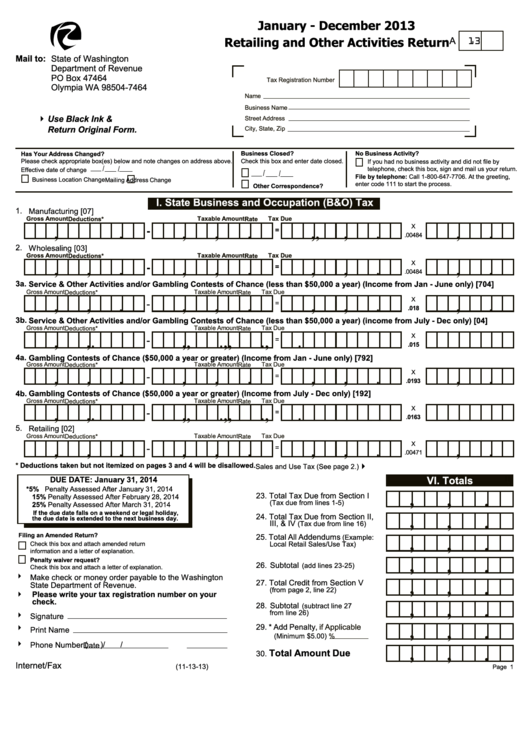

Retailing And Other Activities Return Form - Washington Department Of Revenue - 2013

ADVERTISEMENT

January - December 2013

Retailing and Other Activities Return

A

13

Mail to:

State of Washington

Department of Revenue

PO Box 47464

Tax Registration Number

Olympia WA 98504-7464

Name

Business Name

Use Black Ink &

4

Street Address

Return Original Form.

City, State, Zip

Business Closed?

No Business Activity?

Has Your Address Changed?

Please check appropriate box(es) below and note changes on address above.

Check this box and enter date closed.

If you had no business activity and did not file by

telephone, check this box, sign and mail us your return.

Effective date of change

File by telephone: Call 1-800-647-7706. At the greeting,

Business Location Change

Mailing Address Change

enter code 111 to start the process.

Other Correspondence?

I. State Business and Occupation (B&O) Tax

1.

Manufacturing [07]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

,

,

.

,

,

.

,

,

,

.

,

.

X

-

=

.00484

2.

Wholesaling [03]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

,

,

.

,

,

.

,

,

.

,

.

X

-

=

.00484

3a.

Service & Other Activities and/or Gambling Contests of Chance (less than $50,000 a year) (Income from Jan - June only) [704]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

,

,

.

,

,

.

,

,

.

,

.

X

-

=

.018

3b.

Service & Other Activities and/or Gambling Contests of Chance (less than $50,000 a year) (income from July - Dec only) [04]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

,

,

.

,

,

.

,

,

.

,

.

X

-

=

.015

4a.

Gambling Contests of Chance ($50,000 a year or greater) (Income from Jan - June only) [792]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

,

,

.

,

,

.

,

,

.

,

.

X

-

=

.0193

4b.

Gambling Contests of Chance ($50,000 a year or greater) (Income from July - Dec only) [192]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

,

,

.

,

,

.

,

,

.

,

.

X

-

=

.0163

5.

Retailing [02]

Gross Amount

Taxable Amount

Tax Due

Deductions*

Rate

,

,

.

,

,

.

,

,

.

,

.

X

-

=

.00471

*

Deductions taken but not itemized on pages 3 and 4 will be disallowed.

Sales and Use Tax (See page 2.)

4

VI. Totals

DUE DATE: January 31, 2014

* 5% Penalty Assessed After January 31, 2014

,

,

.

23. Total Tax Due from Section I

15% Penalty Assessed After February 28, 2014

(Tax due from lines 1-5)

25% Penalty Assessed After March 31, 2014

If the due date falls on a weekend or legal holiday,

,

,

.

24. Total Tax Due from Section II,

the due date is extended to the next business day.

III, & IV

(Tax due from line 16)

Filing an Amended Return?

25. Total All Addendums

,

(Example:

,

.

Local Retail Sales/Use Tax)

Check this box and attach amended return

information and a letter of explanation.

,

,

.

Penalty waiver request?

26. Subtotal

(add lines 23-25)

Check this box and attach a letter of explanation.

4

Make check or money order payable to the Washington

,

,

.

27. Total Credit from Section V

State Department of Revenue.

(from page 2, line 22)

Please write your tax registration number on your

4

check.

,

,

.

28. Subtotal

(subtract line 27

from line 26)

4

Signature

,

,

.

29. * Add Penalty,

if Applicable

4

Print Name

(Minimum $5.00)

%

4

Phone Number

(

)

/

/

Date

,

,

.

Total Amount Due

30.

Internet/Fax

(11-13-13)

Page

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4