Form Dw1 - Employer'S Return Of Employee Income Tax Withheld - City Of Dayton

ADVERTISEMENT

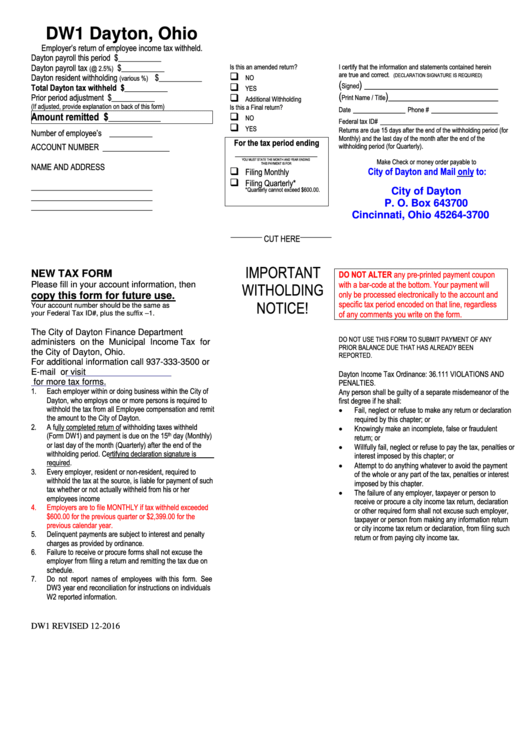

DW1 Dayton, Ohio

Employer’s return of employee income tax withheld.

Dayton payroll this period

$___________

I certify that the information and statements contained herein

Dayton payroll tax

$___________

Is this an amended return?

(@ 2.5%)

are true and correct

. (DECLARATION SIGNATURE IS REQUIRED)

Dayton resident withholding

$___________

NO

(various %)

(

) ____________________________

Signed

Total Dayton tax withheld

$___________

YES

(

)_______________________

Prior period adjustment

$___________

Print Name / Title

Additional Withholding

(If adjusted, provide explanation on back of this form)

___________

______________

Is this a Final return?

Date

Phone #

Amount remitted

$___________

NO

_________________________

Federal tax ID#

YES

Returns are due 15 days after the end of the withholding period (for

Number of employee’s

___________

Monthly) and the last day of the month after the end of the

For the tax period ending

ACCOUNT NUMBER

withholding period (for Quarterly).

______________

_____________________

YOU MUST STATE THE MONTH AND YEAR ENDING

Make Check or money order payable to

NAME AND ADDRESS

THIS PAYMENT IS FOR

City of Dayton and Mail only to:

Filing Monthly

Filing Quarterly*

_______________________________

City of Dayton

*Quarterly cannot exceed $600.00.

_______________________________

P. O. Box 643700

_______________________________

Cincinnati, Ohio 45264-3700

________

________

CUT HERE

IMPORTANT

NEW TAX FORM

DO NOT ALTER any pre-printed payment coupon

with a bar-code at the bottom. Your payment will

Please fill in your account information, then

WITHOLDING

only be processed electronically to the account and

copy this form for future use.

NOTICE!

specific tax period encoded on that line, regardless

Your account number should be the same as

your Federal Tax ID#, plus the suffix –1.

of any comments you write on the form.

The City of Dayton Finance Department

DO NOT USE THIS FORM TO SUBMIT PAYMENT OF ANY

administers on the Municipal Income Tax for

PRIOR BALANCE DUE THAT HAS ALREADY BEEN

the City of Dayton, Ohio.

REPORTED.

For additional information call 937-333-3500 or

E-mail

taxquestions@daytonohio.gov

or

visit

Dayton Income Tax Ordinance: 36.111 VIOLATIONS AND

PENALTIES.

for more tax forms.

1.

Each employer within or doing business within the City of

Any person shall be guilty of a separate misdemeanor of the

Dayton, who employs one or more persons is required to

first degree if he shall:

withhold the tax from all Employee compensation and remit

Fail, neglect or refuse to make any return or declaration

the amount to the City of Dayton.

required by this chapter; or

2.

A fully completed return of withholding taxes withheld

Knowingly make an incomplete, false or fraudulent

(Form DW1) and payment is due on the 15

th

day (Monthly)

return; or

or last day of the month (Quarterly) after the end of the

Willfully fail, neglect or refuse to pay the tax, penalties or

withholding period. Certifying declaration signature is

interest imposed by this chapter; or

required.

Attempt to do anything whatever to avoid the payment

3.

Every employer, resident or non-resident, required to

of the whole or any part of the tax, penalties or interest

withhold the tax at the source, is liable for payment of such

imposed by this chapter.

tax whether or not actually withheld from his or her

The failure of any employer, taxpayer or person to

employees income

receive or procure a city income tax return, declaration

4.

Employers are to file MONTHLY if tax withheld exceeded

or other required form shall not excuse such employer,

$600.00 for the previous quarter or $2,399.00 for the

taxpayer or person from making any information return

previous calendar year.

or city income tax return or declaration, from filing such

5.

Delinquent payments are subject to interest and penalty

return or from paying city income tax.

charges as provided by ordinance.

6.

Failure to receive or procure forms shall not excuse the

employer from filing a return and remitting the tax due on

schedule.

7.

Do not report names of employees with this form. See

DW3 year end reconciliation for instructions on individuals

W2 reported information.

DW1 REVISED 12-2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1