Form M-22 Specific Instructions - Fuel Tax - Maui County

ADVERTISEMENT

FORM M-22

(REV. 6/2003)

PAGE 2

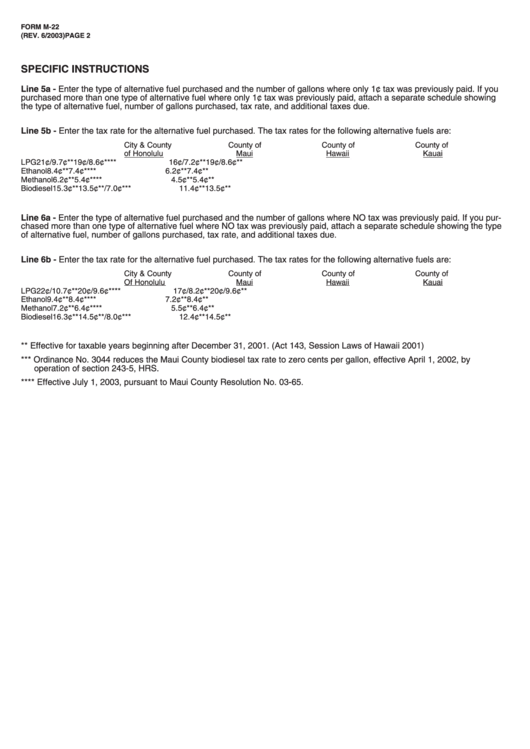

SPECIFIC INSTRUCTIONS

Line 5a - Enter the type of alternative fuel purchased and the number of gallons where only 1¢ tax was previously paid. If you

purchased more than one type of alternative fuel where only 1¢ tax was previously paid, attach a separate schedule showing

the type of alternative fuel, number of gallons purchased, tax rate, and additional taxes due.

Line 5b - Enter the tax rate for the alternative fuel purchased. The tax rates for the following alternative fuels are:

City & County

County of

County of

County of

of Honolulu

Maui

Hawaii

Kauai

LPG

21¢/9.7¢**

19¢/8.6¢****

16¢/7.2¢**

19¢/8.6¢**

Ethanol

8.4¢**

7.4¢****

6.2¢**

7.4¢**

Methanol

6.2¢**

5.4¢****

4.5¢**

5.4¢**

Biodiesel

15.3¢**

13.5¢**/7.0¢***

11.4¢**

13.5¢**

Line 6a - Enter the type of alternative fuel purchased and the number of gallons where NO tax was previously paid. If you pur-

chased more than one type of alternative fuel where NO tax was previously paid, attach a separate schedule showing the type

of alternative fuel, number of gallons purchased, tax rate, and additional taxes due.

Line 6b - Enter the tax rate for the alternative fuel purchased. The tax rates for the following alternative fuels are:

City & County

County of

County of

County of

Of Honolulu

Maui

Hawaii

Kauai

LPG

22¢/10.7¢**

20¢/9.6¢****

17¢/8.2¢**

20¢/9.6¢**

Ethanol

9.4¢**

8.4¢****

7.2¢**

8.4¢**

Methanol

7.2¢**

6.4¢****

5.5¢**

6.4¢**

Biodiesel

16.3¢**

14.5¢**/8.0¢***

12.4¢**

14.5¢**

** Effective for taxable years beginning after December 31, 2001. (Act 143, Session Laws of Hawaii 2001)

*** Ordinance No. 3044 reduces the Maui County biodiesel tax rate to zero cents per gallon, effective April 1, 2002, by

operation of section 243-5, HRS.

**** Effective July 1, 2003, pursuant to Maui County Resolution No. 03-65.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1