Form Ga-8453 P - Georgia Partnership Tax Return Declaration For Electronic Filing, Summary Of Agreement - 2011

ADVERTISEMENT

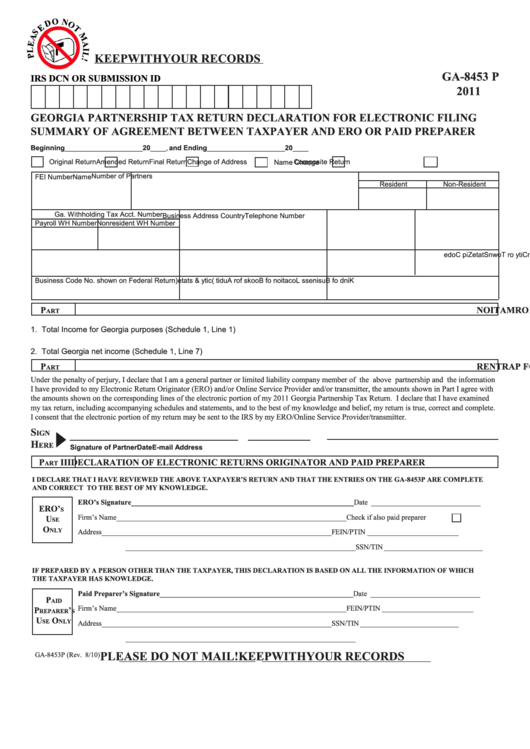

KEEP WITH YOUR RECORDS

GA-8453 P

IRS DCN OR SUBMISSION ID

2011

GEORGIA PARTNERSHIP TAX RETURN DECLARATION FOR ELECTRONIC FILING

SUMMARY OF AGREEMENT BETWEEN TAXPAYER AND ERO OR PAID PREPARER

Beginning____________________20____, and Ending____________________20____

Original Return

Amended Return

Final Return

Change of Address

Composite Return

Name Change

Number of Partners

FEI Number

Name

Resident

Non-Resident

Ga. Withholding Tax Acct. Number

Business Address

Country

Telephone Number

Payroll WH Number Nonresident WH Number

G

. a

S

l a

s e

T

x a

R

e

. g

N

u

m

b

r e

C

y t i

r o

T

o

w

n

S

a t

e t

Z

p i

C

o

d

e

Business Code No. shown on Federal Return

K

n i

d

f o

B

u

s

n i

e

s s

L

o

c

t a

o i

n

f o

B

o

o

k

f s

r o

A

u

d

t i

c (

y t i

&

t s

t a

) e

P

I

T

A

X

R

E

T

U

R

N

I

N

F

O

R

M

A

T

I

O

N

ART

1. Total Income for Georgia purposes (Schedule 1, Line 1) ...................................................

1. _____________________________

2. Total Georgia net income (Schedule 1, Line 7) ...................................................................

2. _____________________________

P

I I

D

E

C

L

A

R

A

T

I

O

N

O

F

P

A

R

T

N

E

R

ART

Under the penalty of perjury, I declare that I am a general partner or limited liability company member of the above partnership and the information

I have provided to my Electronic Return Originator (ERO) and/or Online Service Provider and/or transmitter, the amounts shown in Part I agree with

the amounts shown on the corresponding lines of the electronic portion of my 2011 Georgia Partnership Tax Return. I declare that I have examined

my tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, my return is true, correct and complete.

I consent that the electronic portion of my return may be sent to the IRS by my ERO/Online Service Provider/transmitter.

S

IGN

H

ERE

Signature of Partner

Date

E-mail Address

P

III

DECLARATION OF ELECTRONIC RETURNS ORIGINATOR AND PAID PREPARER

ART

I DECLARE THAT I HAVE REVIEWED THE ABOVE TAXPAYER’S RETURN AND THAT THE ENTRIES ON THE GA-8453P ARE COMPLETE

AND CORRECT TO THE BEST OF MY KNOWLEDGE.

ERO’s Signature _____________________________________________________________

Date ______________________________

ERO’

S

Firm’s Name

_______________________________________________________________

Check if also paid preparer

U

SE

O

NLY

Address

_______________________________________________________________

FEIN/PTIN _________________________

_______________________________________________________________

SSN/TIN ___________________________

IF PREPARED BY A PERSON OTHER THAN THE TAXPAYER, THIS DECLARATION IS BASED ON ALL THE INFORMATION OF WHICH

THE TAXPAYER HAS KNOWLEDGE.

Paid Preparer’s Signature _____________________________________________________

Date ______________________________

P

AID

Firm’s Name

_______________________________________________________________

FEIN/PTIN _________________________

P

’

REPARER

S

U

O

SE

NLY

Address

_______________________________________________________________

SSN/TIN ___________________________

_______________________________________________________________

PLEASE DO NOT MAIL! KEEP WITH YOUR RECORDS

GA-8453P (Rev. 8/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1