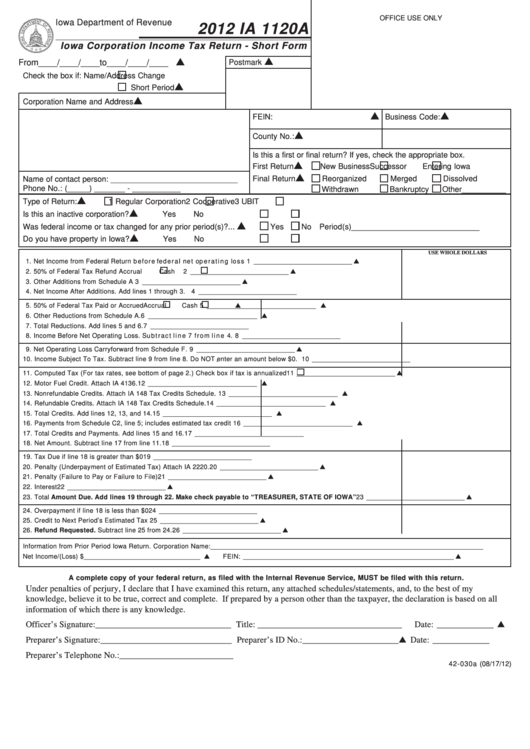

Form Ia 1120a - Iowa Corporation Income Tax Return - Short Form - 2012

ADVERTISEMENT

OFFICE USE ONLY

Iowa Department of Revenue

2012 IA 1120A

Iowa Corporation Income Tax Return - Short Form

L

L

From____/____/____to____/____/____

Postmark

Check the box if:

Name/Address Change

L

Short Period

L

Corporation Name and Address

L

L

FEIN:

Business Code:

L

County No.:

Is this a first or final return? If yes, check the appropriate box.

L

First Return

New Business

Successor

Entering Iowa

L

Name of contact person: _____________________________

Final Return

Reorganized

Merged

Dissolved

Phone No.: (_____) _______ - ___________

Withdrawn

Bankruptcy

Other__________

L

Type of Return:

1 Regular Corporation

2 Cooperative

3 UBIT

L

Is this an inactive corporation? .................................................

Yes

No

L

Was federal income or tax changed for any prior period(s)? ...

Yes

No Period(s)_____________________________

L

Do you have property in Iowa? ................................................

Yes

No

USE WHOLE DOLLARS

1. Net Income from Federal Return b efo re fed e r a l ne t op e r a t i n g lo s s ............................................................................... 1 ___________________________ L

2. 50% of Federal Tax Refund .....................

Accrual

Cash

....................................................................................... 2 ___________________________ L

3. Other Additions from Schedule A ............................................................................................................................................. 3 ___________________________ L

4. Net Income After Additions. Add lines 1 through 3. .............................................................................................................. 4 ___________________________

5. 50% of Federal Tax Paid or Accrued ......

Accrual

Cash ............. 5 ______________________________ L

L

6. Other Reductions from Schedule A. ............................................................ 6 ______________________________ L

7. Total Reductions. Add lines 5 and 6. ........................................................................................................................................ 7 ___________________________

8. Income Before Net Operating Loss. Su bt r a c t l i n e 7 f r o m l i n e 4. ..................................................................................... 8 ___________________________

9. Net Operating Loss Carryforward from Schedule F. ............................................................................................................... 9 ___________________________ L

10. Income Subject To Tax. Subtract line 9 from line 8. Do NOT enter an amount below $0. ................................................. 10 ___________________________

11. Computed Tax (For tax rates, see bottom of page 2.)

Check box if tax is annualized

............................................... 11 ___________________________ L

12. Motor Fuel Credit. Attach IA 4136. .............................................................. 12 ______________________________ L

13. Nonrefundable Credits. Attach IA 148 Tax Credits Schedule. .................. 13 ______________________________ L

14. Refundable Credits. Attach IA 148 Tax Credits Schedule. ........................ 14 ______________________________ L

15. Total Credits. Add lines 12, 13, and 14. ...................................................... 15 ______________________________ L

16. Payments from Schedule C2, line 5; includes estimated tax credit .......... 16 ______________________________ L

17. Total Credits and Payments. Add lines 15 and 16. .................................... 17 ______________________________

18. Net Amount. Subtract line 17 from line 11. .............................................................................................................................. 18 ___________________________

19. Tax Due if line 18 is greater than $0 ........................................................................................................................................ 19 ___________________________

20. Penalty (Underpayment of Estimated Tax) Attach IA 2220. ................................................................................................... 20 ___________________________ L

21. Penalty (Failure to Pay or Failure to File) ................................................................................................................................ 21 ___________________________ L

22. Interest ....................................................................................................................................................................................... 22 ___________________________ L

23. Total Amount Due. Add lines 19 through 22. Make check payable to “TREASURER, STATE OF IOWA” ................. 23 ___________________________ L

24. Overpayment if line 18 is less than $0 ..................................................................................................................................... 24 ___________________________

25. Credit to Next Period’s Estimated Tax ..................................................................................................................................... 25 ___________________________ L

26. Refund Requested. Subtract line 25 from 24. ........................................................................................................................ 26 ___________________________ L

Information from Prior Period Iowa Return. Corporation Name: ___________________________________________________________________________

Net Income/(Loss) $ ________________________________ L

FEIN: __________________________________________________________ L

A complete copy of your federal return, as filed with the Internal Revenue Service, MUST be filed with this return.

Under penalties of perjury, I declare that I have examined this return, any attached schedules/statements, and, to the best of my

knowledge, believe it to be true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based on all

information of which there is any knowledge.

Officer’s Signature: _______________________________ Title: _________________________________

Date: _____________ L

Preparer’s Signature: ______________________________ Preparer’s ID No.: ______________________L Date: _____________

Preparer’s Telephone No.: __________________________

42-030a (08/17/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2