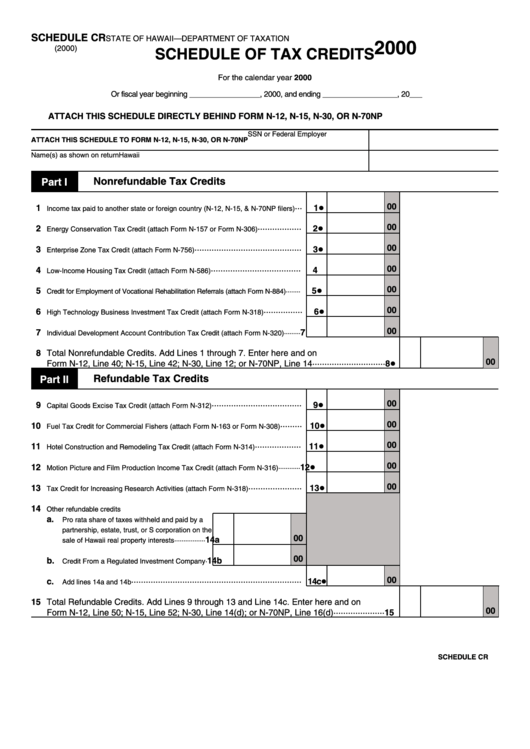

Schedule Cr - Schedule Of Tax Credits - 2000

ADVERTISEMENT

SCHEDULE CR

STATE OF HAWAII—DEPARTMENT OF TAXATION

2000

(2000)

SCHEDULE OF TAX CREDITS

For the calendar year 2000

Or fiscal year beginning _________________, 2000, and ending __________________, 20___

ATTACH THIS SCHEDULE DIRECTLY BEHIND FORM N-12, N-15, N-30, OR N-70NP

SSN or Federal Employer I.D. No.

ATTACH THIS SCHEDULE TO FORM N-12, N-15, N-30, OR N-70NP

Name(s) as shown on return

Hawaii G.E./Use Identification No.

Nonrefundable Tax Credits

Part I

00

1

···

1!

Income tax paid to another state or foreign country (N-12, N-15, & N-70NP filers)

00

2

··················

2!

Energy Conservation Tax Credit (attach Form N-157 or Form N-306)

00

3

············································

3!

Enterprise Zone Tax Credit (attach Form N-756)

00

4

·····································

4

Low-Income Housing Tax Credit (attach Form N-586)

00

5

5!

Credit for Employment of Vocational Rehabilitation Referrals (attach Form N-884) ········

00

6

················

6!

High Technology Business Investment Tax Credit (attach Form N-318)

00

7

7

Individual Development Account Contribution Tax Credit (attach Form N-320) ·········

8 Total Nonrefundable Credits. Add Lines 1 through 7. Enter here and on

00

Form N-12, Line 40; N-15, Line 42; N-30, Line 12; or N-70NP, Line 14 ······························

8!

Refundable Tax Credits

Part II

00

9

·····································

9!

Capital Goods Excise Tax Credit (attach Form N-312)

00

10

········· 10!

Fuel Tax Credit for Commercial Fishers (attach Form N-163 or Form N-308)

00

11

··················· 11!

Hotel Construction and Remodeling Tax Credit (attach Form N-314)

00

12

12!

Motion Picture and Film Production Income Tax Credit (attach Form N-316) ············

00

13

······················ 13!

Tax Credit for Increasing Research Activities (attach Form N-318)

14

Other refundable credits

a.

Pro rata share of taxes withheld and paid by a

partnership, estate, trust, or S corporation on the

00

14a

sale of Hawaii real property interests ·················

00

b.

14b

Credit From a Regulated Investment Company·

00

c.

······································································ 14c!

Add lines 14a and 14b

15 Total Refundable Credits. Add Lines 9 through 13 and Line 14c. Enter here and on

00

Form N-12, Line 50; N-15, Line 52; N-30, Line 14(d); or N-70NP, Line 16(d)

·····················

15

SCHEDULE CR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1