Instructions For Form 8880 - 2008

ADVERTISEMENT

2

Form 8880 (2008)

Page

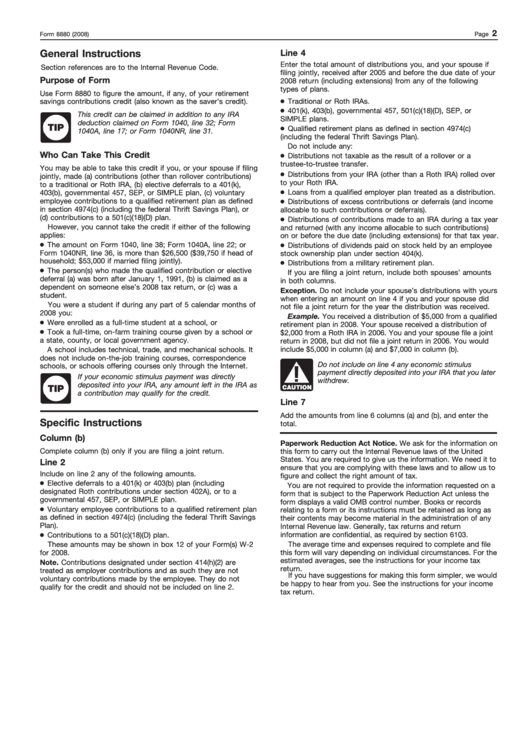

General Instructions

Line 4

Enter the total amount of distributions you, and your spouse if

Section references are to the Internal Revenue Code.

filing jointly, received after 2005 and before the due date of your

Purpose of Form

2008 return (including extensions) from any of the following

types of plans.

Use Form 8880 to figure the amount, if any, of your retirement

savings contributions credit (also known as the saver’s credit).

Traditional or Roth IRAs.

401(k), 403(b), governmental 457, 501(c)(18)(D), SEP, or

This credit can be claimed in addition to any IRA

SIMPLE plans.

deduction claimed on Form 1040, line 32; Form

TIP

Qualified retirement plans as defined in section 4974(c)

1040A, line 17; or Form 1040NR, line 31.

(including the federal Thrift Savings Plan).

Do not include any:

Who Can Take This Credit

Distributions not taxable as the result of a rollover or a

trustee-to-trustee transfer.

You may be able to take this credit if you, or your spouse if filing

Distributions from your IRA (other than a Roth IRA) rolled over

jointly, made (a) contributions (other than rollover contributions)

to your Roth IRA.

to a traditional or Roth IRA, (b) elective deferrals to a 401(k),

Loans from a qualified employer plan treated as a distribution.

403(b), governmental 457, SEP, or SIMPLE plan, (c) voluntary

employee contributions to a qualified retirement plan as defined

Distributions of excess contributions or deferrals (and income

in section 4974(c) (including the federal Thrift Savings Plan), or

allocable to such contributions or deferrals).

(d) contributions to a 501(c)(18)(D) plan.

Distributions of contributions made to an IRA during a tax year

However, you cannot take the credit if either of the following

and returned (with any income allocable to such contributions)

applies:

on or before the due date (including extensions) for that tax year.

The amount on Form 1040, line 38; Form 1040A, line 22; or

Distributions of dividends paid on stock held by an employee

Form 1040NR, line 36, is more than $26,500 ($39,750 if head of

stock ownership plan under section 404(k).

household; $53,000 if married filing jointly).

Distributions from a military retirement plan.

The person(s) who made the qualified contribution or elective

If you are filing a joint return, include both spouses’ amounts

deferral (a) was born after January 1, 1991, (b) is claimed as a

in both columns.

dependent on someone else’s 2008 tax return, or (c) was a

Exception. Do not include your spouse’s distributions with yours

student.

when entering an amount on line 4 if you and your spouse did

You were a student if during any part of 5 calendar months of

not file a joint return for the year the distribution was received.

2008 you:

Example. You received a distribution of $5,000 from a qualified

Were enrolled as a full-time student at a school, or

retirement plan in 2008. Your spouse received a distribution of

Took a full-time, on-farm training course given by a school or

$2,000 from a Roth IRA in 2006. You and your spouse file a joint

a state, county, or local government agency.

return in 2008, but did not file a joint return in 2006. You would

include $5,000 in column (a) and $7,000 in column (b).

A school includes technical, trade, and mechanical schools. It

does not include on-the-job training courses, correspondence

Do not include on line 4 any economic stimulus

schools, or schools offering courses only through the Internet.

payment directly deposited into your IRA that you later

If your economic stimulus payment was directly

withdrew.

deposited into your IRA, any amount left in the IRA as

TIP

CAUTION

a contribution may qualify for the credit.

Line 7

Add the amounts from line 6 columns (a) and (b), and enter the

Specific Instructions

total.

Column (b)

Paperwork Reduction Act Notice. We ask for the information on

Complete column (b) only if you are filing a joint return.

this form to carry out the Internal Revenue laws of the United

States. You are required to give us the information. We need it to

Line 2

ensure that you are complying with these laws and to allow us to

Include on line 2 any of the following amounts.

figure and collect the right amount of tax.

Elective deferrals to a 401(k) or 403(b) plan (including

You are not required to provide the information requested on a

designated Roth contributions under section 402A), or to a

form that is subject to the Paperwork Reduction Act unless the

governmental 457, SEP, or SIMPLE plan.

form displays a valid OMB control number. Books or records

Voluntary employee contributions to a qualified retirement plan

relating to a form or its instructions must be retained as long as

as defined in section 4974(c) (including the federal Thrift Savings

their contents may become material in the administration of any

Plan).

Internal Revenue law. Generally, tax returns and return

information are confidential, as required by section 6103.

Contributions to a 501(c)(18)(D) plan.

The average time and expenses required to complete and file

These amounts may be shown in box 12 of your Form(s) W-2

for 2008.

this form will vary depending on individual circumstances. For the

estimated averages, see the instructions for your income tax

Note. Contributions designated under section 414(h)(2) are

return.

treated as employer contributions and as such they are not

If you have suggestions for making this form simpler, we would

voluntary contributions made by the employee. They do not

be happy to hear from you. See the instructions for your income

qualify for the credit and should not be included on line 2.

tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1