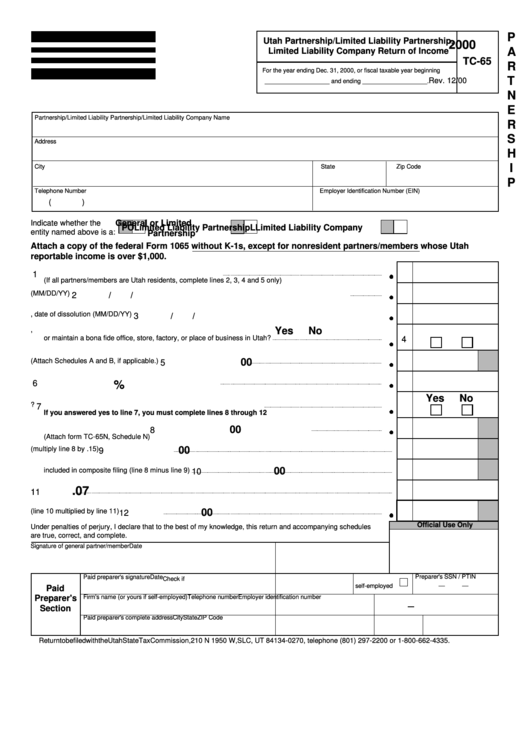

Form Tc-65 - Utah Partnership/limited Liability Partnership, Limited Liability Company Return Of Income - 2000

ADVERTISEMENT

P

Utah Partnership/Limited Liability Partnership,

2000

A

Limited Liability Company Return of Income

TC-65

R

For the year ending Dec. 31, 2000, or fiscal taxable year beginning

T

Rev. 12/00

___________________ and ending ___________________.

N

E

Partnership/Limited Liability Partnership/Limited Liability Company Name

R

S

Address

H

I

City

State

Zip Code

P

Telephone Number

Employer Identification Number (EIN)

(

)

Indicate whether the

General or Limited

P

O

Limited Liability Partnership L

Limited Liability Company

entity named above is a:

Partnership

Attach a copy of the federal Form 1065 without K-1s, except for nonresident partners/members whose Utah

reportable income is over $1,000.

1. Number of partners/members who are not Utah residents

1

(If all partners/members are Utah residents, complete lines 2, 3, 4 and 5 only)

2. Date partnership/limited liability partnership/limited liability company registered in Utah (MM/DD/YY)

2

/

/

3. If partnership/limited liability partnership/limited liability company is dissolved, date of dissolution (MM/DD/YY)

3

/

/

4. Did the partnership/limited liability partnership/limited liability company have income derived from Utah sources,

Yes

No

or maintain a bona fide office, store, factory, or place of business in Utah?

4

5. Amount of Utah income (Attach Schedules A and B, if applicable.)

00

5

6. Percentage of Utah income attributable to nonresidents

6

%

Yes

No

7. Is this a composite return on behalf of nonresident partners/members?

7

If you answered yes to line 7, you must complete lines 8 through 12

8. Utah income attributable to nonresident partners/members included in composite filing

00

8

(Attach form TC-65N, Schedule N)

9. Deduction amount (multiply line 8 by .15)

00

9

10. Utah taxable income attributable to nonresident partners/members

00

included in composite filing (line 8 minus line 9)

10

.07

11. Tax rate

11

12. Tax due (line 10 multiplied by line 11)

00

12

Official Use Only

Under penalties of perjury, I declare that to the best of my knowledge, this return and accompanying schedules

are true, correct, and complete.

Signature of general partner/member

Date

Paid preparer's signature

Date

Preparer's SSN / PTIN

Check if

self-employed

Paid

Firm's name (or yours if self-employed)

Telephone number

Employer identification number

Preparer's

Section

Paid preparer's complete address

City

State

ZIP Code

Return to be filed with the Utah State Tax Commission, 210 N 1950 W, SLC, UT 84134-0270, telephone (801) 297-2200 or 1-800-662-4335.

65COPY.FRM Rev 12/00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1