Employer Status Report Form

Download a blank fillable Employer Status Report Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Employer Status Report Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

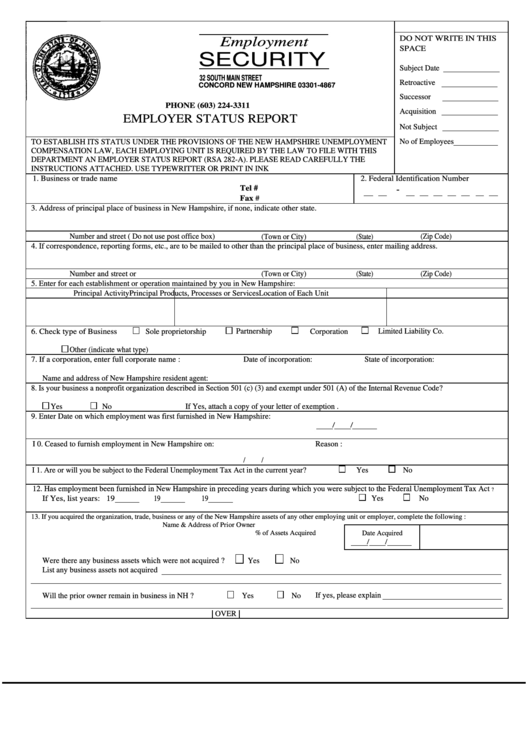

DO NOT WRITE IN THIS

Employment

SPACE

SECURITY

Subject Date

32 SOUTH MAIN STREET

Retroactive

CONCORD NEW HAMPSHIRE 03301-4867

Successor

PHONE (603) 224-3311

Acquisition

EMPLOYER STATUS REPORT

Not Subject

No of Employees

TO ESTABLISH ITS STATUS UNDER THE PROVISIONS OF THE NEW HAMPSHIRE UNEMPLOYMENT

COMPENSATION LAW, EACH EMPLOYING UNIT IS REQUIRED BY THE LAW TO FILE WITH THIS

DEPARTMENT AN EMPLOYER STATUS REPORT (RSA 282-A). PLEASE READ CAREFULLY THE

INSTRUCTIONS ATTACHED. USE TYPEWRITTER OR PRINT IN INK

1. Business or trade name

2. Federal Identification Number

Tel #

-

Fax #

3. Address of principal place of business in New Hampshire, if none, indicate other state.

Number and street ( Do not use post office box)

(Town or City)

(State)

(Zip Code)

4. If correspondence, reporting forms, etc., are to be mailed to other than the principal place of business, enter mailing address.

Number and street or P.O. Box

(Town or City)

(State)

(Zip Code)

5. Enter for each establishment or operation maintained by you in New Hampshire:

Principal Activity

Principal Products, Processes or Services

Location of Each Unit

6. Check type of Business

Sole proprietorship

Partnership

Corporation

Limited Liability Co.

Other (indicate what type)

7. If a corporation, enter full corporate name :

Date of incorporation:

State of incorporation:

Name and address of New Hampshire resident agent:

8. Is your business a nonprofit organization described in Section 501 (c) (3) and exempt under 501 (A) of the Internal Revenue Code?

If Yes, attach a copy of your letter of exemption .

Yes

No

9. Enter Date on which employment was first furnished in New Hampshire:

/

/

I 0. Ceased to furnish employment in New Hampshire on:

Reason :

/

/

I 1. Are or will you be subject to the Federal Unemployment Tax Act in the current year?

Yes

No

12. Has employment been furnished in New Hampshire in preceding years during which you were subject to the Federal Unemployment Tax Act

?

If Yes, list years: 19

19

19

Yes

No

13. If you acquired the organization, trade, business or any of the New Hampshire assets of any other employing unit or employer, complete the following :

Name & Address of Prior Owner

Date Acquired

% of Assets Acquired

/

/

Were there any business assets which were not acquired ?

Yes

No

List any business assets not acquired

If yes, please explain

Will the prior owner remain in business in NH ?

Yes

No

OVER

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2