Deduction Worksheet for Line 11 of 2004 Form 1040NR-EZ

The only itemized deduction that may be claimed on the 2004 Form 1040NR-EZ is state and

local income taxes. However, the deduction is limited if line 10, adjusted gross income, is

more than $142,700 ($71,350 for filing status box 2). Taxpayers who claim state and local

income taxes and whose income on line 10 is more than those amounts must use the

attached worksheet.

Itemized Deductions Worksheet — Form 1040NR-EZ, Line 11

(Keep for your records)

1. Enter the amount of state and local income taxes you paid or that were

withheld from your salary in 2004 . . .

1. _______

2. Multiply line 1 by 80% (.80). . .

2. _______

3. Enter the amount from Form 1040NR-EZ, line 10. . .

3. _______

4. Enter: $142,700 ($71,350 if you checked filing status box 2). . .

4. _______

5. Is the amount on line 4 less than the amount on line 3?

No. Stop. Your deduction is not limited. Enter the amount from

line 1 above on Form 1040NR-EZ, line 11.

Yes. Subtract line 4 from line 3. . .

5. _______

6. Multiply line 5 above by 3% (.03). . .

6. _______

7. Enter the smaller of line 2 or line 6. . .

7. _______

8. Total itemized deductions. Subtract line 7 from line 1. Enter the result here

and on Form 1040NR-EZ, line 11. Then, on the dotted line to the left of the

line 12 entry, enter "IDW". . .

8. _______

Note: The 2004 version of the Instructions for Form 1040NR-EZ is not being revised to

include this worksheet. -- 08-FEB-2005

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21