Form Rpd-41239 - Application For Technology Jobs Tax Credit - 2015

ADVERTISEMENT

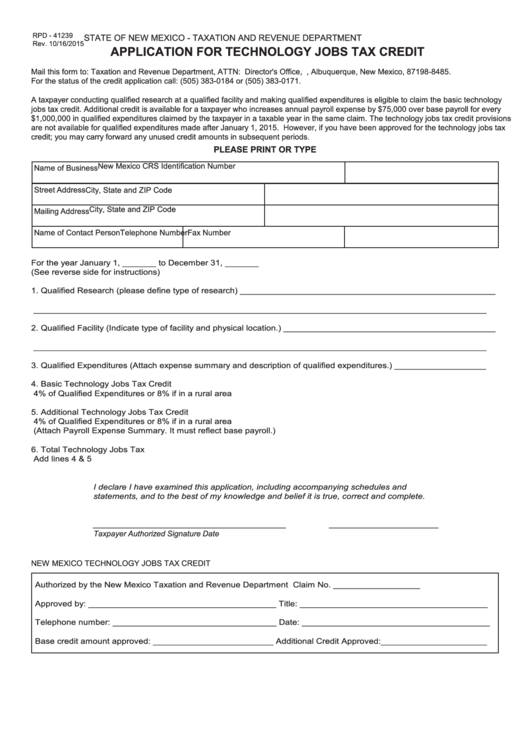

RPD - 41239

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

Rev. 10/16/2015

APPLICATION FOR TECHNOLOGY JOBS TAX CREDIT

Mail this form to: Taxation and Revenue Department, ATTN: Director's Office, P.O. Box 8485, Albuquerque, New Mexico, 87198-8485.

For the status of the credit application call: (505) 383-0184 or (505) 383-0171.

A taxpayer conducting qualified research at a qualified facility and making qualified expenditures is eligible to claim the basic technology

jobs tax credit. Additional credit is available for a taxpayer who increases annual payroll expense by $75,000 over base payroll for every

$1,000,000 in qualified expenditures claimed by the taxpayer in a taxable year in the same claim. The technology jobs tax credit provisions

are not available for qualified expenditures made after January 1, 2015. However, if you have been approved for the technology jobs tax

credit; you may carry forward any unused credit amounts in subsequent periods.

PLEASE PRINT OR TYPE

New Mexico CRS Identification Number

Name of Business

Street Address

City, State and ZIP Code

City, State and ZIP Code

Mailing Address

Name of Contact Person

Telephone Number

Fax Number

For the year January 1, _______ to December 31, _______

(See reverse side for instructions)

1.

Qualified Research (please define type of research) _____________________________________________________

______________________________________________________________________________________________

2.

Qualified Facility (Indicate type of facility and physical location.) ____________________________________________

______________________________________________________________________________________________

3.

Qualified Expenditures (Attach expense summary and description of qualified expenditures.)

___________________

4.

Basic Technology Jobs Tax Credit .........................................................................................

___________________

4% of Qualified Expenditures or 8% if in a rural area

5.

Additional Technology Jobs Tax Credit ..................................................................................

___________________

4% of Qualified Expenditures or 8% if in a rural area

(Attach Payroll Expense Summary. It must reflect base payroll.)

6.

Total Technology Jobs Tax Credit...........................................................................................

___________________

Add lines 4 & 5

I declare I have examined this application, including accompanying schedules and

statements, and to the best of my knowledge and belief it is true, correct and complete.

____________________________________________

_________________________

Taxpayer Authorized Signature

Date

NEW MEXICO TECHNOLOGY JOBS TAX CREDIT

Authorized by the New Mexico Taxation and Revenue Department

Claim No. __________________

Approved by: _______________________________________

Title: _______________________________________

Telephone number: __________________________________

Date: _______________________________________

Base credit amount approved: _________________________

Additional Credit Approved:______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2