Form Dr-601i - Florida Intangible Personal Property Tax Return For Individual And Joint Filers - 2003

ADVERTISEMENT

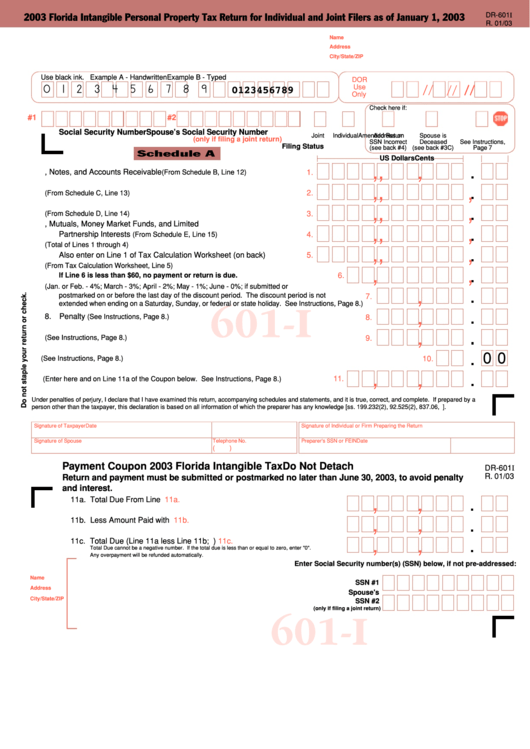

DR-601I

2003 Florida Intangible Personal Property Tax Return for Individual and Joint Filers as of January 1, 2003

R. 01/03

Name

Address

City/State/ZIP

Use black ink. Example A - Handwritten

Example B - Typed

DOR

0 1 2 3 4 5 6 7 8 9

Use

/ / / / /

/ / / / /

0123456789

Only

Check here if:

#1

#2

Social Security Number

Spouse’s Social Security Number

Joint

Individual

Address or

Spouse is

Amended Return

(only if filing a joint return)

SSN Incorrect

Deceased

See Instructions,

Filing Status

(see back #4)

(see back #3C)

Page 7

Schedule A

US Dollars

Cents

,

,

,

1. Loans, Notes, and Accounts Receivable

(From Schedule B, Line 12) .......

1.

,

,

,

2. Beneficial Interest in Any Trust

(From Schedule C, Line 13) ........................

2.

,

,

,

3. Bonds

3.

(From Schedule D, Line 14) ...................................................................

4. Stocks, Mutuals, Money Market Funds, and Limited

,

,

,

Partnership Interests

4.

(From Schedule E, Line 15) .........................................

5. Total Taxable Intangible Assets

(Total of Lines 1 through 4)

,

,

,

Also enter on Line 1 of Tax Calculation Worksheet (on back)

. ................

5.

6. Total Tax Due

(From Tax Calculation Worksheet, Line 5)

,

,

If Line 6 is less than $60, no payment or return is due. ..............................................

6.

7. Discount

(Jan. or Feb. - 4%; March - 3%; April - 2%; May - 1%; June - 0%; if submitted or

,

postmarked on or before the last day of the discount period. The discount period is not ..................

7.

extended when ending on a Saturday, Sunday, or federal or state holiday. See Instructions, Page 8.)

601-I

,

8. Penalty

(See Instructions, Page 8.) ...................................................................................................

8.

,

9. Interest

(See Instructions, Page 8.) ...................................................................................................

9.

0 0

10. Voluntary Election Campaign Contribution

(See Instructions, Page 8.) ...................................................................

10.

,

,

11. Total Due

11.

(Enter here and on Line 11a of the Coupon below. See Instructions, Page 8.)

Under penalties of perjury, I declare that I have examined this return, accompanying schedules and statements, and it is true, correct, and complete. If prepared by a

person other than the taxpayer, this declaration is based on all information of which the preparer has any knowledge [ss. 199.232(2), 92.525(2), 837.06, F.S.].

Signature of Taxpayer

Date

Signature of Individual or Firm Preparing the Return

Signature of Spouse

Telephone No.

Preparer's SSN or FEIN

Date

(

)

Payment Coupon 2003 Florida Intangible Tax

Do Not Detach

DR-601I

R. 01/03

Return and payment must be submitted or postmarked no later than June 30, 2003, to avoid penalty

and interest.

,

11a. Total Due From Line 11 ......................................................................

11a.

,

,

11b. Less Amount Paid with Extension ......................................................

11b.

,

,

,

11c. Total Due (Line 11a less Line 11b; U.S. funds only) ...........................

11c.

Total Due cannot be a negative number. If the total due is less than or equal to zero, enter "0".

Any overpayment will be refunded automatically.

Enter Social Security number(s) (SSN) below, if not pre-addressed:

Name

SSN #1

Address

Spouse's

City/State/ZIP

SSN #2

(only if filing a joint return)

601-I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4