Instructions For Completing The Temporary Registration Certificate Form August 1998

ADVERTISEMENT

S

W

D

R

TATE OF

ASHINGTON

EPARTMENT OF

EVENUE

Instructions for Completing the Temporary Registration Certificate

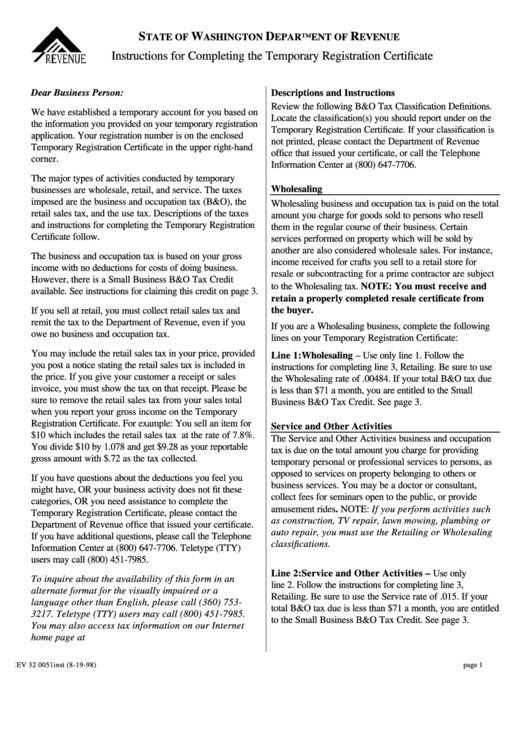

Dear Business Person:

Descriptions and Instructions

Review the following B&O Tax Classification Definitions.

We have established a temporary account for you based on

Locate the classification(s) you should report under on the

the information you provided on your temporary registration

Temporary Registration Certificate. If your classification is

application. Your registration number is on the enclosed

not printed, please contact the Department of Revenue

Temporary Registration Certificate in the upper right-hand

office that issued your certificate, or call the Telephone

corner.

Information Center at (800) 647-7706.

The major types of activities conducted by temporary

Wholesaling

businesses are wholesale, retail, and service. The taxes

imposed are the business and occupation tax (B&O), the

Wholesaling business and occupation tax is paid on the total

retail sales tax, and the use tax. Descriptions of the taxes

amount you charge for goods sold to persons who resell

and instructions for completing the Temporary Registration

them in the regular course of their business. Certain

Certificate follow.

services performed on property which will be sold by

another are also considered wholesale sales. For instance,

The business and occupation tax is based on your gross

income received for crafts you sell to a retail store for

income with no deductions for costs of doing business.

resale or subcontracting for a prime contractor are subject

However, there is a Small Business B&O Tax Credit

to the Wholesaling tax. NOTE: You must receive and

available. See instructions for claiming this credit on page 3.

retain a properly completed resale certificate from

the buyer.

If you sell at retail, you must collect retail sales tax and

remit the tax to the Department of Revenue, even if you

If you are a Wholesaling business, complete the following

owe no business and occupation tax.

lines on your Temporary Registration Certificate:

You may include the retail sales tax in your price, provided

Line 1:

Wholesaling – Use only line 1. Follow the

you post a notice stating the retail sales tax is included in

instructions for completing line 3, Retailing. Be sure to use

the price. If you give your customer a receipt or sales

the Wholesaling rate of .00484. If your total B&O tax due

invoice, you must show the tax on that receipt. Please be

is less than $71 a month, you are entitled to the Small

sure to remove the retail sales tax from your sales total

Business B&O Tax Credit. See page 3.

when you report your gross income on the Temporary

Registration Certificate. For example: You sell an item for

Service and Other Activities

$10 which includes the retail sales tax at the rate of 7.8%.

The Service and Other Activities business and occupation

You divide $10 by 1.078 and get $9.28 as your reportable

tax is due on the total amount you charge for providing

gross amount with $.72 as the tax collected.

temporary personal or professional services to persons, as

opposed to services on property belonging to others or

If you have questions about the deductions you feel you

business services. You may be a doctor or consultant,

might have, OR your business activity does not fit these

collect fees for seminars open to the public, or provide

categories, OR you need assistance to complete the

amusement rides. NOTE: If you perform activities such

Temporary Registration Certificate, please contact the

as construction, TV repair, lawn mowing, plumbing or

Department of Revenue office that issued your certificate.

auto repair, you must use the Retailing or Wholesaling

If you have additional questions, please call the Telephone

classifications.

Information Center at (800) 647-7706. Teletype (TTY)

users may call (800) 451-7985.

Line 2:

Service and Other Activities – Use only

To inquire about the availability of this form in an

line 2. Follow the instructions for completing line 3,

alternate format for the visually impaired or a

Retailing. Be sure to use the Service rate of .015. If your

language other than English, please call (360) 753-

total B&O tax due is less than $71 a month, you are entitled

3217. Teletype (TTY) users may call (800) 451-7985.

to the Small Business B&O Tax Credit. See page 3.

You may also access tax information on our Internet

home page at

REV 32 0051inst (8-19-98)

page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3