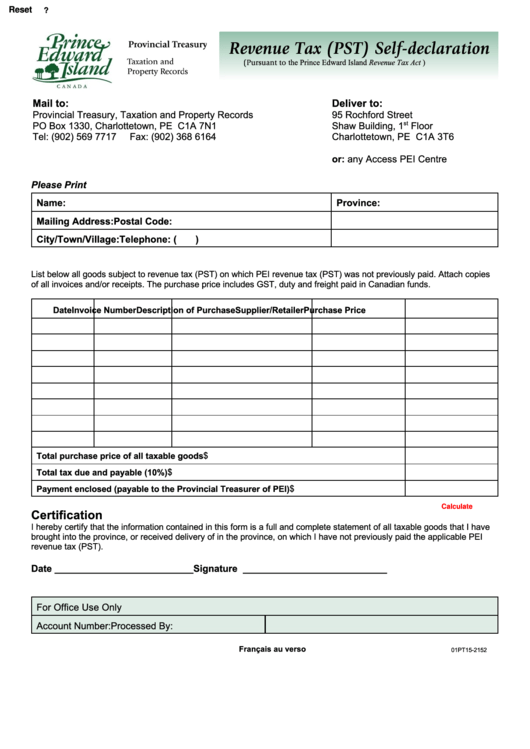

Revenue Tax (Pst) Self-Declaration - Prince Edward Island Provincial Treasury

ADVERTISEMENT

Reset

?

oÉîÉåìÉ=q~ñ=EmpqF=pÉäÑJÇÉÅä~ê~íáçå

Emìêëì~åí=íç=the Prince Edward Island Revenue Tax Act R.S.P.E.I. 1988)

Mail to:

Deliver to:

Provincial Treasury, Taxation and Property Records

95 Rochford Street

st

PO Box 1330, Charlottetown, PE C1A 7N1

Shaw Building, 1

Floor

Tel: (902) 569 7717

Fax: (902) 368 6164

Charlottetown, PE C1A 3T6

or: any Access PEI Centre

Please Print

Name:

Province:

Mailing Address:

Postal Code:

City/Town/Village:

Telephone: (

)

List below all goods subject to revenue tax (PST) on which PEI revenue tax (PST) was not previously paid. Attach copies

of all invoices and/or receipts. The purchase price includes GST, duty and freight paid in Canadian funds.

Date

Invoice Number

Description of Purchase

Supplier/Retailer

Purchase Price

$

Total purchase price of all taxable goods

$

Total tax due and payable (10%)

Payment enclosed (payable to the Provincial Treasurer of PEI)

$

Calculate

Certification

I hereby certify that the information contained in this form is a full and complete statement of all taxable goods that I have

brought into the province, or received delivery of in the province, on which I have not previously paid the applicable PEI

revenue tax (PST).

Date __________________________

Signature ___________________________

For Office Use Only

Account Number:

Processed By:

Français au verso

01PT15-2152

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1