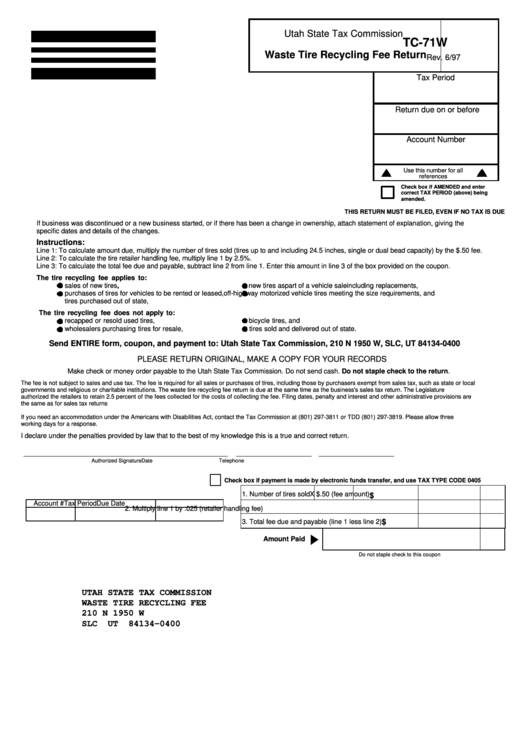

Utah State Tax Commission

TC-71W

Waste Tire Recycling Fee Return

Rev. 6/97

Tax Period

Return due on or before

Account Number

Use this number for all

references

Check box if AMENDED and enter

correct TAX PERIOD (above) being

amended.

THIS RETURN MUST BE FILED, EVEN IF NO TAX IS DUE

If business was discontinued or a new business started, or if there has been a change in ownership, attach statement of explanation, giving the

specific dates and details of the changes.

Instructions:

Line 1: To calculate amount due, multiply the number of tires sold (tires up to and including 24.5 inches, single or dual bead capacity) by the $.50 fee.

Line 2: To calculate the tire retailer handling fee, multiply line 1 by 2.5%.

Line 3: To calculate the total fee due and payable, subtract line 2 from line 1. Enter this amount in line 3 of the box provided on the coupon.

The tire recycling fee applies to:

sales of new tires,

new tires as part of a vehicle sale including replacements,

purchases of tires for vehicles to be rented or leased,

off-highway motorized vehicle tires meeting the size requirements, and

tires purchased out of state,

The tire recycling fee does not apply to:

recapped or resold used tires,

bicycle tires, and

wholesalers purchasing tires for resale,

tires sold and delivered out of state.

Send ENTIRE form, coupon, and payment to: Utah State Tax Commission, 210 N 1950 W, SLC, UT 84134-0400

PLEASE RETURN ORIGINAL, MAKE A COPY FOR YOUR RECORDS

Make check or money order payable to the Utah State Tax Commission. Do not send cash.

Do not staple check to the return .

The fee is not subject to sales and use tax. The fee is required for all sales or purchases of tires, including those by purchasers exempt from sales tax, such as state or local

governments and religious or charitable institutions. The waste tire recycling fee return is due at the same time as the business's sales tax return. The Legislature

authorized the retailers to retain 2.5 percent of the fees collected for the costs of collecting the fee. Filing dates, penalty and interest and other administrative provisions are

the same as for sales tax returns

If you need an accommodation under the Americans with Disabilities Act, contact the Tax Commission at (801) 297-3811 or TDD (801) 297-3819. Please allow three

working days for a response.

I declare under the penalties provided by law that to the best of my knowledge this is a true and correct return.

Authorized Signature

Date

Telephone

71W.FRM Rev. 6/97

Check box if payment is made by electronic funds transfer, and use

TAX TYPE CODE 0405

1. Number of tires sold

X $.50 (fee amount)

$

Account #

Tax Period

Due Date

2. Multiply line 1 by .025 (retailer handling fee)

3. Total fee due and payable (line 1 less line 2)

$

Amount Paid

Do not staple check to this coupon

UTAH STATE TAX COMMISSION

WASTE TIRE RECYCLING FEE

210 N 1950 W

SLC

UT

84134-0400

1

1