Form F-1120 - Florida Corporate Income/franchise And Emergency Excise Tax Return

ADVERTISEMENT

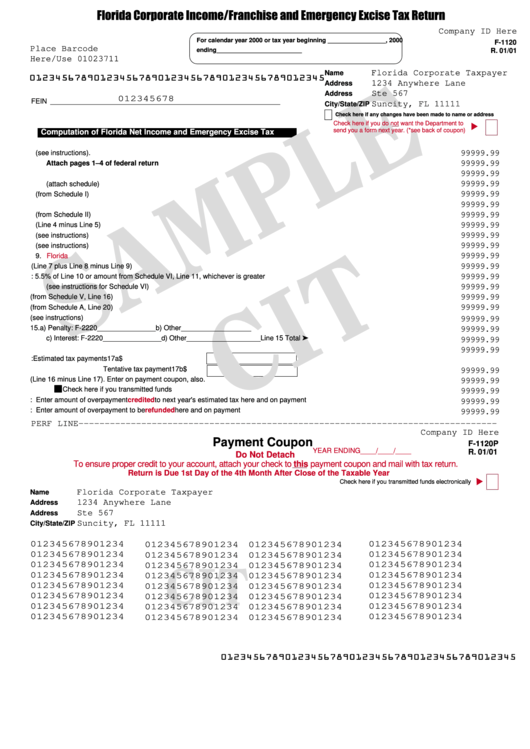

Florida Corporate Income/Franchise and Emergency Excise Tax Return

Company ID Here

For calendar year 2000 or tax year beginning _________________, 2000

F-1120

Place Barcode

ending_________________________

R. 01/01

Here/Use 01023711

Florida Corporate Taxpayer

Name

0123456789012345678901234567890123456789012345

1234 Anywhere Lane

Address

Ste 567

Address

012345678

FEIN ___________________________________________________________

Suncity, FL 11111

City/State/ZIP

Check here if any changes have been made to name or address

Check here if you do not want the Department to

send you a form next year. (*see back of coupon)

Computation of Florida Net Income and Emergency Excise Tax

1. Federal taxable income (see instructions).

99999.99

99999.99

Attach pages 1–4 of federal return .................................................

Check here if negative______ ...................................................

99999.99

2. State income taxes deducted in computing federal taxable income

(attach schedule) ............................................................................... Check here if negative______ ......................................................

99999.99

3. Additions to federal taxable income (from Schedule I) ....................... Check here if negative______ ......................................................

99999.99

4. Total of Lines 1 through 3. .................................................................. Check here if negative______ ......................................................

99999.99

5. Subtractions from federal taxable income (from Schedule II) ............ Check here if negative______ ......................................................

99999.99

6. Adjusted federal income (Line 4 minus Line 5) .................................. Check here if negative______ ......................................................

99999.99

99999.99

7. Florida portion of adjusted federal income (see instructions) ............ Check here if negative______ ......................................................

8. Non-business income allocated to Florida (see instructions) ............. Check here if negative______ ......................................................

99999.99

9.

Florida exemption .........................................................................................................................................................................................

99999.99

10. Florida net income (Line 7 plus Line 8 minus Line 9) ..................................................................................................................................

99999.99

11. Tax due: 5.5% of Line 10 or amount from Schedule VI, Line 11, whichever is greater

99999.99

(see instructions for Schedule VI). ...............................................................................................................................................................

99999.99

99999.99

12. Credits against the tax (from Schedule V, Line 16) ......................................................................................................................................

99999.99

13. Emergency excise tax due (from Schedule A, Line 20) ...............................................................................................................................

14. Total corporate income/franchise and emergency excise tax due (see instructions). ..................................................................................

99999.99

15. a) Penalty: F-2220 _______________ b) Other __________________

99999.99

c) Interest: F-2220 _______________ d) Other ___________________ Line 15 Total

......................................................................

99999.99

16. Total of Lines 14 and 15 ...............................................................................................................................................................................

99999.99

17. Payment credits: Estimated tax payments 17a $

Tentative tax payment

17b

$

.................................................................................

99999.99

18.Total amount due or overpayment (Line 16 minus Line 17). Enter on payment coupon, also.

99999.99

Check here if you transmitted funds electronically .................................................................................................................................

99999.99

19. Credit: Enter amount of overpayment

credited

to next year's estimated tax here and on payment coupon ..............................................

99999.99

20. Refund: Enter amount of overpayment to be

refunded

here and on payment coupon ..............................................................................

99999.99

PERF LINE--------------------------------------------------------------------------------

Company ID Here

Payment Coupon

F-1120P

YEAR ENDING____/____/____

R. 01/01

Do Not Detach

To ensure proper credit to your account, attach your check to this payment coupon and mail with tax return.

Return is Due 1st Day of the 4th Month After Close of the Taxable Year

Check here if you transmitted funds electronically

Name

Florida Corporate Taxpayer

1234 Anywhere Lane

Address

Ste 567

Address

Suncity, FL 11111

City/State/ZIP

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

CIT

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

012345678901234

0123456789012345678901234567890123456789012345

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4