Married Persons Filing Separate Returns Form December 2001

ADVERTISEMENT

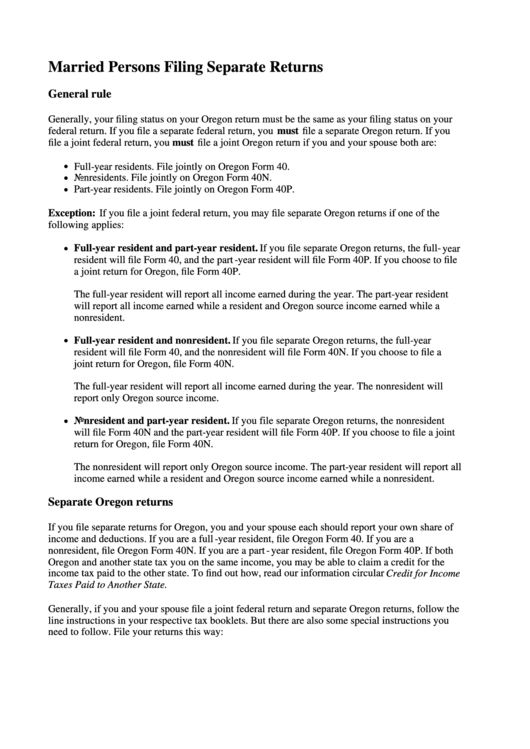

Married Persons Filing Separate Returns

General rule

Generally, your filing status on your Oregon return must be the same as your filing status on your

federal return. If you file a separate federal return, you must file a separate Oregon return. If you

file a joint federal return, you must file a joint Oregon return if you and your spouse both are:

Full-year residents. File jointly on Oregon Form 40.

l

Nonresidents. File jointly on Oregon Form 40N.

l

Part -year residents. File jointly on Oregon Form 40P.

l

Exception: If you file a joint federal return, you may file separate Oregon returns if one of the

following applies:

Full-year resident and part- year resident. If you file separate Oregon returns, the full-year

l

resident will file Form 40, and the part -year resident will file Form 40P. If you choose to file

a joint return for Oregon, file Form 40P.

The full -year resident will report all income earned during the year. The part-year resident

will report all income earned while a resident and Oregon source income earned while a

nonresident.

Full-year resident and nonresident. If you file separate Oregon returns, the full-year

l

resident will file Form 40, and the nonresident will file Form 40N. If you choose to file a

joint return for Oregon, file Form 40N.

The full -year resident will report all income earned during the year. The nonresident will

report only Oregon source income.

Nonresident and part -year resident. If you file separate Oregon returns, the nonresident

l

will file Form 40N and the part -year resident will file Form 40P. If you choose to file a joint

return for Oregon, file Form 40N.

The nonresident will report only Oregon source income. The part-year resident will report all

income earned while a resident and Oregon source income earned while a nonresident.

Separate Oregon returns

If you file separate returns for Oregon, you and your spouse each should report your own share of

income and deductions. If you are a full -year resident, file Oregon Form 40. If you are a

nonresident, file Oregon Form 40N. If you are a part - year resident, file Oregon Form 40P. If both

Oregon and another state tax you on the same income, you may be able to claim a credit for the

income tax paid to the other state. To find out how, read our information circular Credit for Income

Taxes Paid to Another State.

Generally, if you and your spouse file a joint federal return and separate Oregon returns, follow the

line instructions in your respective tax booklets. But there are also some special instructions you

need to follow. File your returns this way:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4