Reset Form

Print Form

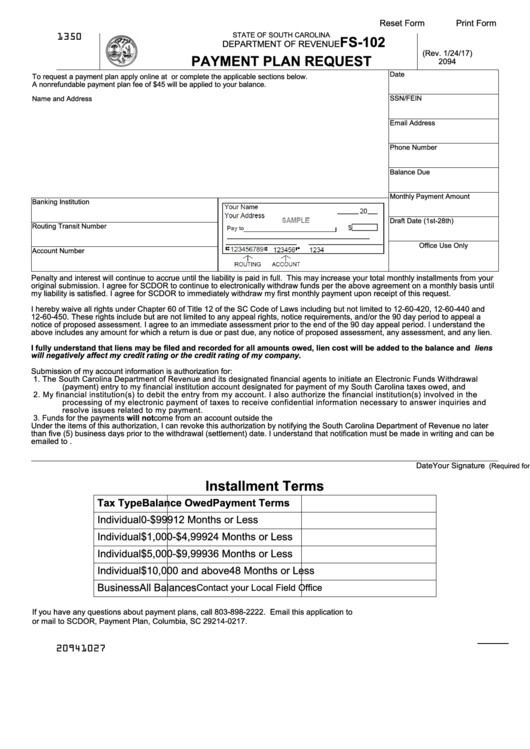

1350

STATE OF SOUTH CAROLINA

FS-102

DEPARTMENT OF REVENUE

(Rev. 1/24/17)

PAYMENT PLAN REQUEST

2094

Date

To request a payment plan apply online at dor.sc.gov/payplan or complete the applicable sections below.

A nonrefundable payment plan fee of $45 will be applied to your balance.

SSN/FEIN

Name and Address

Email Address

Phone Number

Balance Due

Monthly Payment Amount

Banking Institution

Draft Date (1st-28th)

Routing Transit Number

Office Use Only

Account Number

Penalty and interest will continue to accrue until the liability is paid in full. This may increase your total monthly installments from your

original submission. I agree for SCDOR to continue to electronically withdraw funds per the above agreement on a monthly basis until

my liability is satisfied. I agree for SCDOR to immediately withdraw my first monthly payment upon receipt of this request.

I hereby waive all rights under Chapter 60 of Title 12 of the SC Code of Laws including but not limited to 12-60-420, 12-60-440 and

12-60-450. These rights include but are not limited to any appeal rights, notice requirements, and/or the 90 day period to appeal a

notice of proposed assessment. I agree to an immediate assessment prior to the end of the 90 day appeal period. I understand the

above includes any amount for which a return is due or past due, any notice of proposed assessment, any assessment, and any lien.

I fully understand that liens may be filed and recorded for all amounts owed, lien cost will be added to the balance and liens

will negatively affect my credit rating or the credit rating of my company.

Submission of my account information is authorization for:

1. The South Carolina Department of Revenue and its designated financial agents to initiate an Electronic Funds Withdrawal

(payment) entry to my financial institution account designated for payment of my South Carolina taxes owed, and

2. My financial institution(s) to debit the entry from my account. I also authorize the financial institution(s) involved in the

processing of my electronic payment of taxes to receive confidential information necessary to answer inquiries and

resolve issues related to my payment.

3. Funds for the payments will not come from an account outside the U.S.

Under the items of this authorization, I can revoke this authorization by notifying the South Carolina Department of Revenue no later

than five (5) business days prior to the withdrawal (settlement) date. I understand that notification must be made in writing and can be

emailed to PPARequest@dor.sc.gov.

Your Signature

Spouse's Signature

Date

(Required for EFW)

(If applicable)

Installment Terms

Tax Type

Balance Owed

Payment Terms

Individual

0-$999

12 Months or Less

Individual

$1,000-$4,999

24 Months or Less

Individual

$5,000-$9,999

36 Months or Less

Individual

$10,000 and above

48 Months or Less

Business

All Balances

Contact your Local Field Office

If you have any questions about payment plans, call 803-898-2222. Email this application to PPARequest@dor.sc.gov

or mail to SCDOR, Payment Plan, Columbia, SC 29214-0217.

20941027

1

1