Schedule Tc-51 - Venison For Charity Credit - South Carolina Department Of Revenue - 2008

ADVERTISEMENT

1350

1350

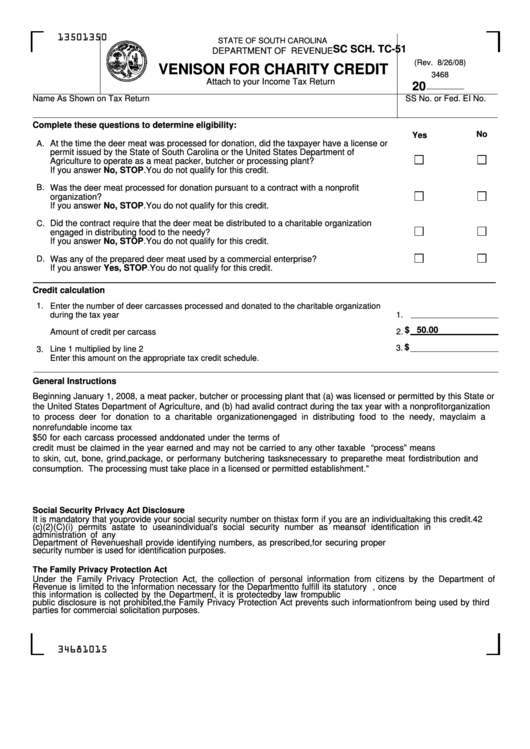

STATE OF SOUTH CAROLINA

SC SCH. TC-51

DEPARTMENT OF REVENUE

(Rev. 8/26/08)

VENISON FOR CHARITY CREDIT

3468

Attach to your Income Tax Return

20

Name As Shown on Tax Return

SS No. or Fed. EI No.

Complete these questions to determine eligibility:

No

Yes

A.

At the time the deer meat was processed for donation, did the taxpayer have a license or

permit issued by the State of South Carolina or the United States Department of

Agriculture to operate as a meat packer, butcher or processing plant?

If you answer No, STOP. You do not qualify for this credit.

B.

Was the deer meat processed for donation pursuant to a contract with a nonprofit

organization?

If you answer No, STOP. You do not qualify for this credit.

Did the contract require that the deer meat be distributed to a charitable organization

C.

engaged in distributing food to the needy?

If you answer No, STOP. You do not qualify for this credit.

D.

Was any of the prepared deer meat used by a commercial enterprise?

If you answer Yes, STOP. You do not qualify for this credit.

Credit calculation

1.

Enter the number of deer carcasses processed and donated to the charitable organization

during the tax year ......................................................................................................................

1.

$ 50.00

2.

Amount of credit per carcass .....................................................................................................

2.

$

3.

Line 1 multiplied by line 2 ..........................................................................................................

3.

Enter this amount on the appropriate tax credit schedule.

General Instructions

Beginning January 1, 2008, a meat packer, butcher or processing plant that (a) was licensed or permitted by this State or

the United States Department of Agriculture, and (b) had a valid contract during the tax year with a nonprofit organization

to process deer for donation to a charitable organization engaged in distributing food to the needy, may claim a

nonrefundable income tax credit. The credit is not allowed if any portion of the donated deer was used by a commercial

enterprise. The amount of credit is $50 for each carcass processed and donated under the terms of the contract. The

credit must be claimed in the year earned and may not be carried to any other taxable year. The term “process” means

to skin, cut, bone, grind, package, or perform any butchering tasks necessary to prepare the meat for distribution and

consumption. The processing must take place in a licensed or permitted establishment."

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taking this credit. 42

U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in

administration of any tax. SC Regulation 117-201 mandates that any person required to make a return to the SC

Department of Revenue shall provide identifying numbers, as prescribed, for securing proper identification. Your social

security number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of

Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once

this information is collected by the Department, it is protected by law from public disclosure. In those situations where

public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third

parties for commercial solicitation purposes.

34681015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1